Answered step by step

Verified Expert Solution

Question

1 Approved Answer

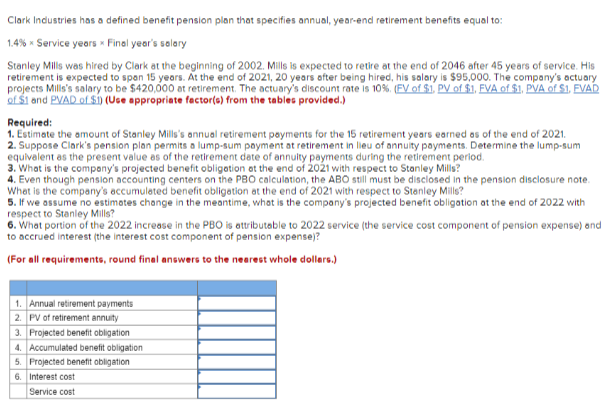

Clark Industries has a defined benefit pension plan that specifies annual, year - end retirement benefits equal to: 1 . 4 % Service years Final

Clark Industries has a defined benefit pension plan that specifies annual, yearend retirement benefits equal to:

Service years Final year's solary

Stanley Mills was hired by Clark at the beginning of Mills is expected to retire at the end of after years of service. His

retirement is expected to spon yeors. At the end of years ofter being hired, his salary is $ The company's actuary

projects Mills's salary to be $ at retirement. The actuary's discount rate is FV of $ PV of $ FVA of $ PVA of S FVAD

of $ and PVAD of SUse appropriate factors from the tables provided.

Required:

Estimate the amount of Stanley Mills's annual retirement poyments for the retirement years earned as of the end of

Suppose Clark's pension plan permits a lumpsum poyment at retirement in lieu of annuity poyments. Determine the lumpsum

equivalent as the present value as of the retirement date of annulty payments during the retirement period.

What is the compony's projected benefit obligotion of the end of with respect to Stanley Mills?

Even though pension accounting centers on the PBO calculation, the ABO still must be disclosed in the pension disclosure note.

What is the company's accumulated benefit obligation at the end of with respect to Stonley Mills?

If we assume no estimotes change in the meantime, what is the compony's projected benefit obligation at the end of with

respect to Stanley Mills?

What portion of the increase in the PBO is attibutable to service the service cost component of pension expense and

to accrued interest the interest cost component of pension expense

For all requirements, round final answers to the nearest whole dollers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started