Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CJK Ltd was incorporated on 15 December 20X9 with an authorised capital of 200,000 ordinary shares of 0.20 each to acquire as at 31

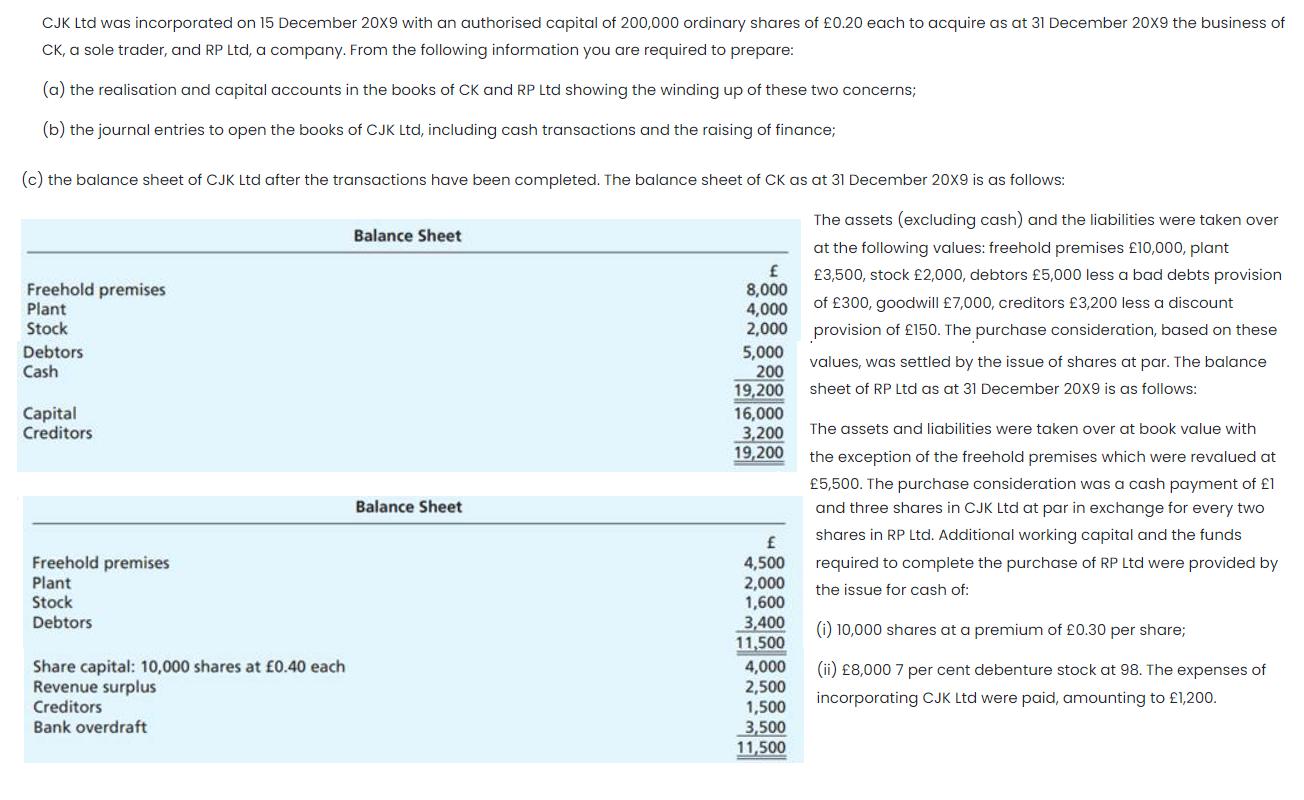

CJK Ltd was incorporated on 15 December 20X9 with an authorised capital of 200,000 ordinary shares of 0.20 each to acquire as at 31 December 20X9 the business of CK, a sole trader, and RP Ltd, a company. From the following information you are required to prepare: (a) the realisation and capital accounts in the books of CK and RP Ltd showing the winding up of these two concerns; (b) the journal entries to open the books of CJK Ltd, including cash transactions and the raising of finance; (c) the balance sheet of CJK Ltd after the transactions have been completed. The balance sheet of CK as at 31 December 20X9 is as follows: The assets (excluding cash) and the liabilities were taken over Balance Sheet at the following values: freehold premises 10,000, plant 3,500, stock 2,000, debtors 5,000 less a bad debts provision Freehold premises Plant Stock 8,000 4,000 2,000 provision of 150. The purchase consideration, based on these of 300, goodwill 7,000, creditors 3,200 less a discount Debtors 5,000 200 19,200 values, was settled by the issue of shares at par. The balance Cash sheet of RP Ltd as at 31 December 20X9 is as follows: Capital Creditors 16,000 3,200 19,200 The assets and liabilities were taken over at book value with the exception of the freehold premises which were revalued at 5,500. The purchase consideration was a cash payment of I Balance Sheet and three shares in CJK Ltd at par in exchange for every two shares in RP Ltd. Additional working capital and the funds Freehold premises 4,500 2,000 1,600 3,400 11,500 required to complete the purchase of RP Ltd were provided by Plant the issue for cash of: Stock Debtors (i) 10,000 shares at a premium of 0.30 per share; Share capital: 10,000 shares at 0.40 each Revenue surplus Creditors 4,000 2,500 1,500 3,500 11,500 (ii) 8,000 7 per cent debenture stock at 98. The expenses of incorporating CJK Ltd were paid, amounting to 1,200. Bank overdraft

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Realisation Ac CK as on 31 december 20X9 Particulars Particulars To freeh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started