Answered step by step

Verified Expert Solution

Question

1 Approved Answer

City Developments Limited (CDL) is a leading global real estate company. Listed on the Singapore Exchange, its income-stable and geographically-diverse portfolio comprises residences, offices,

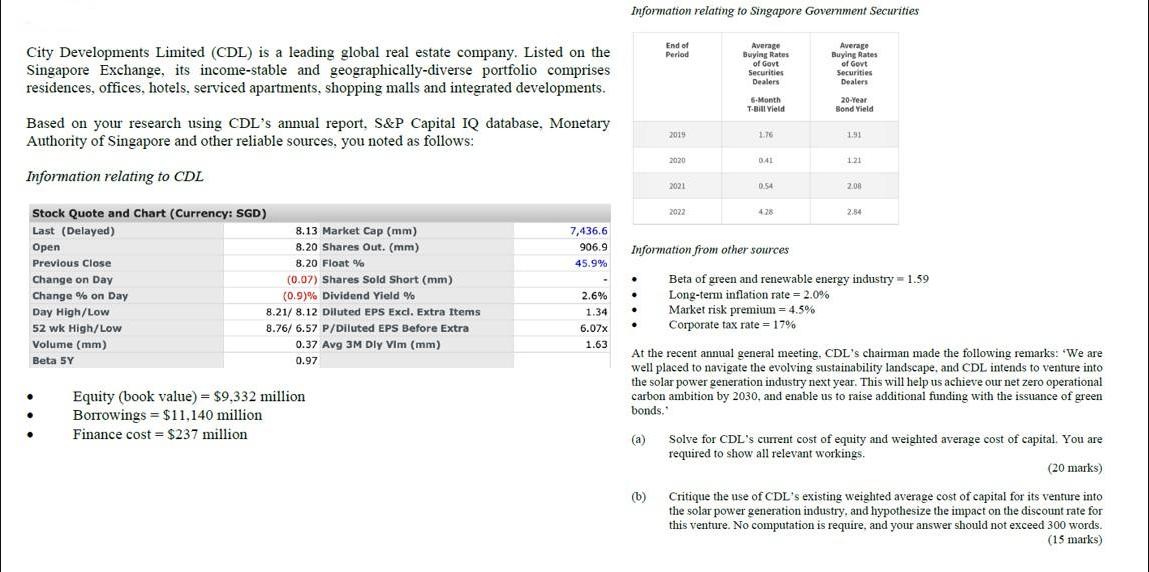

City Developments Limited (CDL) is a leading global real estate company. Listed on the Singapore Exchange, its income-stable and geographically-diverse portfolio comprises residences, offices, hotels, serviced apartments, shopping malls and integrated developments. Based on your research using CDL's annual report, S&P Capital IQ database. Monetary Authority of Singapore and other reliable sources, you noted as follows: Information relating to CDL Stock Quote and Chart (Currency: SGD) Last (Delayed) Open Previous Close Change on Day Change % on Day Day High/Low 52 wk High/Low Volume (mm) Beta 5Y 8.13 Market Cap (mm) 8.20 Shares Out. (mm) 8.20 Float % (0.07) Shares Sold Short (mm) (0.9) % Dividend Yield % 8.21/ 8.12 Diluted EPS Excl. Extra Items 8.76/ 6.57 P/Diluted EPS Before Extra 0.37 Avg 3M Dly Vim (mm) 0.97 Equity (book value) = $9,332 million Borrowings = $11,140 million Finance cost = $237 million 7,436.6 906.9 45.9% 2.6% 1.34 6.07x 1.63 Information relating to Singapore Government Securities End of Period 2019 . 2020 2021 2022 Average Buying Rates of Govt Securities Dealers 6-Month T-Bill Yield 1.76 0.41 0.54 4.28 Information from other sources Average Buying Rates of Govt Securities Dealers Market risk premium = 4.5% Corporate tax rate = 17% 20-Year Bond Yield 1.91 1.21 2.08 2.84 Beta of green and renewable energy industry = 1.59 Long-term inflation rate = 2.0% At the recent annual general meeting. CDL's chairman made the following remarks: 'We are well placed to navigate the evolving sustainability landscape, and CDL intends to venture into the solar power generation industry next year. This will help us achieve our net zero operational carbon ambition by 2030, and enable us to raise additional funding with the issuance of green bonds." (a) Solve for CDL's current cost of equity and weighted average cost of capital. You are required to show all relevant workings. (20 marks) Critique the use of CDL's existing weighted average cost of capital for its venture into the solar power generation industry, and hypothesize the impact on the discount rate for this venture. No computation is require, and your answer should not exceed 300 words. (15 marks)

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a To solve for CDLs current cost of equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started