Question

Citco Company is considering investing up to $455,000 in a sustainability-enhancing project. Its managers have narrowed their choices to three potential projects. Project A would

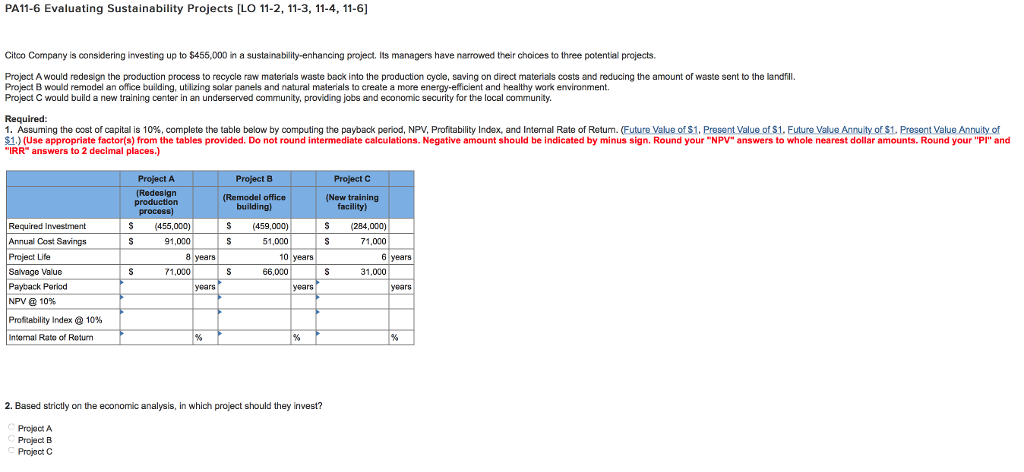

Citco Company is considering investing up to $455,000 in a sustainability-enhancing project. Its managers have narrowed their choices to three potential projects. Project A would redesign the production process to recycle raw materials waste back into the production cycle, saving on direct materials costs and reducing the amount of waste sent to the landfill. Project B would remodel an office building, utilizing solar panels and natural materials to create a more energy-efficient and healthy work environment. Project C would build a new training center in an underserved community, providing jobs and economic security for the local community. Required: 1. Assuming the cost of capital is 10%, complete the table below by computing the payback period, NPV, Profitability Index, and Internal Rate of Return. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Negative amount should be indicated by minus sign. Round your "NPV" answers to whole nearest dollar amounts. Round your "PI" and "IRR" answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started