Question

Claire O'Brien was excited to start her first job out of college at RGB. She had interviewed a year ago and was turned down. After

Claire O'Brien was excited to start her first job out of college at RGB. She had interviewed a year ago and was turned down. After completing her degree with honors, she reapplied and was hired as a financial analyst. Claire thought the company's prospects were good. It was a mature business, but RGB had grown steadily compared to its competitors.

Claire started work on March 17, 2023. Within her first month, she received a memo from the CFO that covered RGB's cost of capital. The CFO tasked her with explaining RGB's weighted average cost of capital to other departmental managers. Claire was not expecting such a big task in her first month.

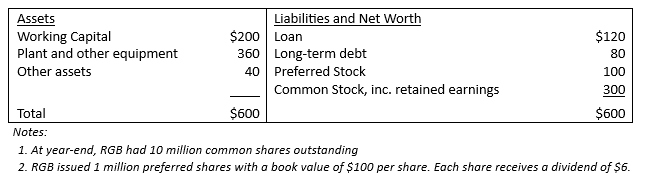

After she reviewed the memo, Claire was apprehensive that some information was incorrect. Claire reviewed RGB's most recent balance sheet. The figures are in millions.

After reviewing the balance sheet, she noted the following items:

- The company's bank charged interest at current market rates, and the long-term debt had just been issued. Book and market values could not differ by much.

- The preferred stock had been issued 35 years ago when interest rates were much lower. The preferred stock, issued initially at a book value of $100 per share, was now trading for only $70 per share.

- The book value per share of the common stock was $30, but the stock was trading for $40 per share. Next year's earnings per share would be about $4, and dividends per share probably $2. (Ten million shares of common stock are outstanding.) RBG usually paid out 50% of earnings as dividends and plowed back the rest.

- Earnings and dividends had grown steadily at 6% to 7% per year, in line with the company's sustainable growth rate. The sustainable growth rate was 4/30 * 0.5 or 0.67 or 6.7%.

RGB's beta had averaged about .5, which was in line with stable, steady-growth businesses.

Claire made a quick cost of equity calculation using the capital asset pricing model (CAPM). With current interest rates of about 7% and a market risk premium of 7%, the CAPM cost of equity was 10.5%.

This cost of equity was significantly less than the 16% decreed in the memo. Claire thought the CFO's cost of equity might be incorrect. She wondered if there was some other way to estimate the cost of equity as a check on the CAPM calculation.

Claire started work on her analysis immediately and decided to speak with the CFO as soon as possible. She focused on comparable rates of return that investors could expect to receive and would compare to the target book value return on equity. She would need to consider CAPM calculations as well as WACC. Claire needed to confirm the correct numbers and show the CFO where she got those numbers.

What is going on? Who is incorrect? Which items are incorrect? What assumptions are Claire or the CFO making? What calculations could Claire use to estimate the cost of equity as a check on the CAPM calculation? Is the CFO's 16% rate of return correct? Is that really what people could get on other investments in the market? Could there be other errors in the calculations? What other information does Claire need to make sure to share with the CFO to explain where she got her numbers?

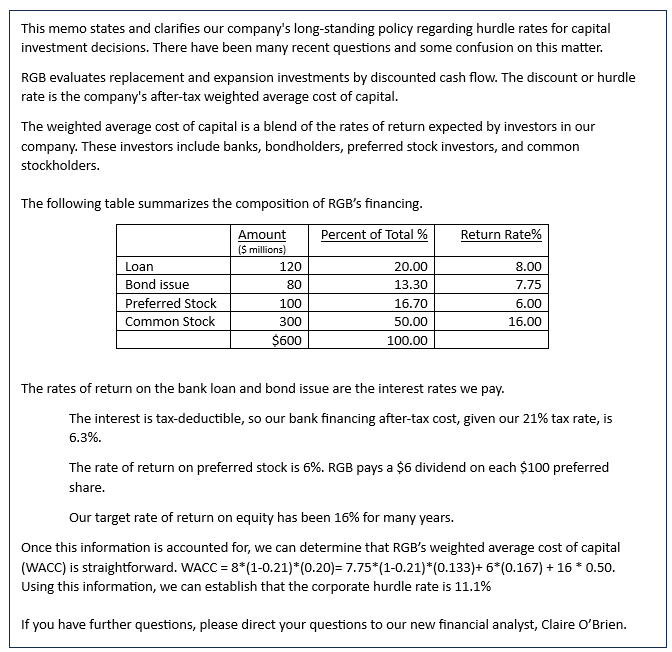

This memo states and clarifies our company's long-standing policy regarding hurdle rates for capital investment decisions. There have been many recent questions and some confusion on this matter. RGB evaluates replacement and expansion investments by discounted cash flow. The discount or hurdle rate is the company's after-tax weighted average cost of capital. The weighted average cost of capital is a blend of the rates of return expected by investors in our company. These investors include banks, bondholders, preferred stock investors, and common stockholders. The following table summarizes the composition of RGB's financing. The rates of return on the bank loan and bond issue are the interest rates we pay. The interest is tax-deductible, so our bank financing after-tax cost, given our 21% tax rate, is 6.3%. The rate of return on preferred stock is 6%. RGB pays a $6 dividend on each $100 preferred share. Our target rate of return on equity has been 16% for many years. Once this information is accounted for, we can determine that RGB's weighted average cost of capital (WACC) is straightforward. WACC =8(10.21)(0.20)=7.75(10.21)(0.133)+6(0.167)+160.50. Using this information, we can establish that the corporate hurdle rate is 11.1% If you have further questions, please direct your questions to our new financial analyst, Claire OBrien. 1. At year-end, RGB had 10 million common shares outstanding 2. RGB issued 1 million preferred shares with a book value of $100 per share. Each share receives a dividend of $6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started