Question

City Bank has estimated that its average daily net transaction accounts balance over the recent 14-day computation period was $231 million. The average daily balance

City Bank has estimated that its average daily net transaction accounts balance over the recent 14-day computation period was $231 million. The average daily balance with the Fed over the 14-day maintenance period was $8.5 million, and the average daily balance of vault cash over the two-week computation period was $6 million.  c. If the bank had transferred $35 million of its deposits every Friday over the two-week computation period to one of its off-shore facilities, what would be the revised average daily reserve requirement?

c. If the bank had transferred $35 million of its deposits every Friday over the two-week computation period to one of its off-shore facilities, what would be the revised average daily reserve requirement?

Revised Average Daily Reserve Requirement________________

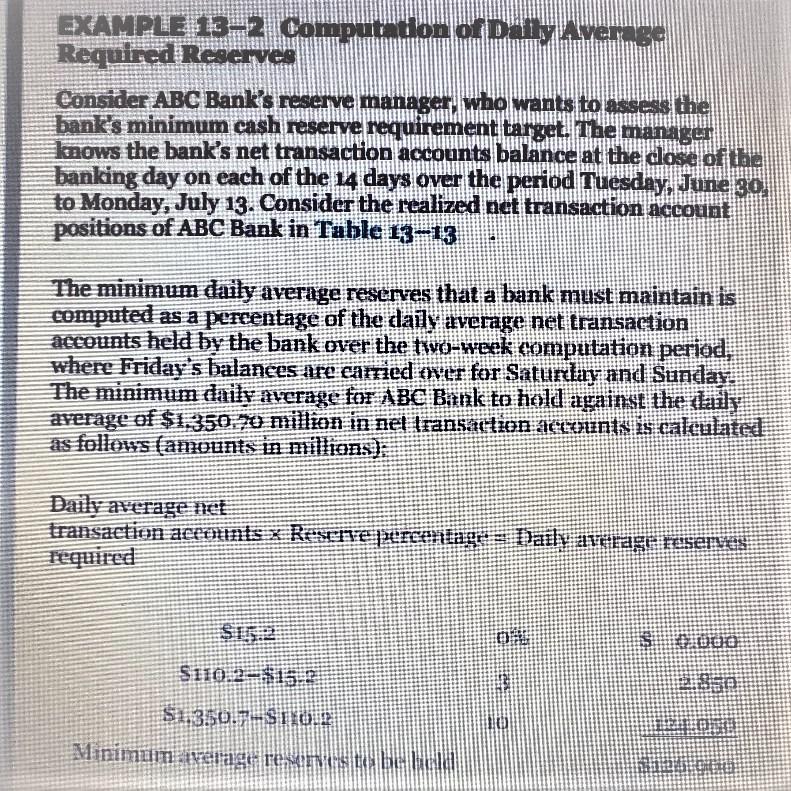

EXAMPLE 13-2 Computation of Dany Avenuse Required Reserves Consider ABC Bank s reserve manager who wants to assess the bank's minimum cash reserve requirement target. The manager knows the bank's net transaction accounts balance at the dose of the banking day on each of the 14 days over the period Tuesday, June 30 to Monday, July 13. Consider the realized net transaction account positions of ABC Bank in Table 13-13 The minimum daily average reserves that a bank must maintain is computed as a percentage of the daily average net transaction accounts held by the bank over the two-week computation period, where Friday's balances are carried over for Saturday and Sunday. The minimum daily average for ABC Bink to hold against the daily average of $12350.2 million in nel transaction accounts is calculated as follows (amounts in millions): Daily average net transaction accounts x RestITE Cerlage Daily average reserves Tequired $152 D Duo $110.2515 2350 $1,350.7-STION Minimum venage rest li EXAMPLE 13-2 Computation of Dany Avenuse Required Reserves Consider ABC Bank s reserve manager who wants to assess the bank's minimum cash reserve requirement target. The manager knows the bank's net transaction accounts balance at the dose of the banking day on each of the 14 days over the period Tuesday, June 30 to Monday, July 13. Consider the realized net transaction account positions of ABC Bank in Table 13-13 The minimum daily average reserves that a bank must maintain is computed as a percentage of the daily average net transaction accounts held by the bank over the two-week computation period, where Friday's balances are carried over for Saturday and Sunday. The minimum daily average for ABC Bink to hold against the daily average of $12350.2 million in nel transaction accounts is calculated as follows (amounts in millions): Daily average net transaction accounts x RestITE Cerlage Daily average reserves Tequired $152 D Duo $110.2515 2350 $1,350.7-STION Minimum venage rest liStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started