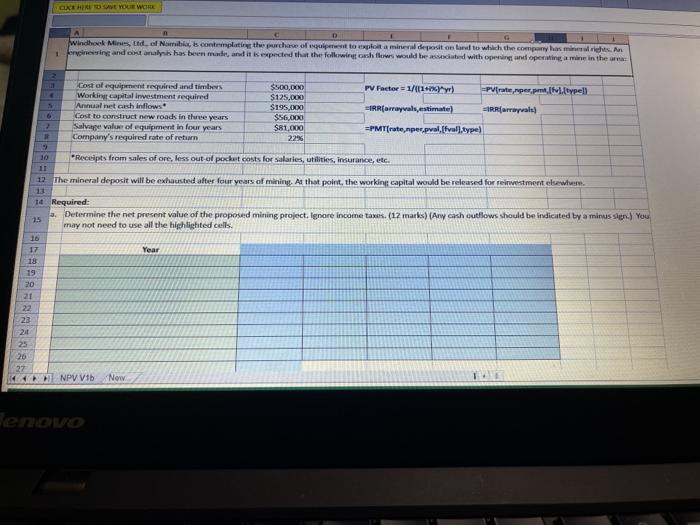

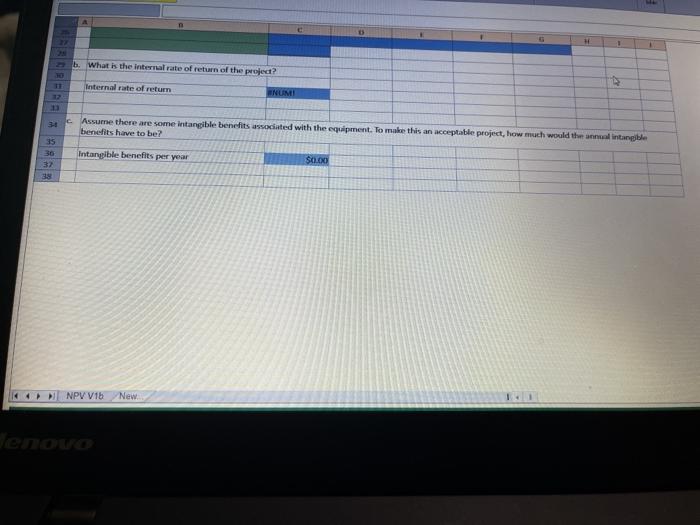

CKTHROAT YOU WCH Windhoek Mines del Namibia, contemplating the purchase of equipment to peta mineral deposit on bar to which the company has milits. An 1 eineering and cost analysis has been made, and it is expected that the fall with flows would be woted with opening and operating a mine in the war PV Factor = 1/((116) =Pratenperpet, tv.lrypell Cost of equipment required and timber Working capital investment required Annual het ashindows Cost to construct new roads in three years Salvage value of equipment in four years Company's required rate of return $500,000 $125,000 $195.000 $56.000 $81.00 2256 TRR(arrayval estimate) IRRfarroa) 6 > =PMTrate,nper pallval.type) "Receipts from sales of ore, less out of pocket costs for salaries, utilities, insurance, etc. 12 The mineral deposit will be exhausted after four years of mining. At that point, the working capital would be released for reinvestment elsewhere 13 14 Required: 25 Determine the net present value of the proposed mining project. Ignore income taxes. (12 marks) (Any cash outflows should be indicated by a minus sign.) You may not need to use all the highlighted cells. 16 Year 18 17 19 20 21 22 23 24 25 20 27 NPV Vib Now Lenovo H 1 b. What is the internal rate of return of the project? SERE Internal rate of return ENUMI Assume there are some intangible benefits associated with the equipment. To make this an acceptable project, how much would the annual intangible benefits have to be? 35 Intangible benefits per year 36 32 38 $0.00 KNPV V1 New. enou CKTHROAT YOU WCH Windhoek Mines del Namibia, contemplating the purchase of equipment to peta mineral deposit on bar to which the company has milits. An 1 eineering and cost analysis has been made, and it is expected that the fall with flows would be woted with opening and operating a mine in the war PV Factor = 1/((116) =Pratenperpet, tv.lrypell Cost of equipment required and timber Working capital investment required Annual het ashindows Cost to construct new roads in three years Salvage value of equipment in four years Company's required rate of return $500,000 $125,000 $195.000 $56.000 $81.00 2256 TRR(arrayval estimate) IRRfarroa) 6 > =PMTrate,nper pallval.type) "Receipts from sales of ore, less out of pocket costs for salaries, utilities, insurance, etc. 12 The mineral deposit will be exhausted after four years of mining. At that point, the working capital would be released for reinvestment elsewhere 13 14 Required: 25 Determine the net present value of the proposed mining project. Ignore income taxes. (12 marks) (Any cash outflows should be indicated by a minus sign.) You may not need to use all the highlighted cells. 16 Year 18 17 19 20 21 22 23 24 25 20 27 NPV Vib Now Lenovo H 1 b. What is the internal rate of return of the project? SERE Internal rate of return ENUMI Assume there are some intangible benefits associated with the equipment. To make this an acceptable project, how much would the annual intangible benefits have to be? 35 Intangible benefits per year 36 32 38 $0.00 KNPV V1 New. enou