Answered step by step

Verified Expert Solution

Question

1 Approved Answer

claration On 1 July 2005 Neil Chen purchased a block of land (1004m2) with a 3 bed-room house on it for $820,000. The house

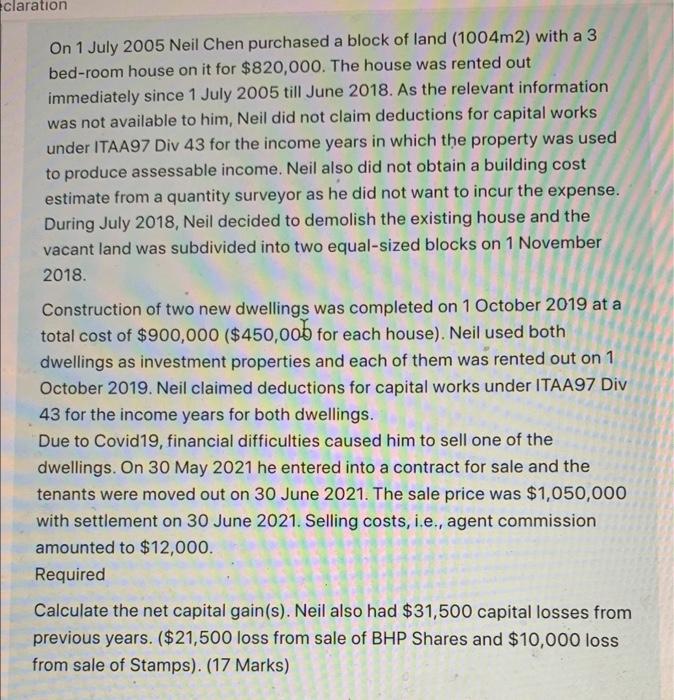

claration On 1 July 2005 Neil Chen purchased a block of land (1004m2) with a 3 bed-room house on it for $820,000. The house was rented out immediately since 1 July 2005 till June 2018. As the relevant information was not available to him, Neil did not claim deductions for capital works under ITAA97 Div 43 for the income years in which the property was used to produce assessable income. Neil also did not obtain a building cost estimate from a quantity surveyor as he did not want to incur the expense. During July 2018, Neil decided to demolish the existing house and the vacant land was subdivided into two equal-sized blocks on 1 November 2018. Construction of two new dwellings was completed on 1 October 2019 at a total cost of $900,000 ($450,000 for each house). Neil used both dwellings as investment properties and each of them was rented out on 1 October 2019. Neil claimed deductions for capital works under ITAA97 Div 43 for the income years for both dwellings. Due to Covid19, financial difficulties caused him to sell one of the dwellings. On 30 May 2021 he entered into a contract for sale and the tenants were moved out on 30 June 2021. The sale price was $1,050,000 with settlement on 30 June 2021. Selling costs, i.e., agent commission amounted to $12,000. Required Calculate the net capital gain(s). Neil also had $31,500 capital losses from previous years. ($21,500 loss from sale of BHP Shares and $10,000 loss from sale of Stamps). (17 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started