Question: CLA 2 Comprehensive Learning Assessment 2 - CLO 1, CLO 2, CLO 3, CLO 6 Review peer reviewed journal articles and write at least three

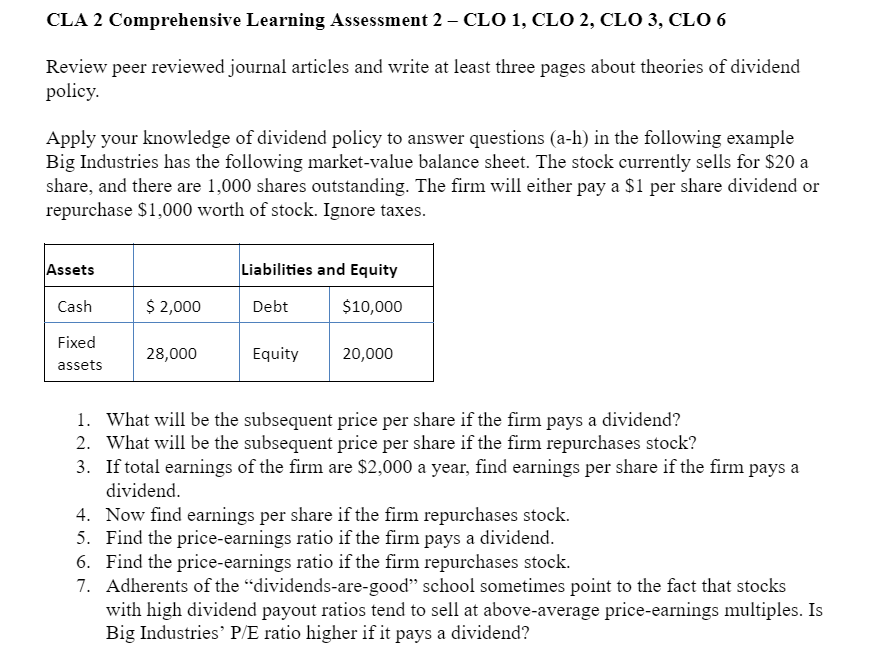

CLA 2 Comprehensive Learning Assessment 2 - CLO 1, CLO 2, CLO 3, CLO 6 Review peer reviewed journal articles and write at least three pages about theories of dividend policy. Apply your knowledge of dividend policy to answer questions (a-h) in the following example Big Industries has the following market-value balance sheet. The stock currently sells for $20 a share, and there are 1,000 shares outstanding. The firm will either pay a $1 per share dividend or repurchase $1,000 worth of stock. Ignore taxes. Assets Liabilities and Equity Cash $ 2,000 Debt $10,000 Fixed 28,000 Equity 20,000 assets 1. What will be the subsequent price per share if the firm pays a dividend? 2. What will be the subsequent price per share if the firm repurchases stock? 3. If total earnings of the firm are $2,000 a year, find earnings per share if the firm pays a dividend. 4. Now find earnings per share if the firm repurchases stock. 5. Find the price-earnings ratio if the firm pays a dividend. 6. Find the price-earnings ratio if the firm repurchases stock. 7. Adherents of the "dividends-are-good" school sometimes point to the fact that stocks with high dividend payout ratios tend to sell at above-average price-earnings multiples. Is Big Industries' P/E ratio higher if it pays a dividend? 8. Looking back at your answers to parts (a) to (f), do you think that the difference in P/E supports the "dividends-are-good" Provide in-text citations and explain in detail. CLA 2 Comprehensive Learning Assessment 2 - CLO 1, CLO 2, CLO 3, CLO 6 Review peer reviewed journal articles and write at least three pages about theories of dividend policy. Apply your knowledge of dividend policy to answer questions (a-h) in the following example Big Industries has the following market-value balance sheet. The stock currently sells for $20 a share, and there are 1,000 shares outstanding. The firm will either pay a $1 per share dividend or repurchase $1,000 worth of stock. Ignore taxes. Assets Liabilities and Equity Cash $ 2,000 Debt $10,000 Fixed 28,000 Equity 20,000 assets 1. What will be the subsequent price per share if the firm pays a dividend? 2. What will be the subsequent price per share if the firm repurchases stock? 3. If total earnings of the firm are $2,000 a year, find earnings per share if the firm pays a dividend. 4. Now find earnings per share if the firm repurchases stock. 5. Find the price-earnings ratio if the firm pays a dividend. 6. Find the price-earnings ratio if the firm repurchases stock. 7. Adherents of the "dividends-are-good" school sometimes point to the fact that stocks with high dividend payout ratios tend to sell at above-average price-earnings multiples. Is Big Industries' P/E ratio higher if it pays a dividend? 8. Looking back at your answers to parts (a) to (f), do you think that the difference in P/E supports the "dividends-are-good" Provide in-text citations and explain in detail

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts