Answered step by step

Verified Expert Solution

Question

1 Approved Answer

City of Dearborn, Michigan Notes to Required Supplementary Information June 30, 2023 City of Dearborn, Michigan Notes to Required Supplementary Information June 30, 2023

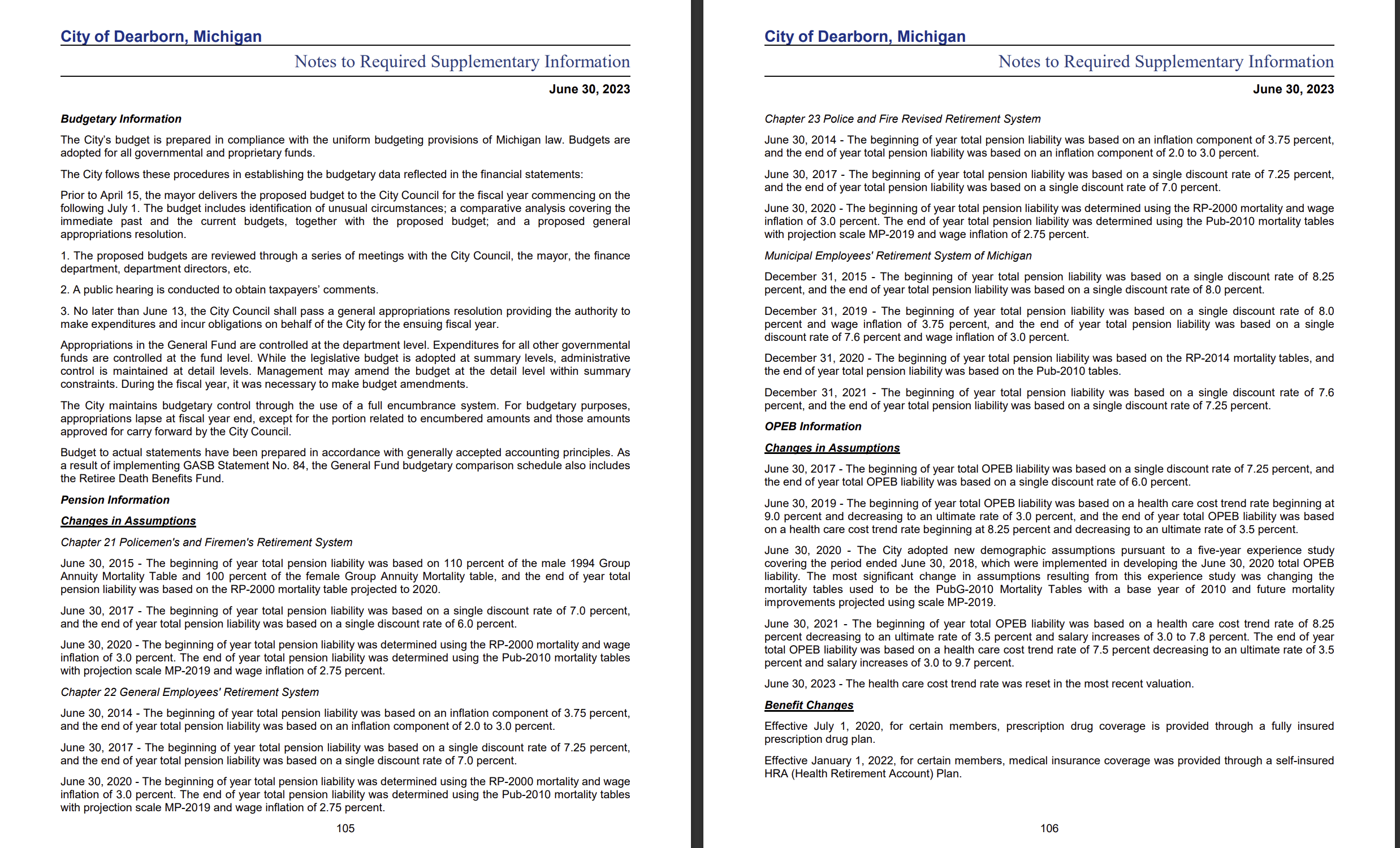

City of Dearborn, Michigan Notes to Required Supplementary Information June 30, 2023 City of Dearborn, Michigan Notes to Required Supplementary Information June 30, 2023 Budgetary Information The City's budget is prepared in compliance with the uniform budgeting provisions of Michigan law. Budgets are adopted for all governmental and proprietary funds. The City follows these procedures in establishing the budgetary data reflected in the financial statements: Prior to April 15, the mayor delivers the proposed budget to the City Council for the fiscal year commencing on the following July 1. The budget includes identification of unusual circumstances; a comparative analysis covering the immediate past and the current budgets, together with the proposed budget; and a proposed general appropriations resolution. 1. The proposed budgets are reviewed through a series of meetings with the City Council, the mayor, the finance department, department directors, etc. 2. A public hearing is conducted to obtain taxpayers' comments. 3. No later than June 13, the City Council shall pass a general appropriations resolution providing the authority to make expenditures and incur obligations on behalf of the City for the ensuing fiscal year. Appropriations in the General Fund are controlled at the department level. Expenditures for all other governmental funds are controlled at the fund level. While the legislative budget is adopted at summary levels, administrative control is maintained at detail levels. Management may amend the budget at the detail level within summary constraints. During the fiscal year, it was necessary to make budget amendments. The City maintains budgetary control through the use of a full encumbrance system. For budgetary purposes, appropriations lapse at fiscal year end, except for the portion related to encumbered amounts and those amounts approved for carry forward by the City Council. Budget to actual statements have been prepared in accordance with generally accepted accounting principles. As a result of implementing GASB Statement No. 84, the General Fund budgetary comparison schedule also includes the Retiree Death Benefits Fund. Pension Information Changes in Assumptions Chapter 21 Policemen's and Firemen's Retirement System June 30, 2015 - The beginning of year total pension liability was based on 110 percent of the male 1994 Group Annuity Mortality Table and 100 percent of the female Group Annuity Mortality table, and the end of year total pension liability was based on the RP-2000 mortality table projected to 2020. June 30, 2017 - The beginning of year total pension liability was based on a single discount rate of 7.0 percent, and the end of year total pension liability was based on a single discount rate of 6.0 percent. June 30, 2020 - The beginning of year total pension liability was determined using the RP-2000 mortality and wage inflation of 3.0 percent. The end of year total pension liability was determined using the Pub-2010 mortality tables with projection scale MP-2019 and wage inflation of 2.75 percent. Chapter 22 General Employees' Retirement System June 30, 2014 - The beginning of year total pension liability was based on an inflation component of 3.75 percent, and the end of year total pension liability was based on an inflation component of 2.0 to 3.0 percent. June 30, 2017 - The beginning of year total pension liability was based on a single discount rate of 7.25 percent, and the end of year total pension liability was based on a single discount rate of 7.0 percent. June 30, 2020 - The beginning of year total pension liability was determined using the RP-2000 mortality and wage inflation of 3.0 percent. The end of year total pension liability was determined using the Pub-2010 mortality tables with projection scale MP-2019 and wage inflation of 2.75 percent. 105 Chapter 23 Police and Fire Revised Retirement System June 30, 2014 - The beginning of year total pension liability was based on an inflation component of 3.75 percent, and the end of year total pension liability was based on an inflation component of 2.0 to 3.0 percent. June 30, 2017 - The beginning of year total pension liability was based on a single discount rate of 7.25 percent, and the end of year total pension liability was based on a single discount rate of 7.0 percent. June 30, 2020 - The beginning of year total pension liability was determined using the RP-2000 mortality and wage inflation of 3.0 percent. The end of year total pension liability was determined using the Pub-2010 mortality tables with projection scale MP-2019 and wage inflation of 2.75 percent. Municipal Employees' Retirement System of Michigan December 31, 2015 - The beginning of year total pension liability was based on a single discount rate of 8.25 percent, and the end of year total pension liability was based on a single discount rate of 8.0 percent. December 31, 2019 - The beginning of year total pension liability was based on a single discount rate of 8.0 percent and wage inflation of 3.75 percent, and the end of year total pension liability was based on a single discount rate of 7.6 percent and wage inflation of 3.0 percent. December 31, 2020 - The beginning of year total pension liability was based on the RP-2014 mortality tables, and the end of year total pension liability was based on the Pub-2010 tables. December 31, 2021 - The beginning of year total pension liability was based on a single discount rate of 7.6 percent, and the end of year total pension liability was based on a single discount rate of 7.25 percent. OPEB Information Changes in Assumptions June 30, 2017 - The beginning of year total OPEB liability was based on a single discount rate of 7.25 percent, and the end of year total OPEB liability was based on a single discount rate of 6.0 percent. June 30, 2019 - The beginning of year total OPEB liability was based on a health care cost trend rate beginning at 9.0 percent and decreasing to an ultimate rate of 3.0 percent, and the end of year total OPEB liability was based on a health care cost trend rate beginning at 8.25 percent and decreasing to an ultimate rate of 3.5 percent. June 30, 2020 - The City adopted new demographic assumptions pursuant to a five-year experience study covering the period ended June 30, 2018, which were implemented in developing the June 30, 2020 total OPEB liability. The most significant change in assumptions resulting from this experience study was changing the mortality tables used to be the PubG-2010 Mortality Tables with a base year of 2010 and future mortality improvements projected using scale MP-2019. June 30, 2021 - The beginning of year total OPEB liability was based on a health care cost trend rate of 8.25 percent decreasing to an ultimate rate of 3.5 percent and salary increases of 3.0 to 7.8 percent. The end of year total OPEB liability was based on a health care cost trend rate of 7.5 percent decreasing to an ultimate rate of 3.5 percent and salary increases of 3.0 to 9.7 percent. June 30, 2023 - The health care cost trend rate was reset in the most recent valuation. Benefit Changes Effective July 1, 2020, for certain members, prescription drug coverage is provided through a fully insured prescription drug plan. Effective January 1, 2022, for certain members, medical insurance coverage was provided through a self-insured HRA (Health Retirement Account) Plan. 106

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started