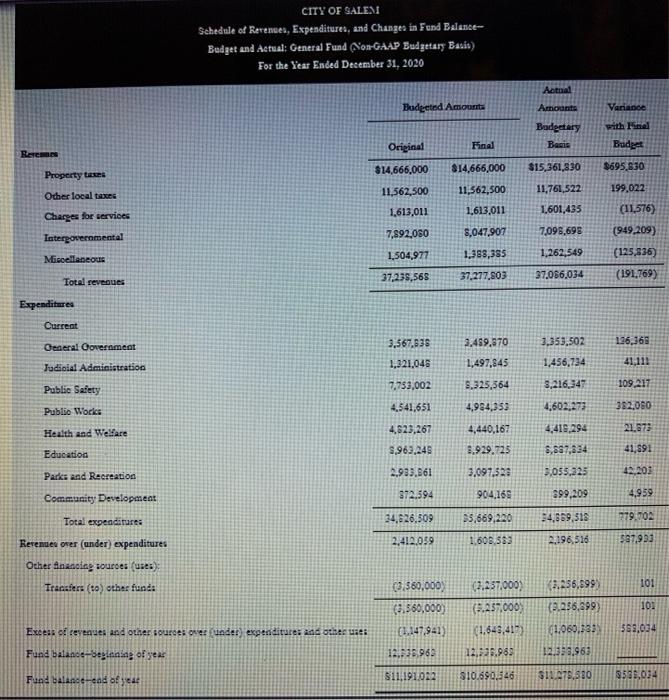

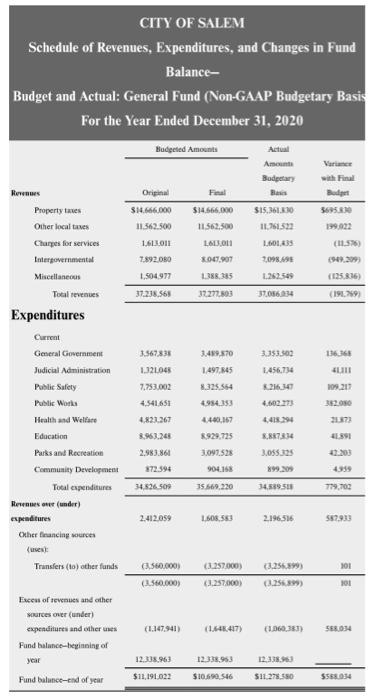

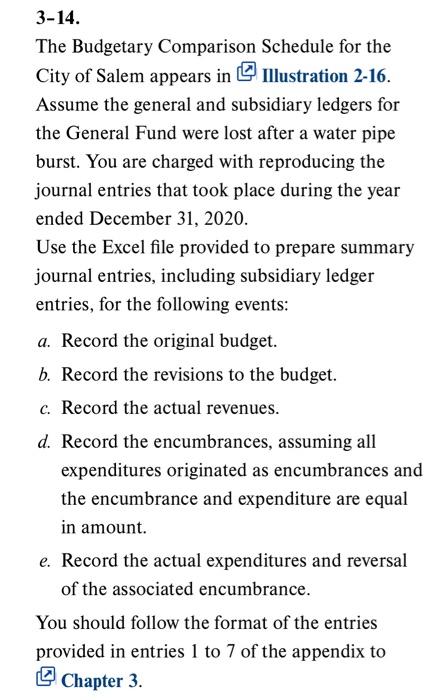

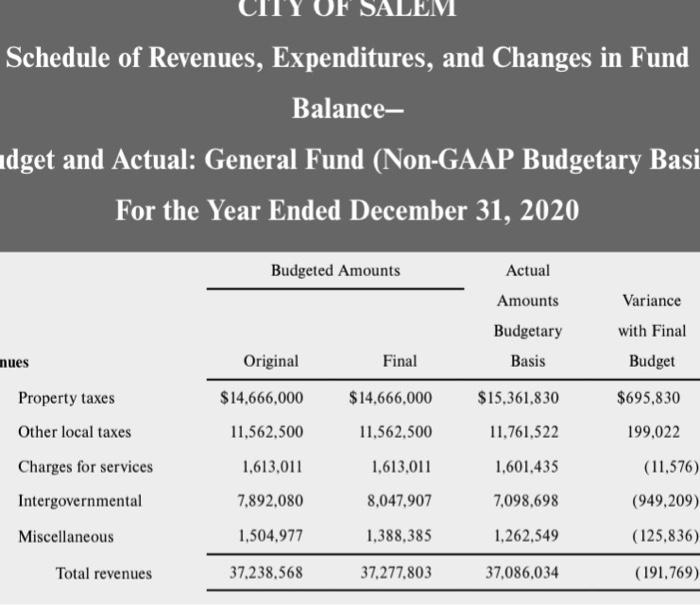

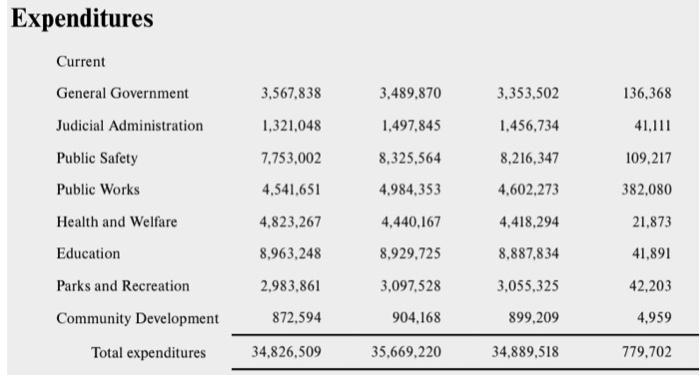

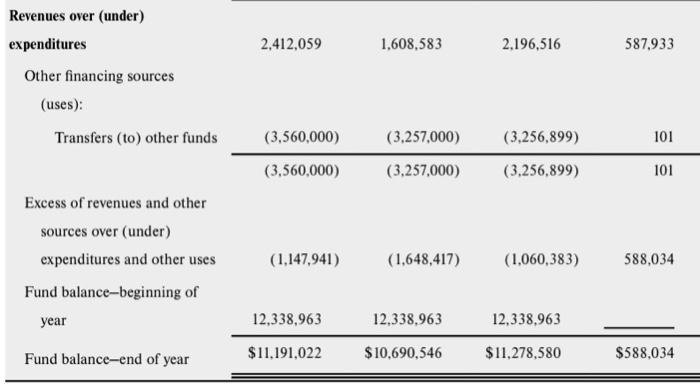

CITY OF GALEN! Fchedule of Revenees, Expenditures, and Changes in Fend Balense- Budget and Actual: General Fund (Non-Gatap Budgetary Basit) For the Year Ended December 31, 2020 Ferenues over (under) expenditures Oeher Anascieg sources (uses): Trapaters (to) other fund: Fund batance-beguning of year Fund balance-cad of yicat Excel-Based Problems 3-14. are char eed with reproducies the joarnal entries that took place durine the sear ended Dectinber 31,2020 at Rroord the oreanal boded 5. Recond the e. Pecord the actibil irthities CITY OF SALEM Schedule of Revenues, Expenditures, and Changes in Fund Balance- Budget and Actual: General Fund (Non-GAAP Budgetary Basis For the Year Ended December 31, 2020 Fucess of tevenues ath crher 314 The Budgetary Comparison Schedule for the City of Salem appears in Illustration 2-16. Assume the general and subsidiary ledgers for the General Fund were lost after a water pipe burst. You are charged with reproducing the journal entries that took place during the year ended December 31, 2020. Use the Excel file provided to prepare summary journal entries, including subsidiary ledger entries, for the following events: a. Record the original budget. b. Record the revisions to the budget. c. Record the actual revenues. d. Record the encumbrances, assuming all expenditures originated as encumbrances and the encumbrance and expenditure are equal in amount. e. Record the actual expenditures and reversal of the associated encumbrance. You should follow the format of the entries provided in entries 1 to 7 of the appendix to () Chapter 3. Schedule of Revenues, Expenditures, and Changes in Fund Balance- dget and Actual: General Fund (Non-GAAP Budgetary Basi For the Year Ended December 31, 2020 Exnenditures Revenues over (under) Excess of revenues and other CITY OF GALEN! Fchedule of Revenees, Expenditures, and Changes in Fend Balense- Budget and Actual: General Fund (Non-Gatap Budgetary Basit) For the Year Ended December 31, 2020 Ferenues over (under) expenditures Oeher Anascieg sources (uses): Trapaters (to) other fund: Fund batance-beguning of year Fund balance-cad of yicat Excel-Based Problems 3-14. are char eed with reproducies the joarnal entries that took place durine the sear ended Dectinber 31,2020 at Rroord the oreanal boded 5. Recond the e. Pecord the actibil irthities CITY OF SALEM Schedule of Revenues, Expenditures, and Changes in Fund Balance- Budget and Actual: General Fund (Non-GAAP Budgetary Basis For the Year Ended December 31, 2020 Fucess of tevenues ath crher 314 The Budgetary Comparison Schedule for the City of Salem appears in Illustration 2-16. Assume the general and subsidiary ledgers for the General Fund were lost after a water pipe burst. You are charged with reproducing the journal entries that took place during the year ended December 31, 2020. Use the Excel file provided to prepare summary journal entries, including subsidiary ledger entries, for the following events: a. Record the original budget. b. Record the revisions to the budget. c. Record the actual revenues. d. Record the encumbrances, assuming all expenditures originated as encumbrances and the encumbrance and expenditure are equal in amount. e. Record the actual expenditures and reversal of the associated encumbrance. You should follow the format of the entries provided in entries 1 to 7 of the appendix to () Chapter 3. Schedule of Revenues, Expenditures, and Changes in Fund Balance- dget and Actual: General Fund (Non-GAAP Budgetary Basi For the Year Ended December 31, 2020 Exnenditures Revenues over (under) Excess of revenues and other