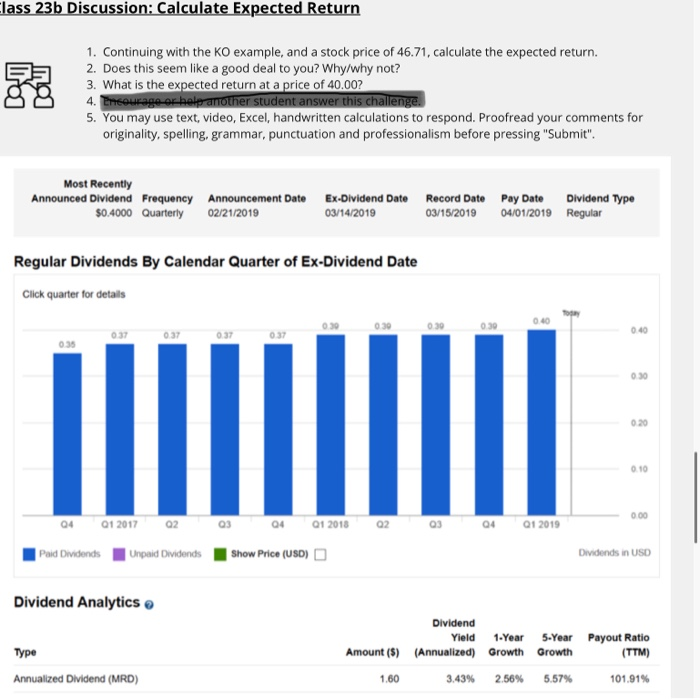

Class 23b Discussion: Calculate Expected Return 1. Continuing with the KO example, and a stock price of 46.71, calculate the expected return. 2. Does this seem like a good deal to you? Why/why not? 3. What is the expected return at a price of 40.00? 4. Encourage or hele another student answer this challenge 5. You may use text, video, Excel, handwritten calculations to respond. Proofread your comments for originality, spelling, grammar, punctuation and professionalism before pressing "Submit". Most Recently Announced Dividend Frequency $0.4000 Quarterly Announcement Date 02/21/2019 Ex-Dividend Date 03/14/2019 Record Date 03/15/2019 Pay Date 04/01/2019 Dividend Type Regular Regular Dividends By Calendar Quarter of Ex-Dividend Date Click quarter for details 03 0.300. 300.30 04 03 037 0.00 04 01 2017 02 03 04 01 2018 02 03 04 Q1 2019 Paid Dividends Unpaid Dividends Show Price (USD) Dividends in USD Dividend Analytics Dividend Yield 1-Year (Annualized) Growth Payout Ratio (TTM) Type 5-Year Growth Amount ($) Annualized Dividend (MRD) 3.43% 2.56% 5.57% 101.91% Class 23b Discussion: Calculate Expected Return 1. Continuing with the KO example, and a stock price of 46.71, calculate the expected return. 2. Does this seem like a good deal to you? Why/why not? 3. What is the expected return at a price of 40.00? 4. Encourage or hele another student answer this challenge 5. You may use text, video, Excel, handwritten calculations to respond. Proofread your comments for originality, spelling, grammar, punctuation and professionalism before pressing "Submit". Most Recently Announced Dividend Frequency $0.4000 Quarterly Announcement Date 02/21/2019 Ex-Dividend Date 03/14/2019 Record Date 03/15/2019 Pay Date 04/01/2019 Dividend Type Regular Regular Dividends By Calendar Quarter of Ex-Dividend Date Click quarter for details 03 0.300. 300.30 04 03 037 0.00 04 01 2017 02 03 04 01 2018 02 03 04 Q1 2019 Paid Dividends Unpaid Dividends Show Price (USD) Dividends in USD Dividend Analytics Dividend Yield 1-Year (Annualized) Growth Payout Ratio (TTM) Type 5-Year Growth Amount ($) Annualized Dividend (MRD) 3.43% 2.56% 5.57% 101.91%