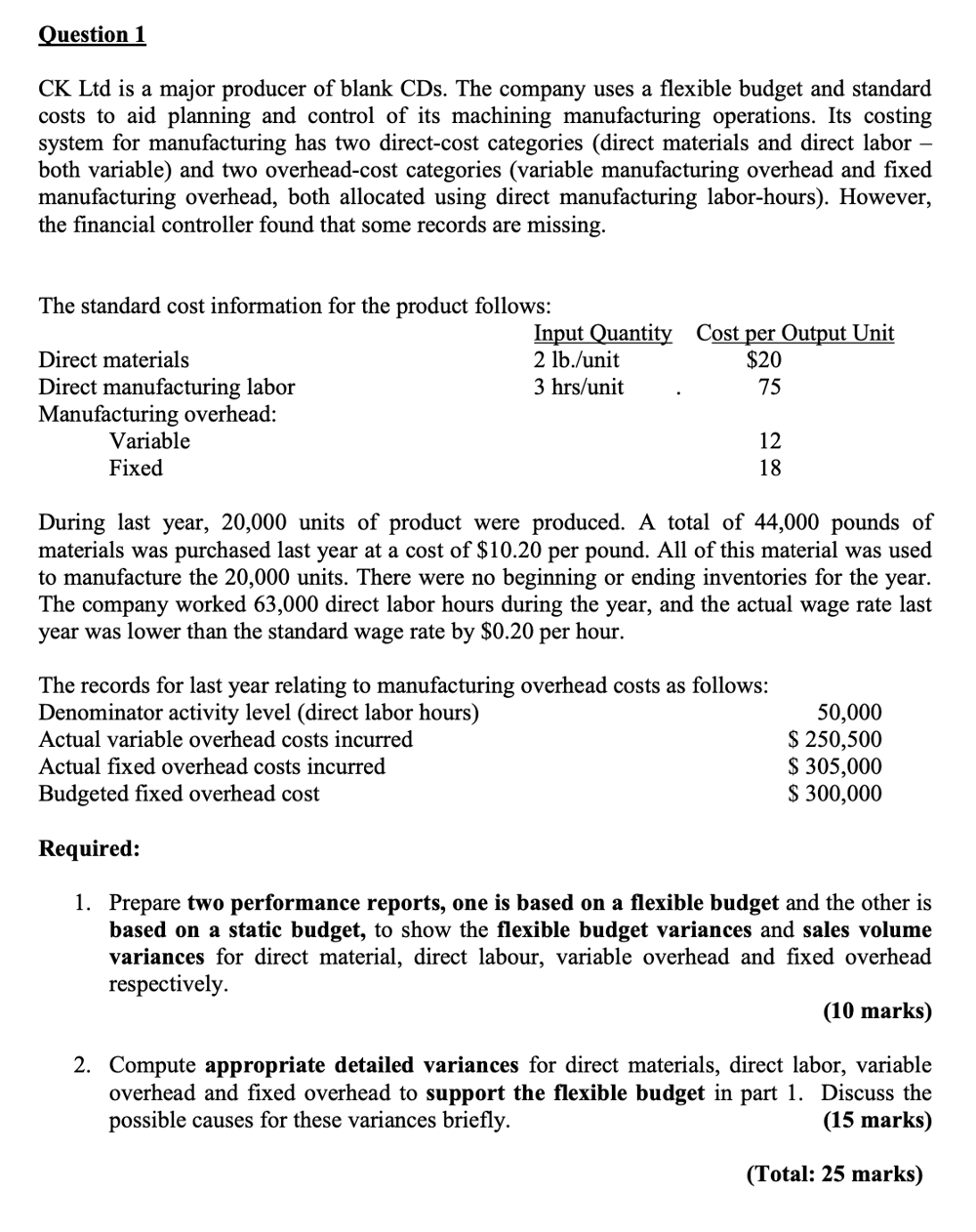

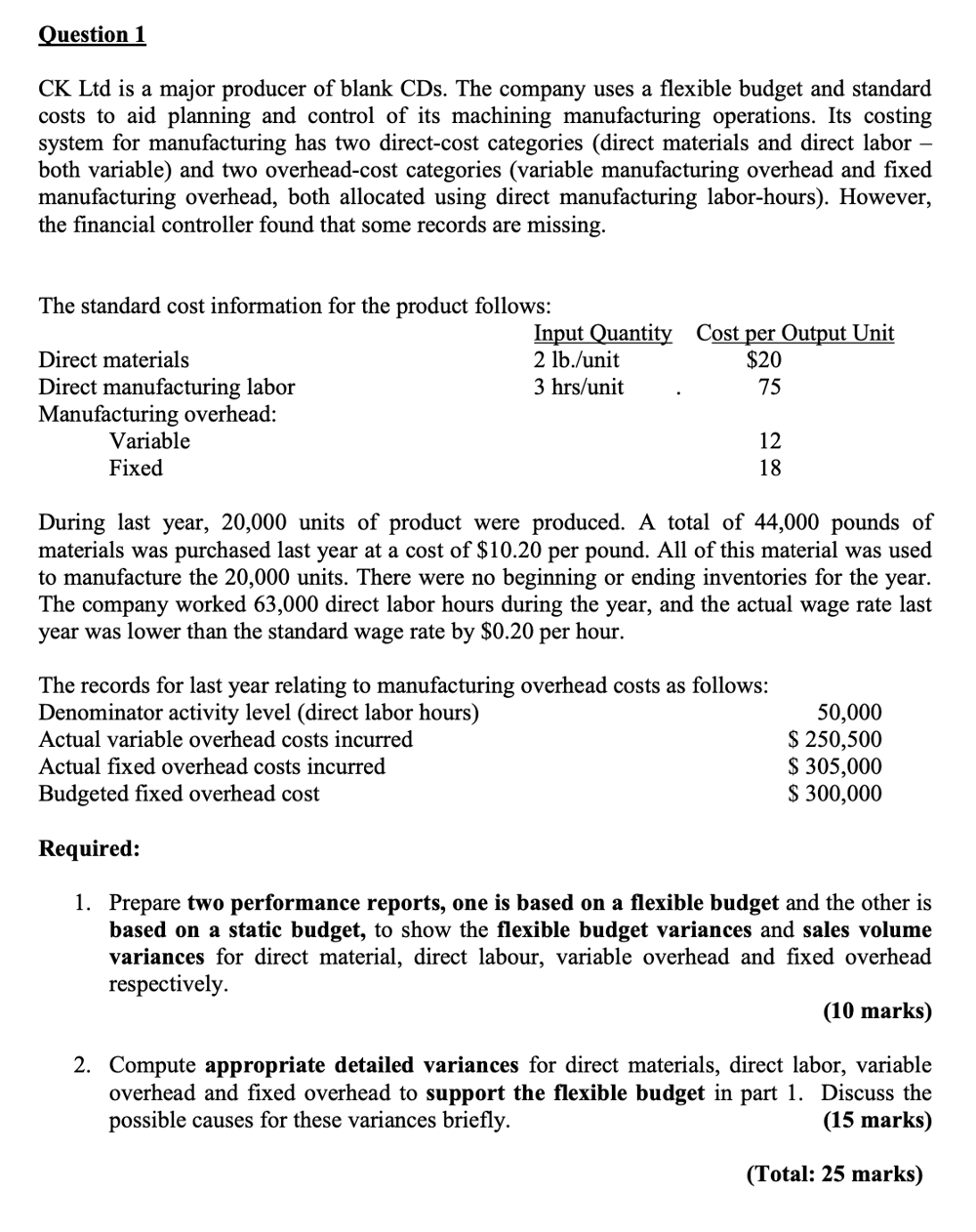

CK Ltd is a major producer of blank CDs. The company uses a flexible budget and standard costs to aid planning and control of its machining manufacturing operations. Its costing system for manufacturing has two direct-cost categories (direct materials and direct labor both variable) and two overhead-cost categories (variable manufacturing overhead and fixed manufacturing overhead, both allocated using direct manufacturing labor-hours). However, the financial controller found that some records are missing. The standard cost information for the product follows: During last year, 20,000 units of product were produced. A total of 44,000 pounds of materials was purchased last year at a cost of $10.20 per pound. All of this material was used to manufacture the 20,000 units. There were no beginning or ending inventories for the year. The company worked 63,000 direct labor hours during the year, and the actual wage rate last year was lower than the standard wage rate by $0.20 per hour. 7 Required: 1. Prepare two performance reports, one is based on a flexible budget and the other is based on a static budget, to show the flexible budget variances and sales volume variances for direct material, direct labour, variable overhead and fixed overhead respectively. (10 marks) 2. Compute appropriate detailed variances for direct materials, direct labor, variable overhead and fixed overhead to support the flexible budget in part 1 . Discuss the possible causes for these variances briefly. (15 marks) CK Ltd is a major producer of blank CDs. The company uses a flexible budget and standard costs to aid planning and control of its machining manufacturing operations. Its costing system for manufacturing has two direct-cost categories (direct materials and direct labor both variable) and two overhead-cost categories (variable manufacturing overhead and fixed manufacturing overhead, both allocated using direct manufacturing labor-hours). However, the financial controller found that some records are missing. The standard cost information for the product follows: During last year, 20,000 units of product were produced. A total of 44,000 pounds of materials was purchased last year at a cost of $10.20 per pound. All of this material was used to manufacture the 20,000 units. There were no beginning or ending inventories for the year. The company worked 63,000 direct labor hours during the year, and the actual wage rate last year was lower than the standard wage rate by $0.20 per hour. 7 Required: 1. Prepare two performance reports, one is based on a flexible budget and the other is based on a static budget, to show the flexible budget variances and sales volume variances for direct material, direct labour, variable overhead and fixed overhead respectively. (10 marks) 2. Compute appropriate detailed variances for direct materials, direct labor, variable overhead and fixed overhead to support the flexible budget in part 1 . Discuss the possible causes for these variances briefly. (15 marks)