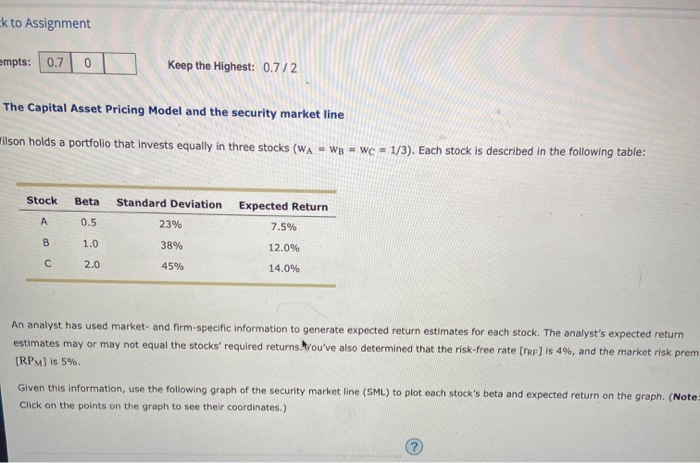

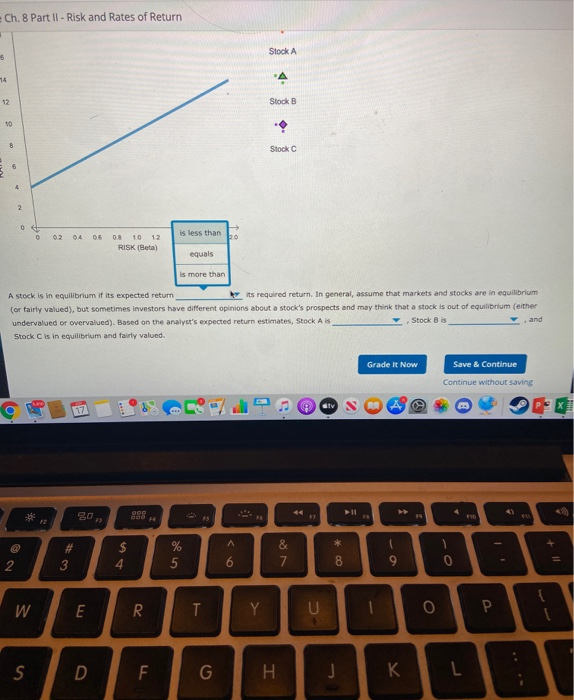

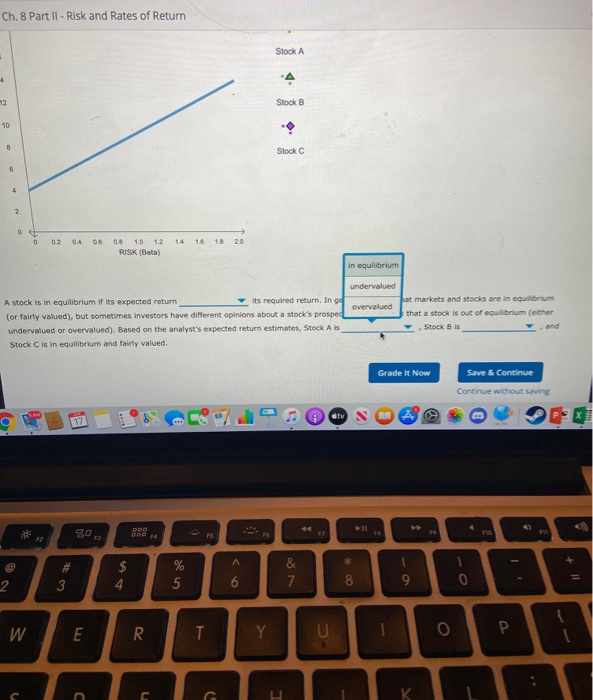

ck to Assignment empts: 0.7 0 Keep the Highest: 0.7/2 The Capital Asset Pricing Model and the security market line Tilson holds a portfolio that invests equally in three stocks (WA - Wg - Wc = 1/3). Each stock is described in the following table: Stock Beta Standard Deviation 23% Expected Return 7.5% A 0.5 B 1.0 38% 12.0% 2.0 45% 14.0% An analyst has used market and firm-specific information to generate expected return estimates for each stock. The analyst's expected return estimates may or may not equal the stocks' required returns. You've also determined that the risk-free rate [her] is 4%, and the market risk prem [RPM) is 5% Given this information, use the following graph of the security market line (SML) to plot each stock's beta and expected return on the graph. (Note: Click on the points on the graph to see their coordinates.) Ch. 8 Part II - Risk and Rates of Return Stock A 14 A 12 Stock B 10 B Stock 6 4 2 0 is less than 0 02 04 06 bo 08 10 12 RISK (Beta) equals is more than A stock is in equilibrium if its expected return its required return. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, Stock A is Stock Bis and Stock C is in equilibrium and fairly valued Grade It Now Save & Continue Continue without saving 17 OOO 5 FS 10 A # 3 $ 4 % 5 & 7 6 2 8 9 Il > W E R T U 0 P S D F . L Ch. 8 Part II - Risk and Rates of Return Stock A 4 A 12 Stock B 10 B Stock 4 2 0 0 02 04 06 1.6 18 2.0 08 10 1.2 RISK (Beta) in equilibrium undervalued overvalued A stock is in equilibrium if its expected return its required return, in od (or fairly valued), but sometimes investors have different opinions about a stock's prosped undervalued or overvalued). Based on the analyst's expected return estimates, Stock Als Stock C is in equilibrium and fairly valued. at markets and stocks are in equilibrium that a stock is out of equilibrium (either Stock Bis Grade It Now Save & Continue Continue without saving 17 19 ty DOG 20 15 A * + # 3 $ 4 % 5 & 7 2 = 6 8 0 W E R T Y U 0 K c C