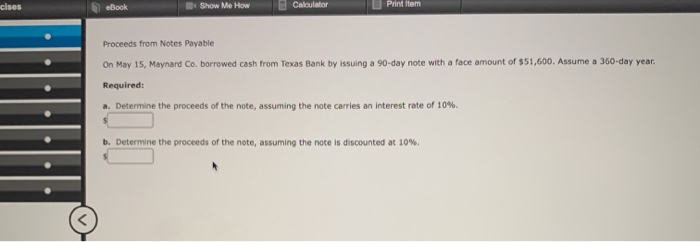

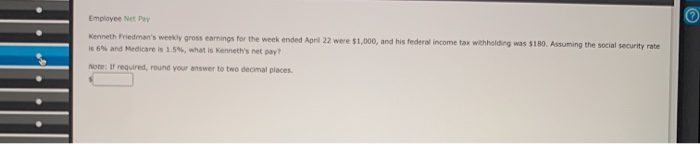

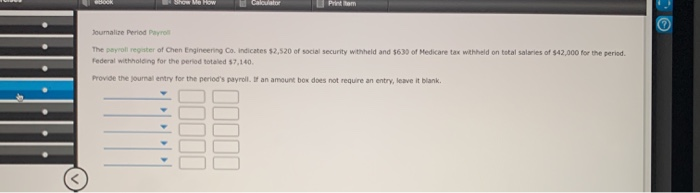

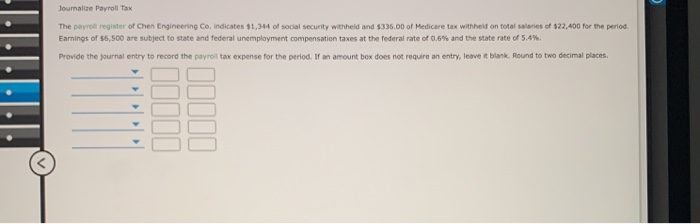

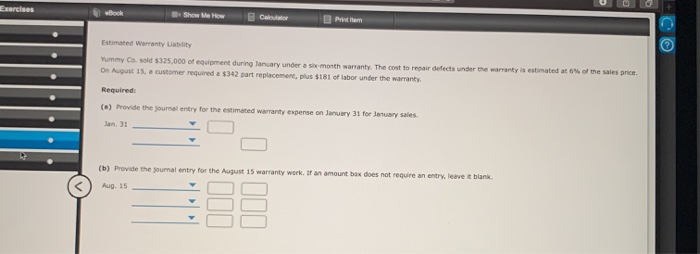

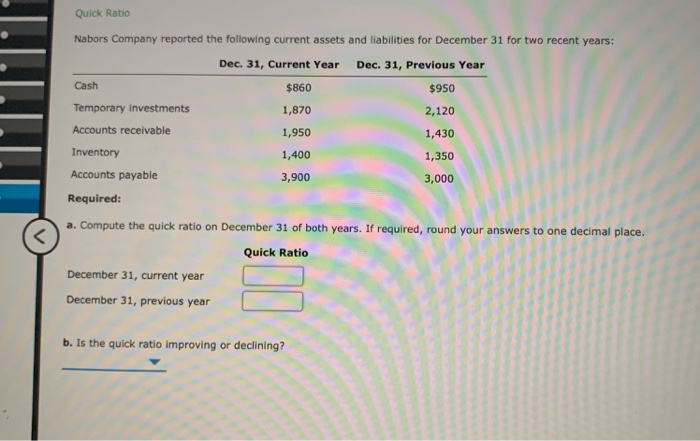

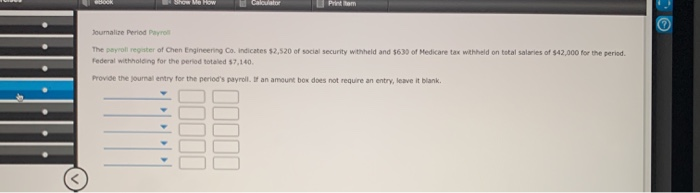

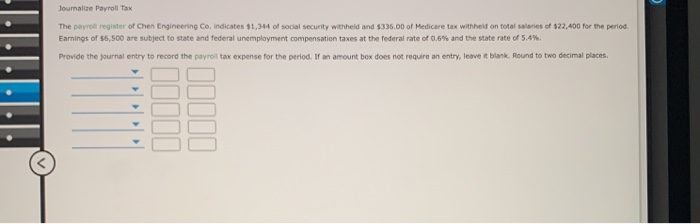

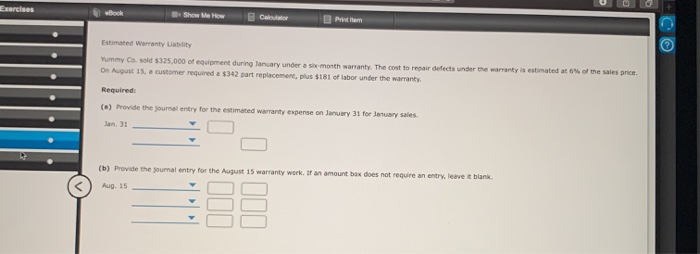

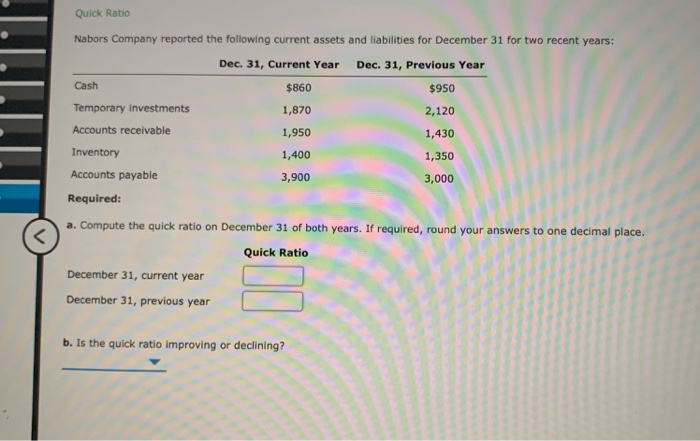

cises eBook Show Me How Calculator Print Item Proceeds from Notes Payable On May 15, Maynard Co. borrowed cash from Texas Bank by Issuing a 90-day note with a face amount of $51,600. Assume a 360-day year, Required: 2. Determine the proceeds of the note, assuming the note carries an interest rate of 10%. b. Determine the proceeds of the note, assuming the note is discounted at 10%. Federal Income Tax Withholding Bob Dunn's weekly gross earnings for the present week were $2,820. Dunn has three exemptions. Using the wage bracket withholding table in Exhibit 2 with a $75 standard withholding allowance for each exemption, what is Dunn's federal income tax withholding? Round your answer to two decimal places. Employee Net Pay Kenneth Friedman's weekly gross earnings for the week ended April 22 were $1,000, and his federal income tax withholding was $180. Assuming the social security rate is 6% and Medicare is 1.5%, what is Kenneth's net pay? Note: If required, round your answer to two decimal places Show Me How Calculator Journalize Period Payron The payroll register of Chen Engineering Co. Indicates $2,520 of social security withheld and 630 of Medicare tax wthheld on total salaries of $42,000 for the period. Federal withholding for the period toated 57.140. Provide the journal entry for the period's payroll. If an amount box does not require an entry, leave it blank. Journalize Payroll Tax The payroll register of Chen Engineering Co. indicates $1,344 of social security withheld and $336,00 of Medicare tax withheld on total salaries of $22,400 for the period. Earnings of $6,500 are subject to state and federal unemployment compensation taxes at the federal rate of 0.6% and the state rate of 5.4%. Provide the journal entry to record the payroll tax expense for the period. If an amount box does not require an entry, leave a blank. Round to two decimal places Exercises eBook Show Me How Estimated Warranty Liability Yummy Casold 5325,000 of equipment during January under a si month warranty. The cost to repair defects under the warranty is estimated at 6% of the sales price On August 15, a customer required a $342 part replacement, plus $181 of labor under the warranty Required: (n) Provide the journal entry for the estimated warranty expense on January 31 for January sales San. 31 (b) Provide the journal entry for the August 15 warranty work. If an amount box does not require an entry leave it blank. Aug. 15 III II. Quick Ratio Nabors Company reported the following current assets and liabilities for December 31 for two recent years: Dec. 31, Current Year Dec. 31, Previous Year Cash $860 $950 Temporary investments 1,870 2,120 Accounts receivable 1,950 1,430 Inventory 1,400 1,350 Accounts payable 3,900 3,000 Required: a. Compute the quick ratio on December 31 of both years. If required, round your answers to one decimal place. Quick Ratio December 31, current year December 31, previous year b. Is the quick ratio improving or declining