Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CK Trading Pte Ltd (CK) is an exclusive distributor of Robo brand of household appliances in the Asia Pacific region. On the last day

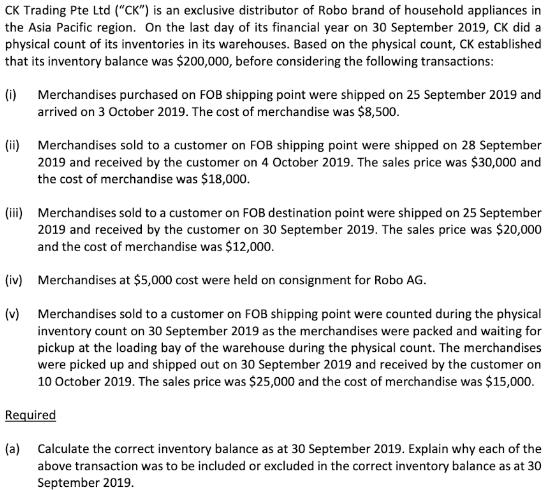

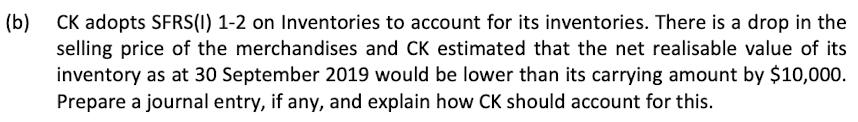

CK Trading Pte Ltd ("CK") is an exclusive distributor of Robo brand of household appliances in the Asia Pacific region. On the last day of its financial year on 30 September 2019, CK did a physical count of its inventories in its warehouses. Based on the physical count, CK established that its inventory balance was $200,000, before considering the following transactions: (i) Merchandises purchased on FOB shipping point were shipped on 25 September 2019 and arrived on 3 October 2019. The cost of merchandise was $8,500. (ii) Merchandises sold to a customer on FOB shipping point were shipped on 28 September 2019 and received by the customer on 4 October 2019. The sales price was $30,000 and the cost of merchandise was $18,000. (iii) Merchandises sold to a customer on FOB destination point were shipped on 25 September 2019 and received by the customer on 30 September 2019. The sales price was $20,000 and the cost of merchandise was $12,000. (iv) Merchandises at $5,000 cost were held on consignment for Robo AG. (v) Merchandises sold to a customer on FOB shipping point were counted during the physical inventory count on 30 September 2019 as the merchandises were packed and waiting for pickup at the loading bay of the warehouse during the physical count. The merchandises were picked up and shipped out on 30 September 2019 and received by the customer on 10 October 2019. The sales price was $25,000 and the cost of merchandise was $15,000. Required (a) Calculate the correct inventory balance as at 30 September 2019. Explain why each of the above transaction was to be included or excluded in the correct inventory balance as at 30 September 2019. (b) CK adopts SFRS(I) 1-2 on Inventories to account for its inventories. There is a drop in the selling price of the merchandises and CK estimated that the net realisable value of its inventory as at 30 September 2019 would be lower than its carrying amount by $10,000. Prepare a journal entry, if any, and explain how CK should account for this.

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the correct inventory balance as of 30 September 2019 we need to consider each of the given transactions and determine whether they sho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started