Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cisco is considering the development of a wireless home networking appliance, called HomeNet. The company expects to sell 300000 units per year over the project's

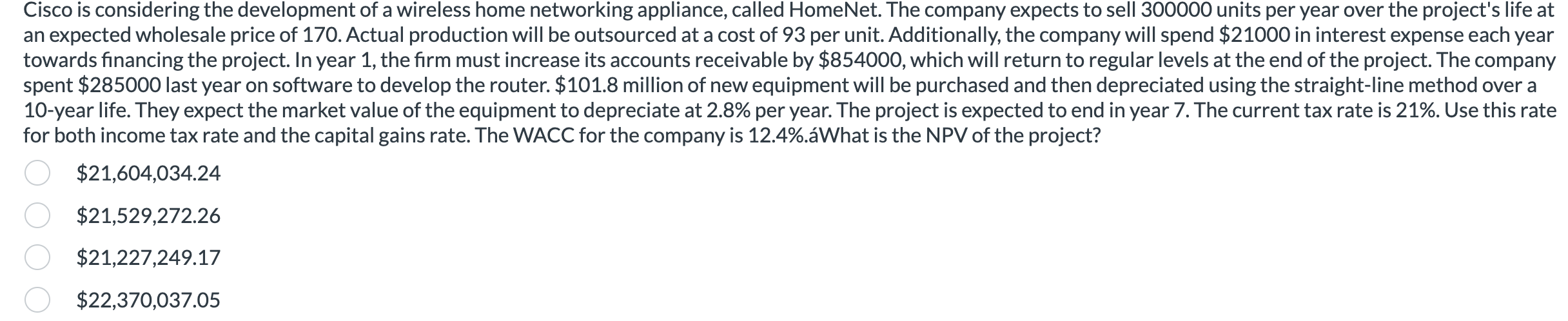

Cisco is considering the development of a wireless home networking appliance, called HomeNet. The company expects to sell 300000 units per year over the project's life at an expected wholesale price of 170 . Actual production will be outsourced at a cost of 93 per unit. Additionally, the company will spend $21000 in interest expense each year towards financing the project. In year 1 , the firm must increase its accounts receivable by $854000, which will return to regular levels at the end of the project. The company spent $285000 last year on software to develop the router. $101.8 million of new equipment will be purchased and then depreciated using the straight-line method over a 10-year life. They expect the market value of the equipment to depreciate at 2.8% per year. The project is expected to end in year 7 . The current tax rate is 21%. Use this rate for both income tax rate and the capital gains rate. The WACC for the company is 12.4%.a What is the NPV of the project? $21,604,034.24$21,529,272.26$21,227,249.17$22,370,037.05

Cisco is considering the development of a wireless home networking appliance, called HomeNet. The company expects to sell 300000 units per year over the project's life at an expected wholesale price of 170 . Actual production will be outsourced at a cost of 93 per unit. Additionally, the company will spend $21000 in interest expense each year towards financing the project. In year 1 , the firm must increase its accounts receivable by $854000, which will return to regular levels at the end of the project. The company spent $285000 last year on software to develop the router. $101.8 million of new equipment will be purchased and then depreciated using the straight-line method over a 10-year life. They expect the market value of the equipment to depreciate at 2.8% per year. The project is expected to end in year 7 . The current tax rate is 21%. Use this rate for both income tax rate and the capital gains rate. The WACC for the company is 12.4%.a What is the NPV of the project? $21,604,034.24$21,529,272.26$21,227,249.17$22,370,037.05 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started