Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Circle ONLY the statements that are true: a.) Book depreciation always beats MACRS deprecation for personal property, therefore one should commit to book depreciation

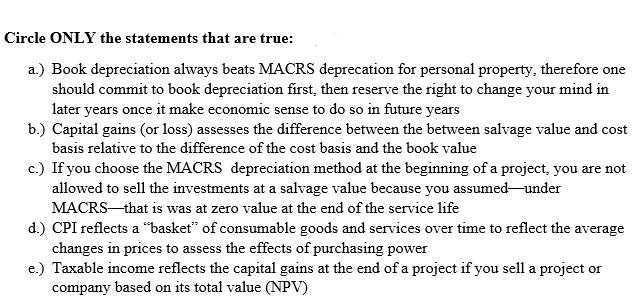

Circle ONLY the statements that are true: a.) Book depreciation always beats MACRS deprecation for personal property, therefore one should commit to book depreciation first, then reserve the right to change your mind in later years once it make economic sense to do so in future years b.) Capital gains (or loss) assesses the difference between the between salvage value and cost basis relative to the difference of the cost basis and the book value c.) If you choose the MACRS depreciation method at the beginning of a project, you are not allowed to sell the investments at a salvage value because you assumed under MACRS that is was at zero value at the end of the service life d.) CPI reflects a "basket" of consumable goods and services over time to reflect the average changes in prices to assess the effects of purchasing power e.) Taxable income reflects the capital gains at the end of a project if you sell a project or company based on its total value (NPV)

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer c and d Explanation MACRS allows for more depreciation deduction ov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started