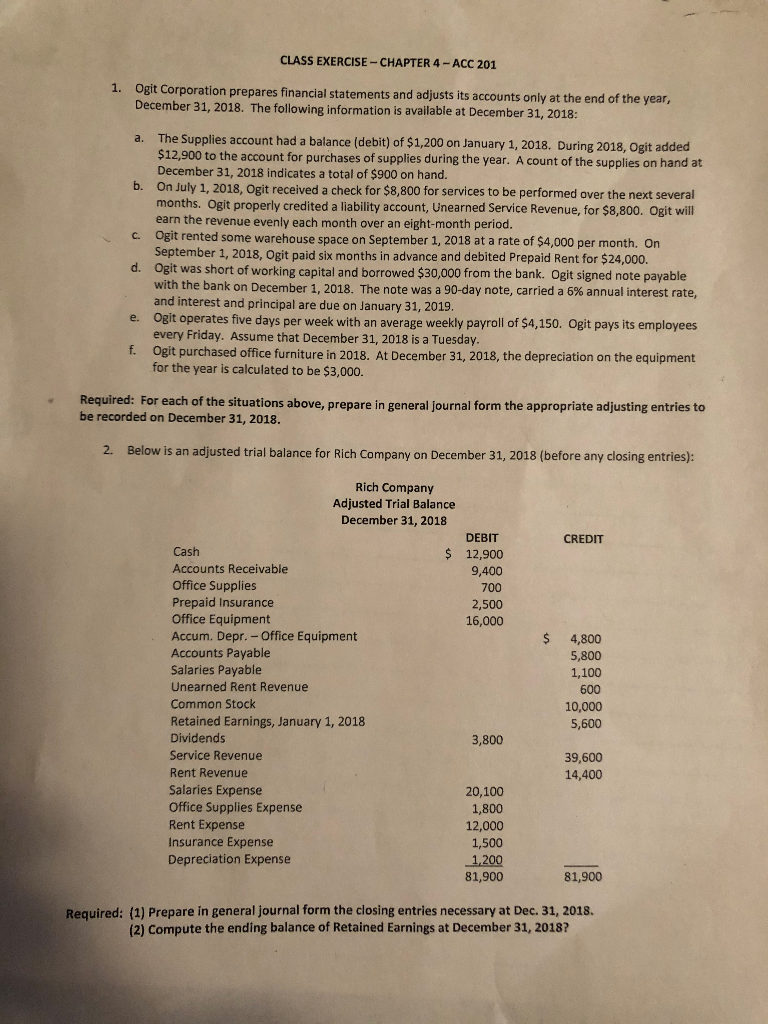

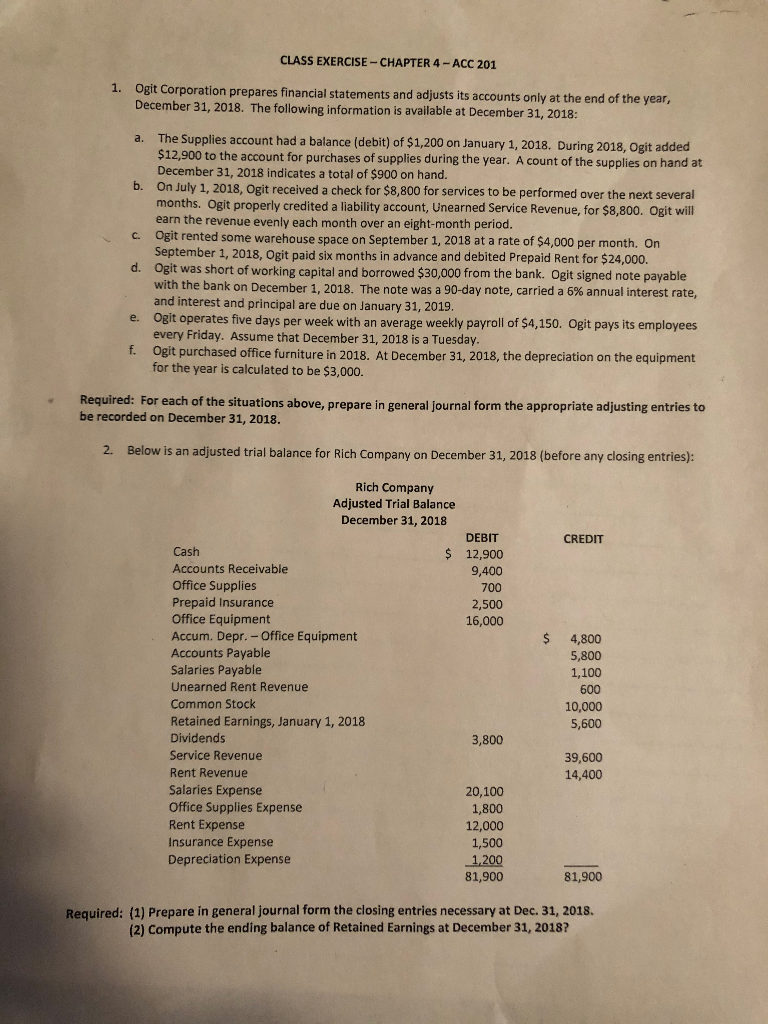

CLASS EXERCISE - CHAPTER 4 - ACC 201 1. Ogit Corporation prepares financial statements and adjusts its accounts only at the end of the year, December 31, 2018. The following information is available at December 31, 2018: a. The Supplies account had a balance (debit) of $1,200 on January 1, 2018. During 2018, Ogit added $12,900 to the account for purchases of supplies during the year. A count of the supplies on hand at December 31, 2018 indicates a total of $900 on hand. b. On July 1, 2018, Ogit received a check for $8,800 for services to be performed over the next several months. Ogit properly credited a liability account, Unearned Service Revenue, for $8,800. Ogit will earn the revenue evenly each month over an eight-month period. c. Ogit rented some warehouse space on September 1, 2018 at a rate of $4,000 per month. On September 1, 2018, Ogit paid six months in advance and debited Prepaid Rent for $24,000. d. Ogit was short of working capital and borrowed $30,000 from the bank. Ogit signed note payable with the bank on December 1, 2018. The note was a 90-day note, carried a 6% annual interest rate, and interest and principal are due on January 31, 2019. e. Ogit operates five days per week with an average weekly payroll of $4,150. Ogit pays its employees every Friday. Assume that December 31, 2018 is a Tuesday. f. Ogit purchased office furniture in 2018. At December 31, 2018, the depreciation on the equipment for the year is calculated to be $3,000. Required: For each of the situations above, prepare in general Journal form the appropriate adjusting entries to be recorded on December 31, 2018. 2. Below is an adjusted trial balance for Rich Company on December 31, 2018 (before any closing entries): Rich Company Adjusted Trial Balance December 31, 2018 CREDIT $ DEBIT 12,900 9,400 700 2,500 16,000 $ Cash Accounts Receivable Office Supplies Prepaid Insurance Office Equipment Accum. Depr. - Office Equipment Accounts Payable Salaries Payable Unearned Rent Revenue Common Stock Retained Earnings, January 1, 2018 Dividends Service Revenue Rent Revenue Salaries Expense Office Supplies Expense Rent Expense Insurance Expense Depreciation Expense 4,800 5,800 1,100 600 10,000 5,600 3,800 39,600 14,400 20,100 1,800 12,000 1,500 1,200 81,900 81,900 Required: (1) Prepare in general Journal form the closing entries necessary at Dec 31, 2018 (2) Compute the ending balance of Retained Earnings at December 31, 2018? CLASS EXERCISE - CHAPTER 4 - ACC 201 1. Ogit Corporation prepares financial statements and adjusts its accounts only at the end of the year, December 31, 2018. The following information is available at December 31, 2018: a. The Supplies account had a balance (debit) of $1,200 on January 1, 2018. During 2018, Ogit added $12,900 to the account for purchases of supplies during the year. A count of the supplies on hand at December 31, 2018 indicates a total of $900 on hand. b. On July 1, 2018, Ogit received a check for $8,800 for services to be performed over the next several months. Ogit properly credited a liability account, Unearned Service Revenue, for $8,800. Ogit will earn the revenue evenly each month over an eight-month period. c. Ogit rented some warehouse space on September 1, 2018 at a rate of $4,000 per month. On September 1, 2018, Ogit paid six months in advance and debited Prepaid Rent for $24,000. d. Ogit was short of working capital and borrowed $30,000 from the bank. Ogit signed note payable with the bank on December 1, 2018. The note was a 90-day note, carried a 6% annual interest rate, and interest and principal are due on January 31, 2019. e. Ogit operates five days per week with an average weekly payroll of $4,150. Ogit pays its employees every Friday. Assume that December 31, 2018 is a Tuesday. f. Ogit purchased office furniture in 2018. At December 31, 2018, the depreciation on the equipment for the year is calculated to be $3,000. Required: For each of the situations above, prepare in general Journal form the appropriate adjusting entries to be recorded on December 31, 2018. 2. Below is an adjusted trial balance for Rich Company on December 31, 2018 (before any closing entries): Rich Company Adjusted Trial Balance December 31, 2018 CREDIT $ DEBIT 12,900 9,400 700 2,500 16,000 $ Cash Accounts Receivable Office Supplies Prepaid Insurance Office Equipment Accum. Depr. - Office Equipment Accounts Payable Salaries Payable Unearned Rent Revenue Common Stock Retained Earnings, January 1, 2018 Dividends Service Revenue Rent Revenue Salaries Expense Office Supplies Expense Rent Expense Insurance Expense Depreciation Expense 4,800 5,800 1,100 600 10,000 5,600 3,800 39,600 14,400 20,100 1,800 12,000 1,500 1,200 81,900 81,900 Required: (1) Prepare in general Journal form the closing entries necessary at Dec 31, 2018 (2) Compute the ending balance of Retained Earnings at December 31, 2018