Question

Clarification to already answered question (can't seem to get a response to my comments on the original question, and I need this before 10 tonight).

Clarification to already answered question (can't seem to get a response to my comments on the original question, and I need this before 10 tonight).

Original question...

Sales Mix Decision

Hi, the Chegg Textbook Solutions answer to 9AP for the book, Managerial Accounting 10th ed by Crosson and Needles, Chapter 9 - P9 under Alternative Problems is incorect. The below is the correct question which needs to be answered as soon as possible.

Sales Mix Decision

Dr. Stott, who specializes in internal medicine, wants to analyze his sales mix to find out how the time of his physician assistant, Connie Mortiz, can be used to generate the highest operating income.

Mortiz sees patients in Dr. Stott's office, consults with patients over the telephone, and conducts one daily weight-loss support group attended by up to 50 patients. Statistics for the three services are as follows:

| Office Visits | Phone Calls | Weight-Loss Support Group | |

| Maximum number of patient billings per day | 20 | 40 | 50 |

| Hours per billing | .25 | .10 | 1.0 |

| Billing rate | $50 | $25 | $10 |

| Variable costs | $25 | $12 | $5 |

Mortiz works seven hours a day.

Required

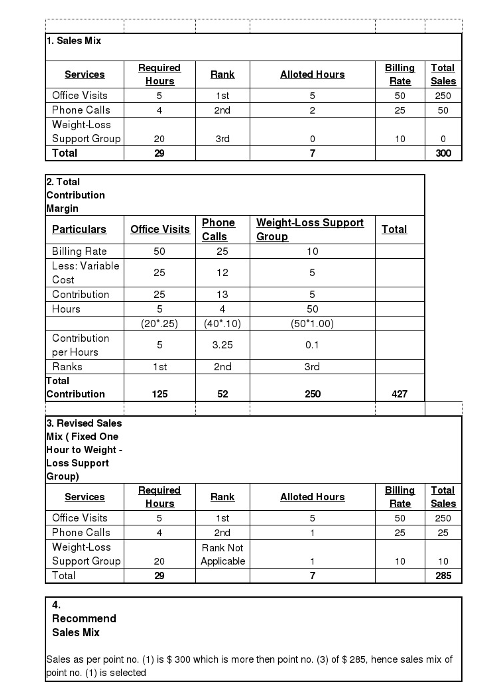

1. Determine the best sales mix. Rank the services offered in order of their profitability.

2. Based on the ranking in 1, how much time should Mortiz spend on each service in a day? (Hint: Remember to consider the maximum number of patient billings per day.) What would be the daily total contribution margin generated by Mortiz?

3. Dr. Stott believes the ranking is incorrect. He knows that the daily 60-minute meeting of the weight-loss support group has 50 patients and should continue to be offered. If the new ranking for the services is (1) weight-loss support group, (2) phone calls, and (3) office visits, how much time should Mortiz spend on each service in a day? What would be the total contribution margin generated by Mortiz, assuming the weight-loss support group has the maximum number of patient billings? 4. Manager Insight: Which ranking would you recommend? What additional amount of total contribution margin would be generated if your recommendation is accepted?

The Expert Answer (from Anonymos)...

My Comment/ Question I need help with...

1) is there a way you can provide the steps worked/ and explanation on how you got your numbers, or can you send the excel spread sheet so I can see how the steps were solved? or 2) For starts I don't understand how you got '20' for the support group required hours

Sales Mix Services Required Allotted Hours Billing Total Bank 4 2nd 2 25 50 Phone Calls Weight-Loss Support Group 20 7 300 Total 2. Total Contribution Margin Particulars office visits phone weight-Loss Support Total Grou Billing Rate 50 25 10 Less: Variable Contribution 25 13 5 Hours 50 (20.25) (40.10) (50'1.00) per Hours Ranks 1st 2nd 3rd 3, Revised Sales Mix Fixed One Hour to Weight Loss Support Group) Billing Iotal Services Hours Rank Alloted Hours Bate Sales Office visits 5 1st 5 50 250 25 25 Weight-Loss Rank Not Support Group Recommend Sales Mix Sales as per point no. (1) is $300 which is more then point no. (3) of 285 hence sales mix of point no. (1) is selectedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started