Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Citation Builders, Incorporated, builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in

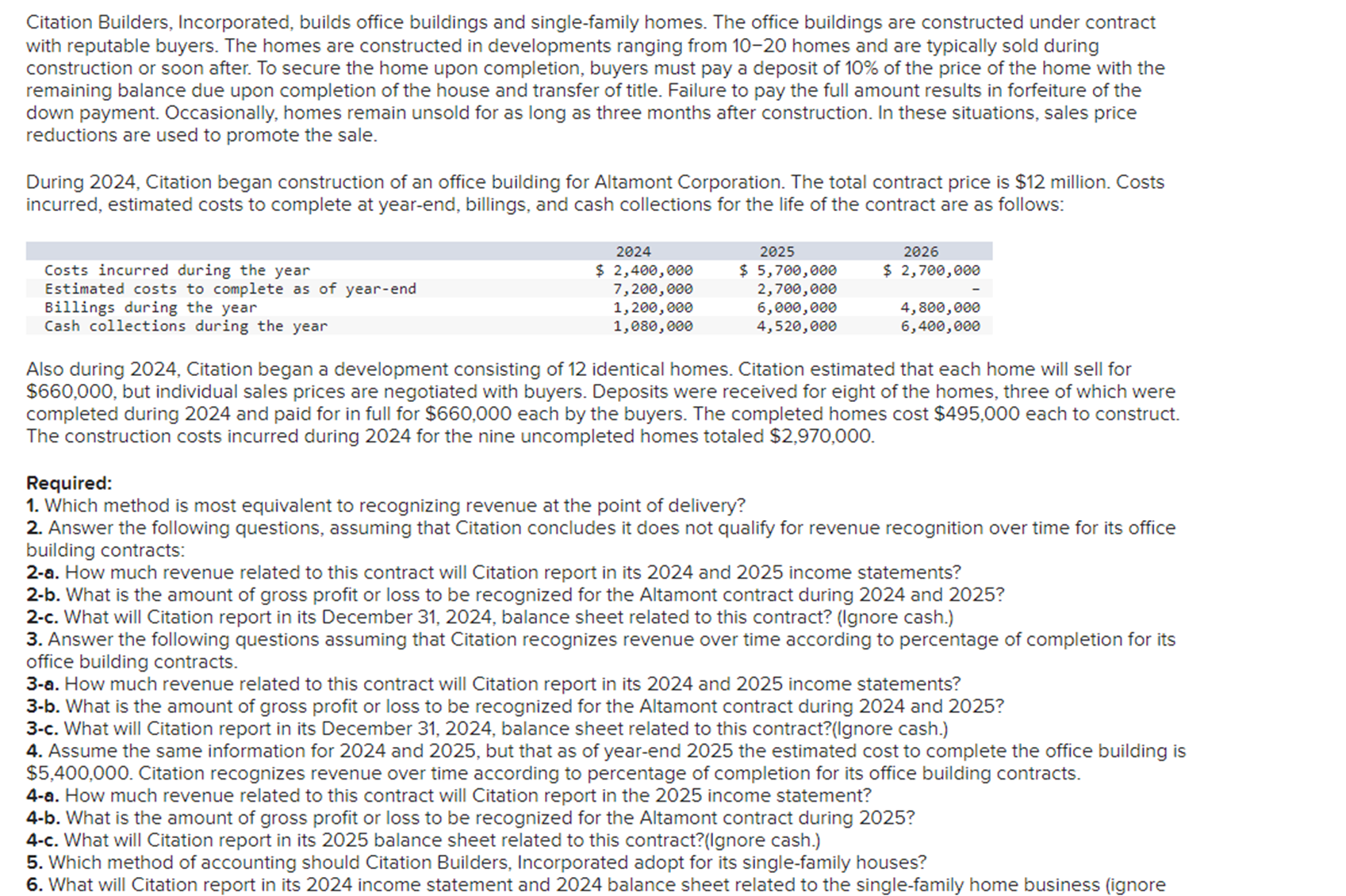

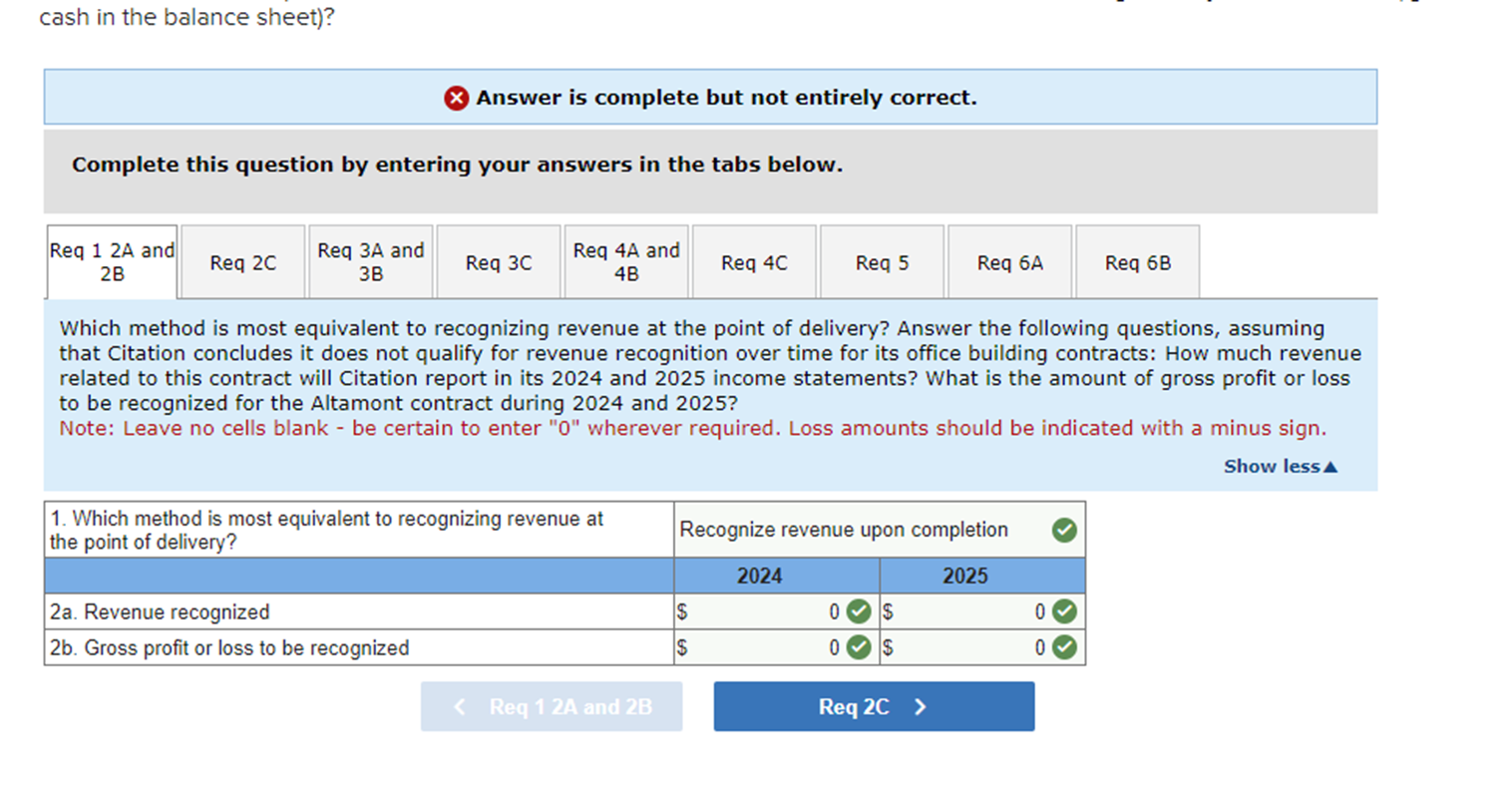

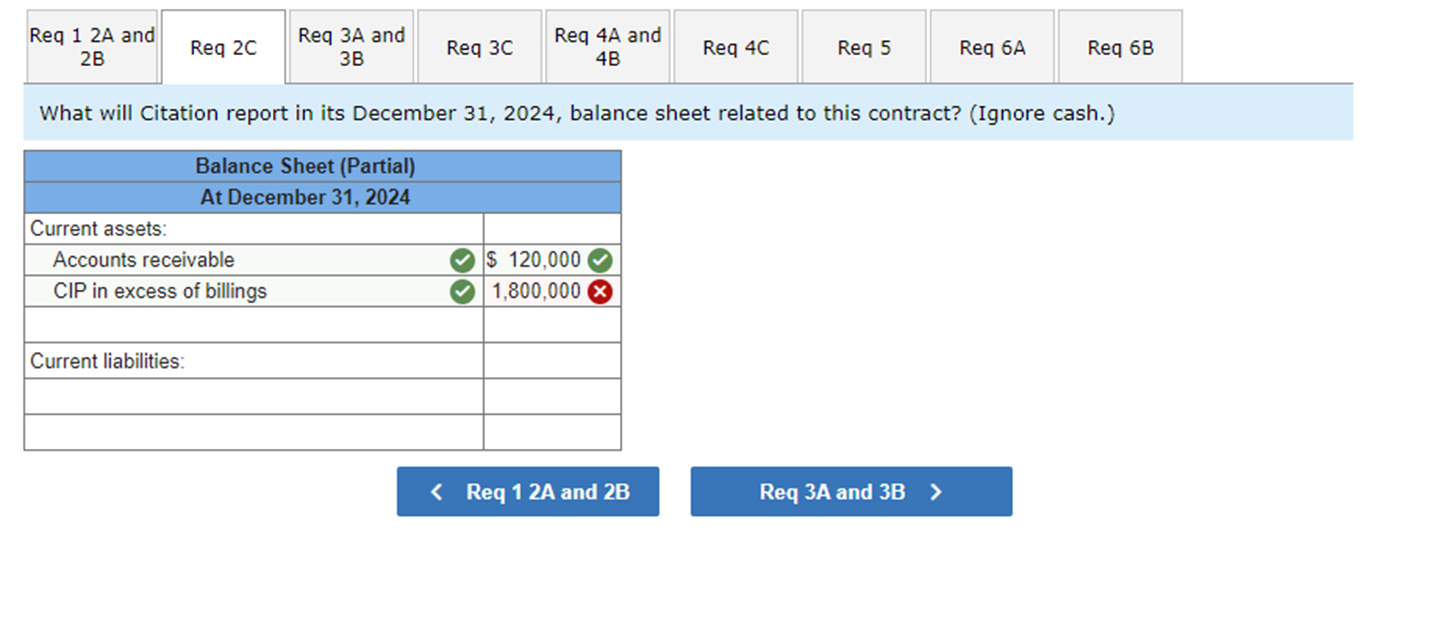

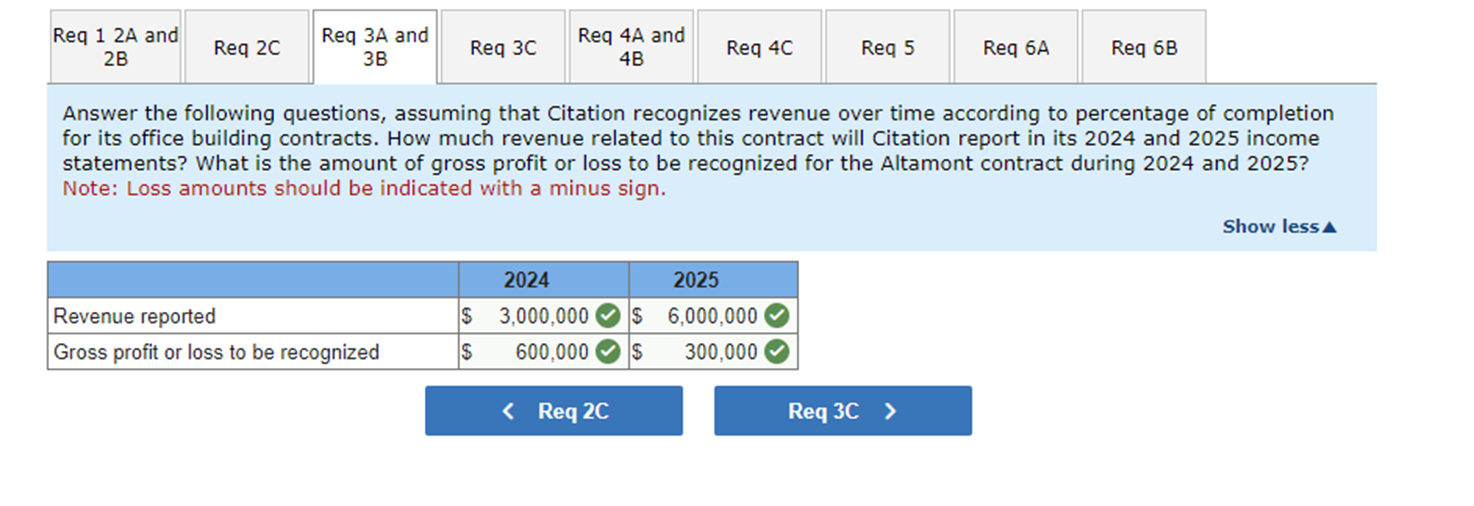

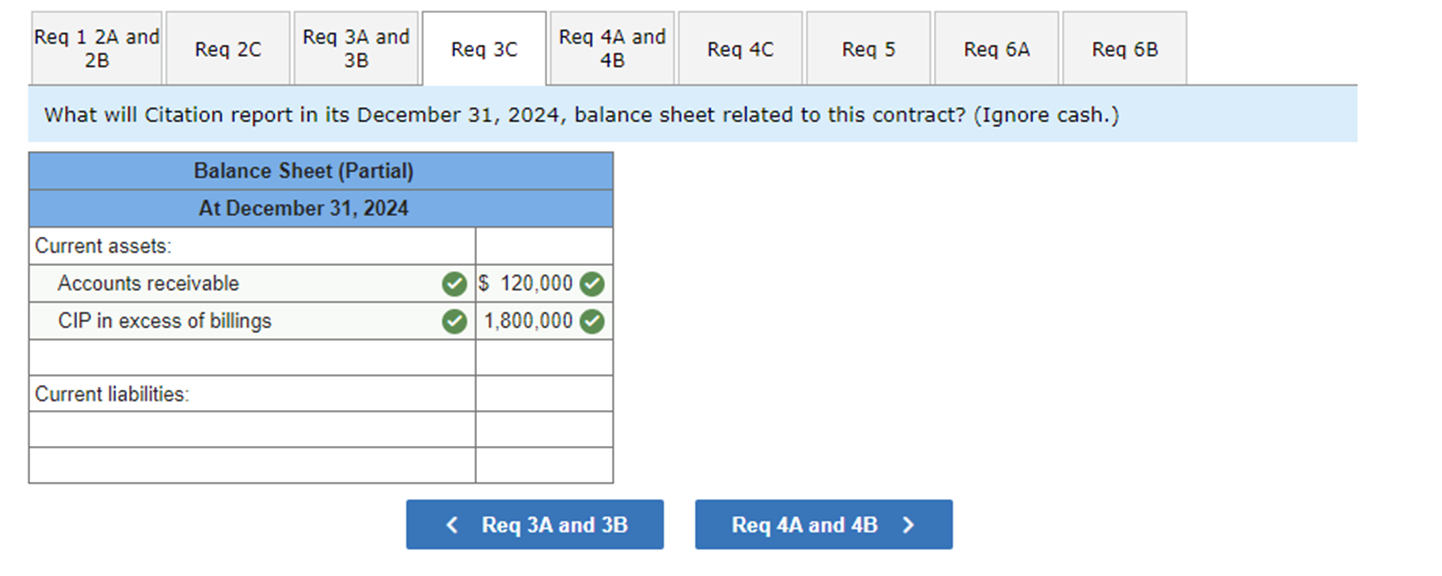

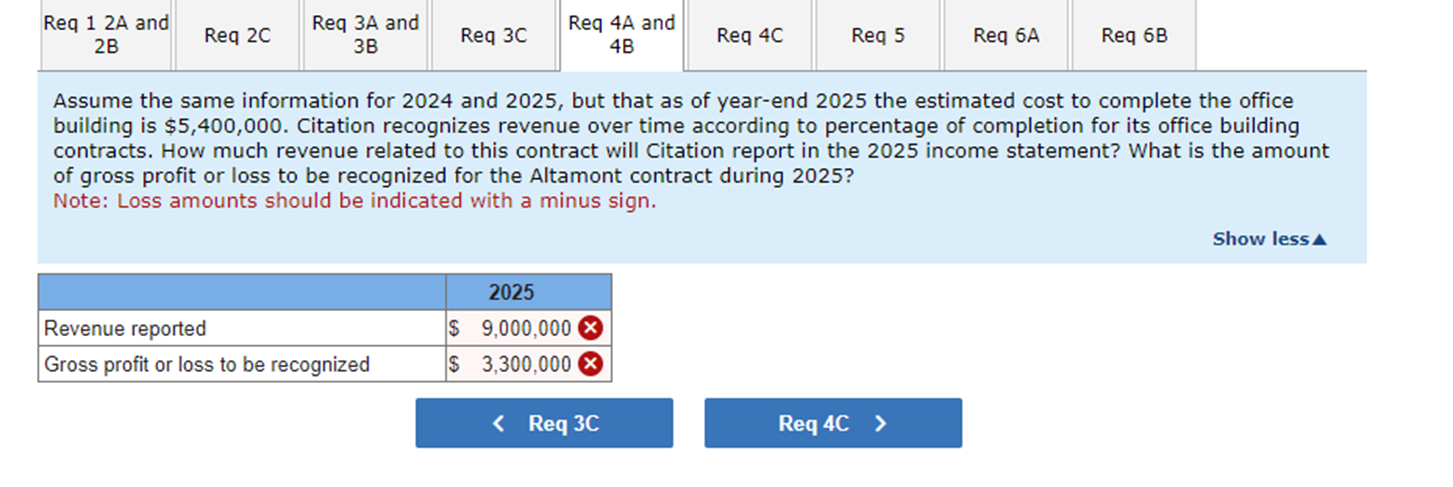

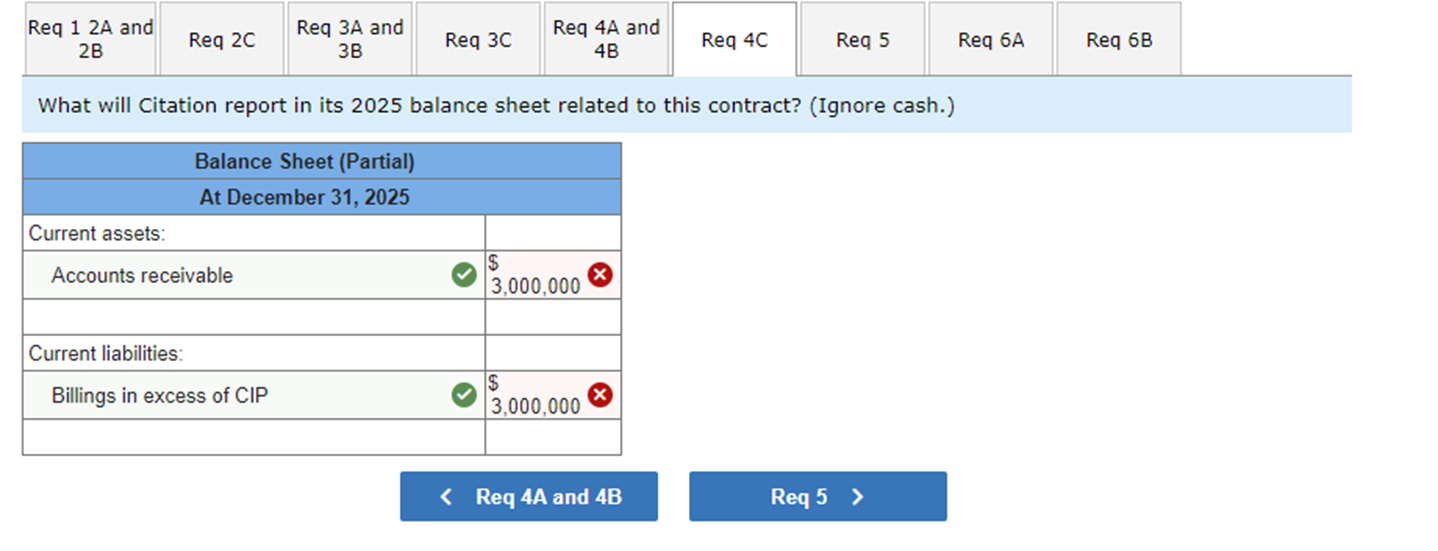

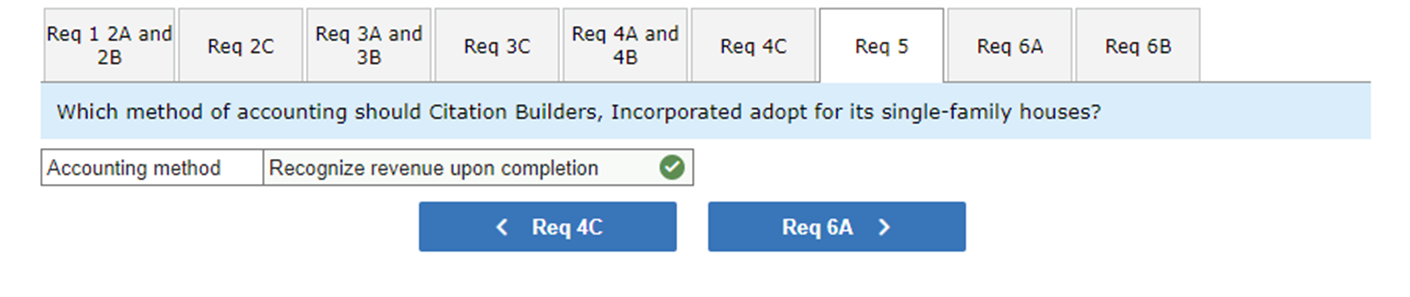

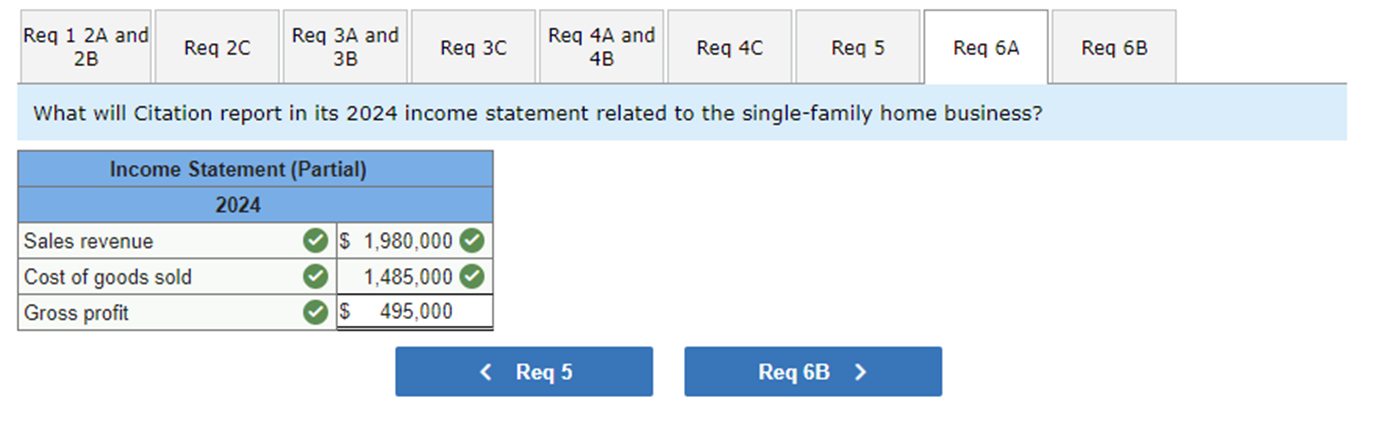

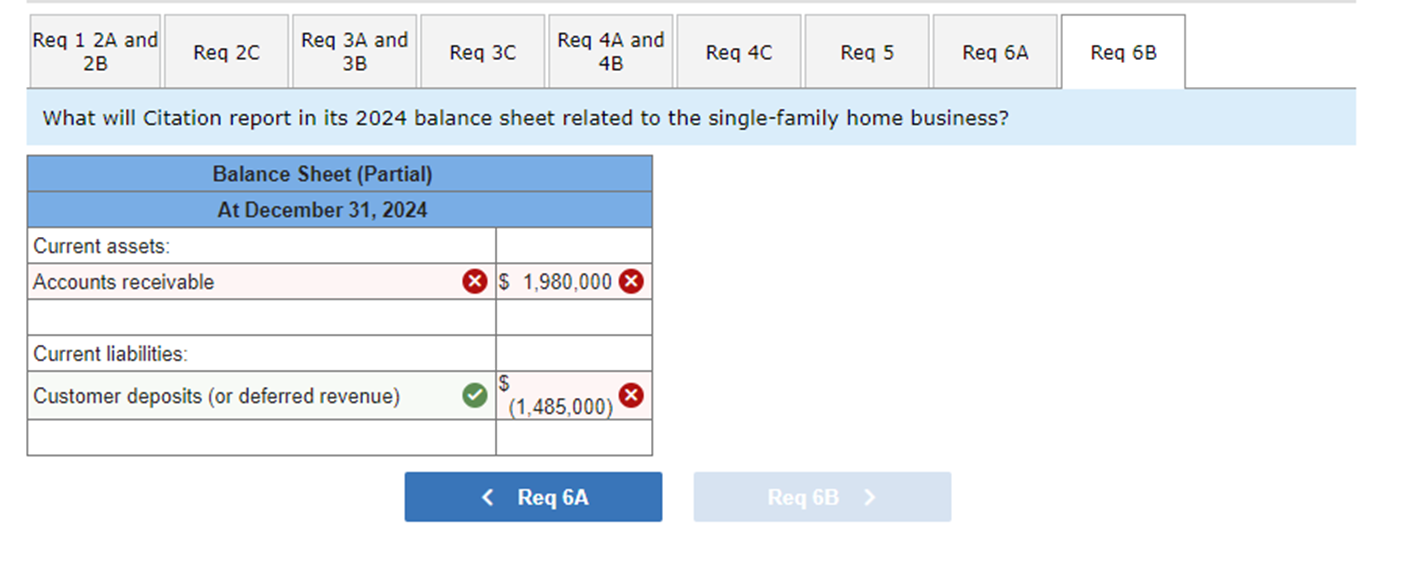

Citation Builders, Incorporated, builds office buildings and single-family homes. The office buildings are constructed under contract with reputable buyers. The homes are constructed in developments ranging from 10-20 homes and are typically sold during construction or soon after. To secure the home upon completion, buyers must pay a deposit of 10% of the price of the home with the remaining balance due upon completion of the house and transfer of title. Failure to pay the full amount results in forfeiture of the down payment. Occasionally, homes remain unsold for as long as three months after construction. In these situations, sales price reductions are used to promote the sale. During 2024, Citation began construction of an office building for Altamont Corporation. The total contract price is $12 million. Costs incurred, estimated costs to complete at year-end, billings, and cash collections for the life of the contract are as follows: Costs incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year 2024 2025 2026 $ 2,400,000 7,200,000 1,200,000 1,080,000 $ 5,700,000 $ 2,700,000 2,700,000 4,800,000 6,400,000 6,000,000 4,520,000 Also during 2024, Citation began a development consisting of 12 identical homes. Citation estimated that each home will sell for $660,000, but individual sales prices are negotiated with buyers. Deposits were received for eight of the homes, three of which were completed during 2024 and paid for in full for $660,000 each by the buyers. The completed homes cost $495,000 each to construct. The construction costs incurred during 2024 for the nine uncompleted homes totaled $2,970,000. Required: 1. Which method is most equivalent to recognizing revenue at the point of delivery? 2. Answer the following questions, assuming that Citation concludes it does not qualify for revenue recognition over time for its office building contracts: 2-a. How much revenue related to this contract will Citation report in its 2024 and 2025 income statements? 2-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2024 and 2025? 2-c. What will Citation report in its December 31, 2024, balance sheet related to this contract? (Ignore cash.) 3. Answer the following questions assuming that Citation recognizes revenue over time according to percentage of completion for its office building contracts. 3-a. How much revenue related to this contract will Citation report in its 2024 and 2025 income statements? 3-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2024 and 2025? 3-c. What will Citation report in its December 31, 2024, balance sheet related to this contract?(Ignore cash.) 4. Assume the same information for 2024 and 2025, but that as of year-end 2025 the estimated cost to complete the office building is $5,400,000. Citation recognizes revenue over time according to percentage of completion for its office building contracts. 4-a. How much revenue related to this contract will Citation report in the 2025 income statement? 4-b. What is the amount of gross profit or loss to be recognized for the Altamont contract during 2025? 4-c. What will Citation report in its 2025 balance sheet related to this contract? (Ignore cash.) 5. Which method of accounting should Citation Builders, Incorporated adopt for its single-family houses? 6. What will Citation report in its 2024 income statement and 2024 balance sheet related to the single-family home business (ignore cash in the balance sheet)? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req 1 2A and 2B Req 2C Req 3A and 3B Req 3C Req 4A and 4B Req 4C Req 5 Reg 6A Req 6B Which method is most equivalent to recognizing revenue at the point of delivery? Answer the following questions, assuming that Citation concludes it does not qualify for revenue recognition over time for its office building contracts: How much revenue related to this contract will Citation report in its 2024 and 2025 income statements? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2024 and 2025? Note: Leave no cells blank - be certain to enter "0" wherever required. Loss amounts should be indicated with a minus sign. Show less 1. Which method is most equivalent to recognizing revenue at the point of delivery? Recognize revenue upon completion 2024 2025 2a. Revenue recognized $ 0 S $ 0 2b. Gross profit or loss to be recognized S 0 $ 0 Req 1 2A and 2B Req 2C Req 3A and 3B Req 4A and Req 3C 4B Req 4C Req 5 Req 6A Req 6B What will Citation report in its December 31, 2024, balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) At December 31, 2024 Current assets: Accounts receivable CIP in excess of billings Current liabilities: $ 120,000 1,800,000 x < Req 1 2A and 2B Req 3A and 3B > Req 1 2A and Req 3A and Req 2C 3B Req 3C Req 4A and 4B Req 4C Req 5 Req 6A Req 6B 2B Answer the following questions, assuming that Citation recognizes revenue over time according to percentage of completion for its office building contracts. How much revenue related to this contract will Citation report in its 2024 and 2025 income statements? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2024 and 2025? Note: Loss amounts should be indicated with a minus sign. Show less 2024 Revenue reported $ 3,000,000 2025 $6,000,000 Gross profit or loss to be recognized $ 600,000 $ 300,000 < Req 2C Req 3C > Req 1 2A and 2B Req 2C Req 3A and 3B Req 3C Req 4A and Req 4C 4B Req 5 Req 6A Req 6B What will Citation report in its December 31, 2024, balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) Current assets: At December 31, 2024 Accounts receivable CIP in excess of billings Current liabilities: $ 120,000 1,800,000 < Req 3A and 3B Req 4A and 4B > Req 1 2A and Req 2C 2B Req 3A and 3B Req 4A and Req 3C Req 4C 4B Req 5 Req 6A Req 6B Assume the same information for 2024 and 2025, but that as of year-end 2025 the estimated cost to complete the office building is $5,400,000. Citation recognizes revenue over time according to percentage of completion for its office building contracts. How much revenue related to this contract will Citation report in the 2025 income statement? What is the amount of gross profit or loss to be recognized for the Altamont contract during 2025? Note: Loss amounts should be indicated with a minus sign. Revenue reported 2025 $9,000,000 Gross profit or loss to be recognized $ 3,300,000 < Req 3C Req 4C > Show less Req 1 2A and 2B Req 2C Req 3A and 3B Req 3C Req 4A and 4B Req 4C Req 5 Req 6A Reg 6B What will Citation report in its 2025 balance sheet related to this contract? (Ignore cash.) Balance Sheet (Partial) At December 31, 2025 Current assets: Accounts receivable Current liabilities: $ 3,000,000 $ Billings in excess of CIP 3,000,000 < Req 4A and 4B Req 5 > Req 1 2A and 2B Req 2C Req 3A and 3B Req 3C Req 4A and Req 4C 4B Req 5 Req 6A Req 6B Which method of accounting should Citation Builders, Incorporated adopt for its single-family houses? Accounting method Recognize revenue upon completion < Req 4C Req 6A > Req 1 2A and 2B Req 2C Req 3A and 3B Req 4A and Req 3C Req 4C 4B Req 5 Req 6A Req 6B What will Citation report in its 2024 income statement related to the single-family home business? Income Statement (Partial) 2024 Sales revenue Cost of goods sold Gross profit $1,980,000 1,485,000 $ 495,000 < Req 5 Req 6B > Req 1 2A and 2B Req 2C Req 3A and 3B Req 4A and Req 3C Req 4C Req 5 4B Req 6A Req 6B What will Citation report in its 2024 balance sheet related to the single-family home business? Balance Sheet (Partial) At December 31, 2024 Current assets: Accounts receivable $1,980,000 Current liabilities: $ Customer deposits (or deferred revenue) (1,485,000) < Req 6A Req 6B >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started