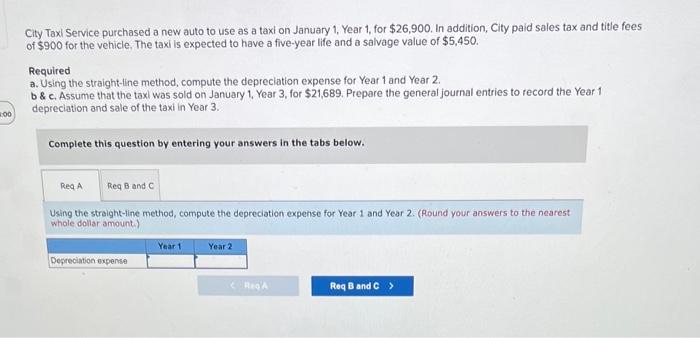

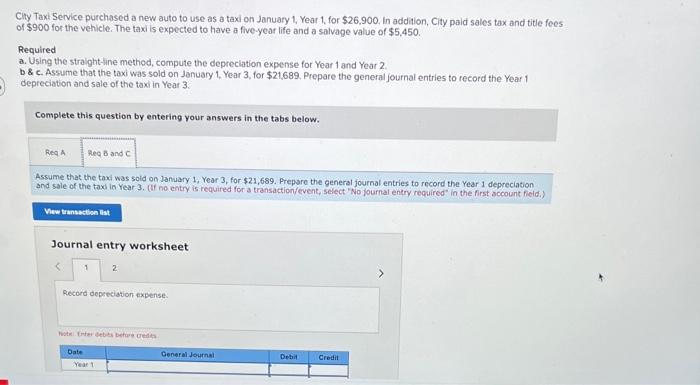

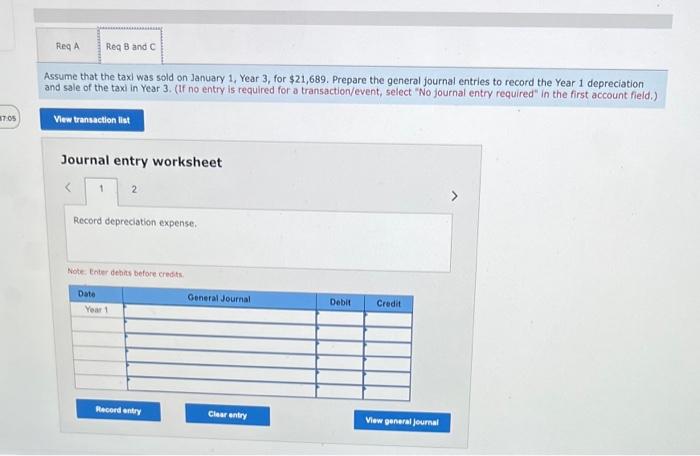

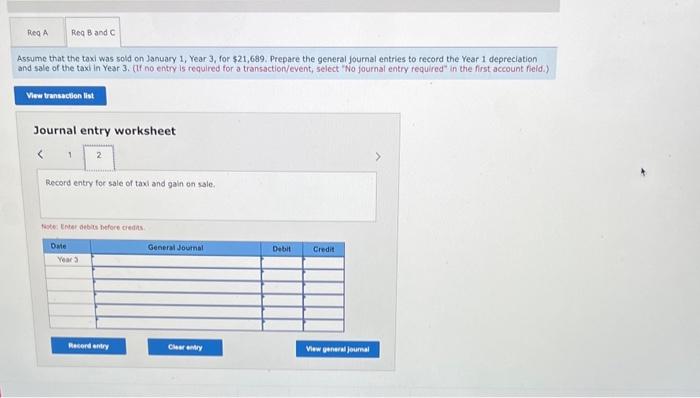

City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1, for $26,900. In addition, City paid sales tax and title fee: of $900 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $5,450. Required a. Using the straight-line method, compute the depreclation expense for Year 1 and Year 2. b&c. Assume that the taxl was sold on January 1, Year 3, for $21,689. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. Complete this question by entering your answers in the tabs below. Using the straight-iline method, compute the depreciation expense for Year 1 and Year 2. (Round your answers to the nearest whole dollar amount.) City Taxi Service purchased a new auto to use as a taxi on January 1, Year 1 , for $26,900. In addition, City paid sales tax and title fees of $900 for the vehicle. The taxi is expected to have a five-year life and a salvage value of $5,450. Required a. Using the straight-line method, compute the depreciation expense for Year 1 and Year 2. b \& c. Assume that the taxi was sold on January 1, Year 3, for \$21,689. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3 . Complete this question by entering your answers in the tabs below. Assume that the taxi was sold on January 1, Year 3, for $21,689. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3 . (th no entry is required for a transaction/event, select 'No journal entry required" in the first account field.) Assume that the taxi was sold on January 1 , Year 3 , for $21,689. Prepare the general journal entries to record the Year 1 depreciation and sale of the taxi in Year 3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 2 Assume that the taxi was sold on January 1, Year 3 , for $21,689. Prepare the genefal joumal entries to record the Year 1 depreciation and sale of the taxi in Year 3. (If no entry is required for a transaction/event, select "No fournal entry required" in the first account field. Journal entry worksheet Record entry for sale of taxl and gaif on wale. twote. Ener gebis fitfore dedis