Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clarist Inc. issued 20,000 shares of $3 par common stock at $8.65 per share at the start of the year. In the last month of

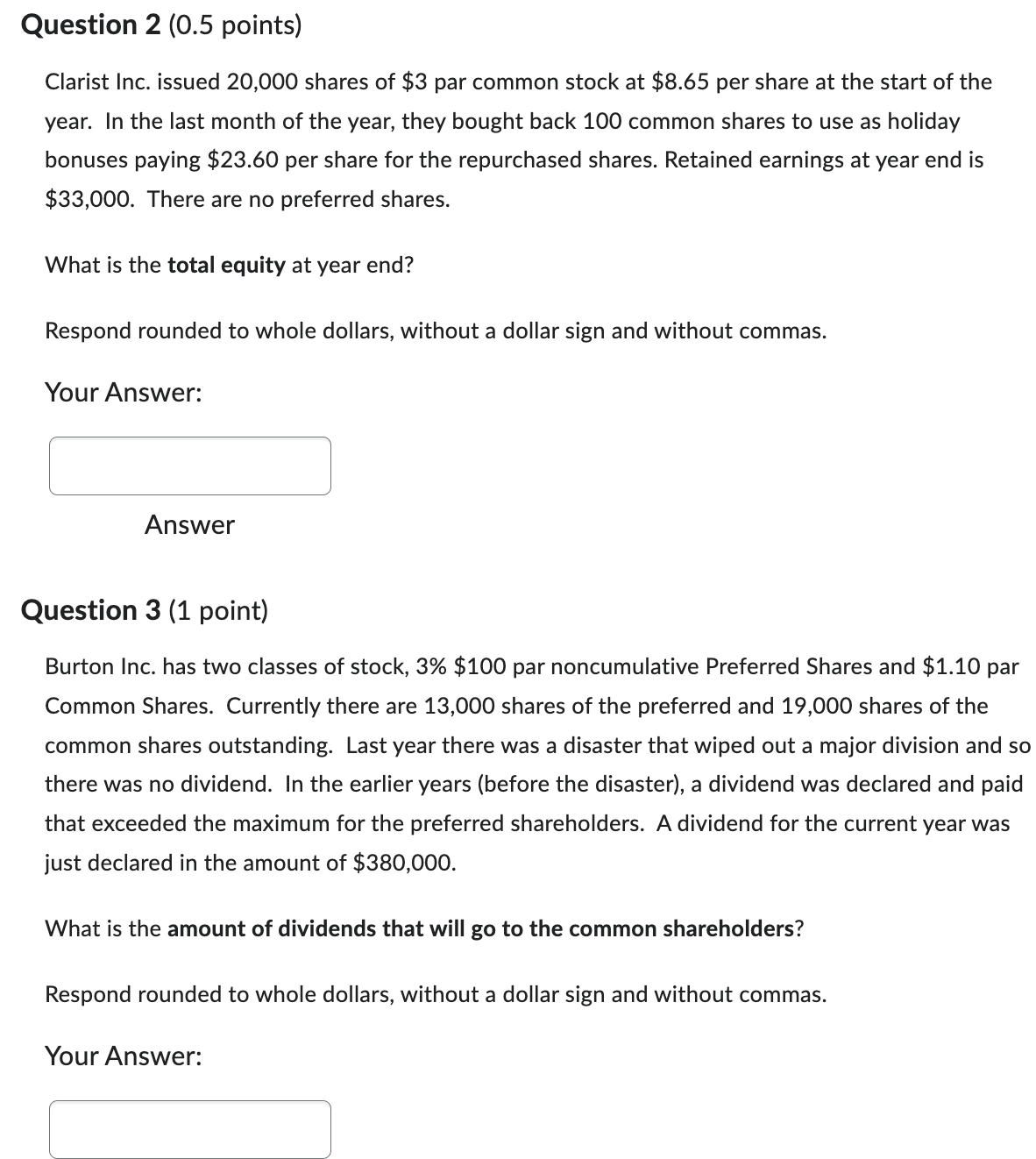

Clarist Inc. issued 20,000 shares of $3 par common stock at $8.65 per share at the start of the year. In the last month of the year, they bought back 100 common shares to use as holiday bonuses paying $23.60 per share for the repurchased shares. Retained earnings at year end is $33,000. There are no preferred shares. What is the total equity at year end? Respond rounded to whole dollars, without a dollar sign and without commas. Your Answer: Answer Question 3 (1 point) Burton Inc. has two classes of stock, 3\% \$100 par noncumulative Preferred Shares and \$1.10 par Common Shares. Currently there are 13,000 shares of the preferred and 19,000 shares of the common shares outstanding. Last year there was a disaster that wiped out a major division and so there was no dividend. In the earlier years (before the disaster), a dividend was declared and paid that exceeded the maximum for the preferred shareholders. A dividend for the current year was just declared in the amount of $380,000. What is the amount of dividends that will go to the common shareholders? Respond rounded to whole dollars, without a dollar sign and without commas. Your Answer: Clarist Inc. issued 20,000 shares of $3 par common stock at $8.65 per share at the start of the year. In the last month of the year, they bought back 100 common shares to use as holiday bonuses paying $23.60 per share for the repurchased shares. Retained earnings at year end is $33,000. There are no preferred shares. What is the total equity at year end? Respond rounded to whole dollars, without a dollar sign and without commas. Your Answer: Answer Question 3 (1 point) Burton Inc. has two classes of stock, 3\% \$100 par noncumulative Preferred Shares and \$1.10 par Common Shares. Currently there are 13,000 shares of the preferred and 19,000 shares of the common shares outstanding. Last year there was a disaster that wiped out a major division and so there was no dividend. In the earlier years (before the disaster), a dividend was declared and paid that exceeded the maximum for the preferred shareholders. A dividend for the current year was just declared in the amount of $380,000. What is the amount of dividends that will go to the common shareholders? Respond rounded to whole dollars, without a dollar sign and without commas. Your

Clarist Inc. issued 20,000 shares of $3 par common stock at $8.65 per share at the start of the year. In the last month of the year, they bought back 100 common shares to use as holiday bonuses paying $23.60 per share for the repurchased shares. Retained earnings at year end is $33,000. There are no preferred shares. What is the total equity at year end? Respond rounded to whole dollars, without a dollar sign and without commas. Your Answer: Answer Question 3 (1 point) Burton Inc. has two classes of stock, 3\% \$100 par noncumulative Preferred Shares and \$1.10 par Common Shares. Currently there are 13,000 shares of the preferred and 19,000 shares of the common shares outstanding. Last year there was a disaster that wiped out a major division and so there was no dividend. In the earlier years (before the disaster), a dividend was declared and paid that exceeded the maximum for the preferred shareholders. A dividend for the current year was just declared in the amount of $380,000. What is the amount of dividends that will go to the common shareholders? Respond rounded to whole dollars, without a dollar sign and without commas. Your Answer: Clarist Inc. issued 20,000 shares of $3 par common stock at $8.65 per share at the start of the year. In the last month of the year, they bought back 100 common shares to use as holiday bonuses paying $23.60 per share for the repurchased shares. Retained earnings at year end is $33,000. There are no preferred shares. What is the total equity at year end? Respond rounded to whole dollars, without a dollar sign and without commas. Your Answer: Answer Question 3 (1 point) Burton Inc. has two classes of stock, 3\% \$100 par noncumulative Preferred Shares and \$1.10 par Common Shares. Currently there are 13,000 shares of the preferred and 19,000 shares of the common shares outstanding. Last year there was a disaster that wiped out a major division and so there was no dividend. In the earlier years (before the disaster), a dividend was declared and paid that exceeded the maximum for the preferred shareholders. A dividend for the current year was just declared in the amount of $380,000. What is the amount of dividends that will go to the common shareholders? Respond rounded to whole dollars, without a dollar sign and without commas. Your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started