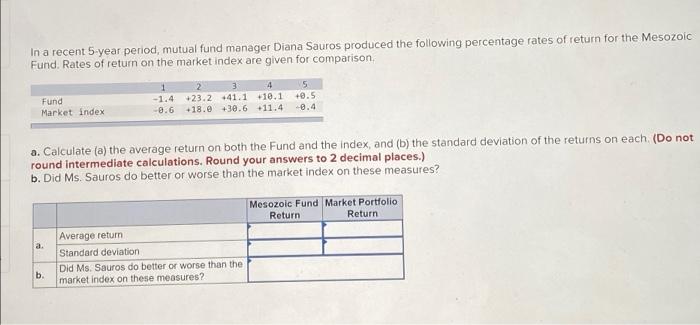

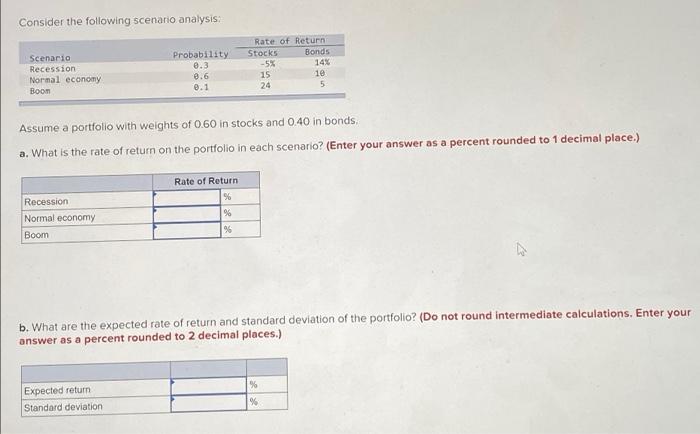

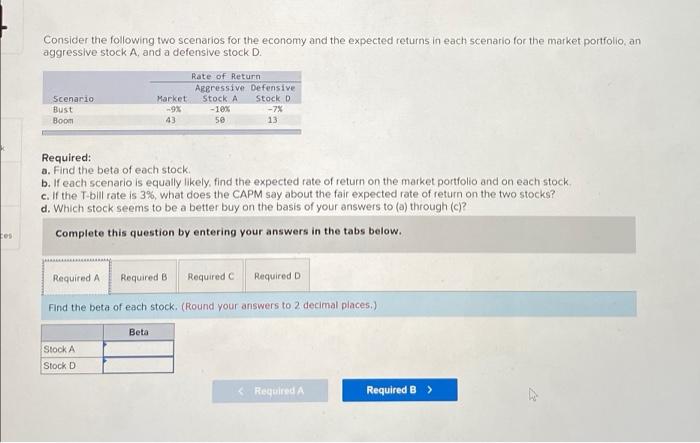

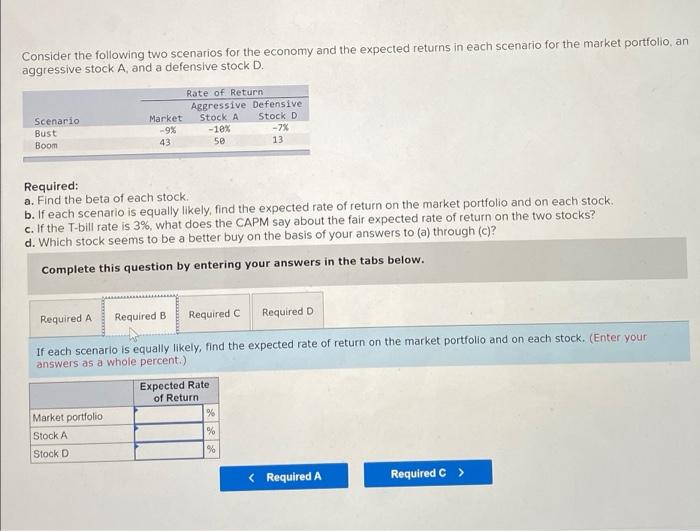

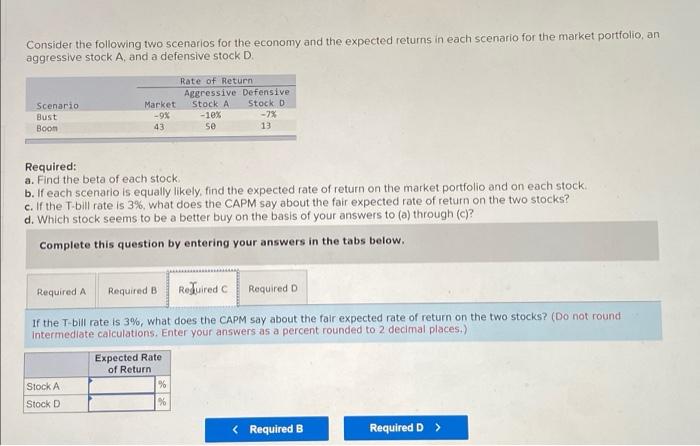

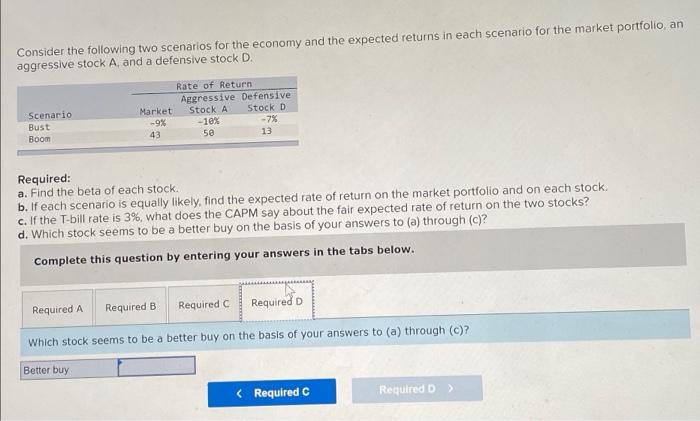

In a recent 5-year period, mutual fund manager Diana Sauros produced the following percentage rates of return for the Mesozoic Fund. Rates of return on the market index are given for comparison. 5 Fund Market index 1 2 3 4 -1.4 +23.2 +41.1 10.1 +0.5 -8.6 +18.0 +30.6 +11.4 -0.4 a. Calculate (a) the average return on both the Fund and the index, and (b) the standard deviation of the returns on each. (Do not round intermediate calculations. Round your answers to 2 decimal places.) b. Did Ms. Sauros do better or worse than the market index on these measures? Mesozoic Fund Market Portfolio Return Return Average return. a. Standard deviation b. Did Ms. Sauros do better or worse than the market index on these measures? Consider the following scenario analysis: Rate of Returni Stocks Bonds Scenario Recession Probability 0.3 -5% 14% 0.6 15 10 Normal economy Boom 0.1 24 5 Assume a portfolio with weights of 0.60 in stocks and 0.40 in bonds. a. What is the rate of return on the portfolio in each scenario? (Enter your answer as a percent rounded to 1 decimal place.) Rate of Return Recession % % Normal economy Boom % b. What are the expected rate of return and standard deviation of the portfolio? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Expected return. % Standard deviation % Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Rate of Return Aggressive Defensive Stock A Scenario. Market Stock D Bust -9% -10% -7% Boom 43 50 13 Required: a. Find the beta of each stock. b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. c. If the T-bill rate is 3%, what does the CAPM say about the fair expected rate of return on the two stocks? d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? tes Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Find the beta of each stock. (Round your answers to 2 decimal places.) Beta Stock A Stock D Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Rate of Return Aggressive Defensive Scenario Market Stock A Stock Di Bust -9% -10% -7% Boom 43 50 13 Required: a. Find the beta of each stock. b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. c. If the T-bill rate is 3%, what does the CAPM say about the fair expected rate of return on the two stocks? d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. (Enter your answers as a whole percent.) Expected Rate of Return Market portfolio % Stock A % Stock D % Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Rate of Return Aggressive Defensive Stock A Scenario Market Stock D Bust -9% -10% -7% Boon 43 se 13 Required: a. Find the beta of each stock. b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock.. c. If the T-bill rate is 3%, what does the CAPM say about the fair expected rate of return on the two stocks? d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D If the T-bill rate is 3%, what does the CAPM say about the fair expected rate of return on the two stocks? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Expected Rate of Return Stock A Stock D % % Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Rate of Return Aggressive Defensive Scenario Market Stock A Stock D Bust -9% -7% -10% 50 Boom 43 13 Required: a. Find the beta of each stock.. b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. c. If the T-bill rate is 3%, what does the CAPM say about the fair expected rate of return on the two stocks? d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Which stock seems to be a better buy on the basis of your answers to (a) through (c)? Better buy