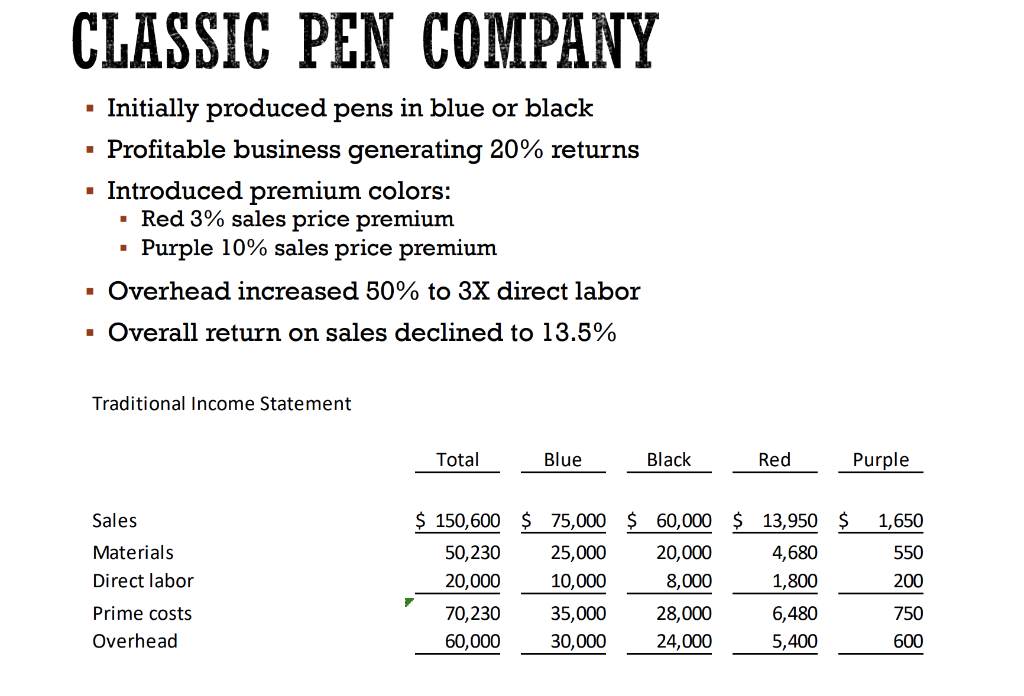

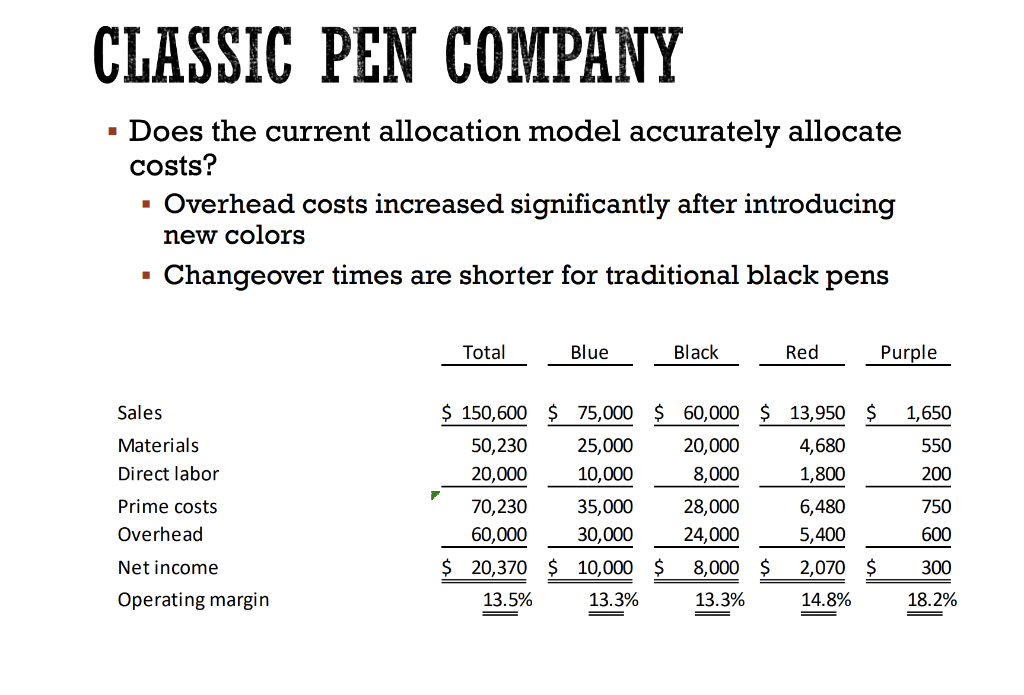

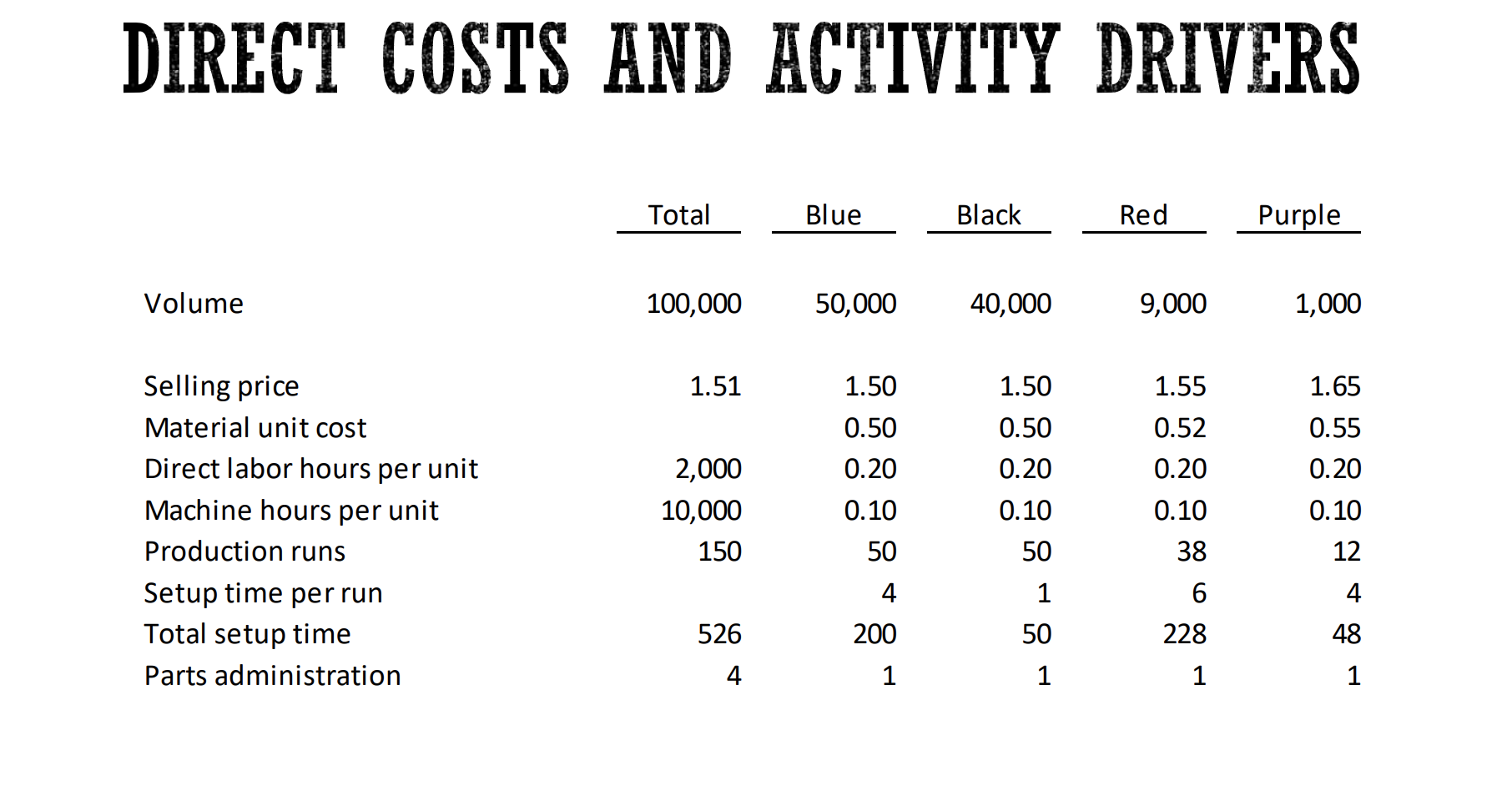

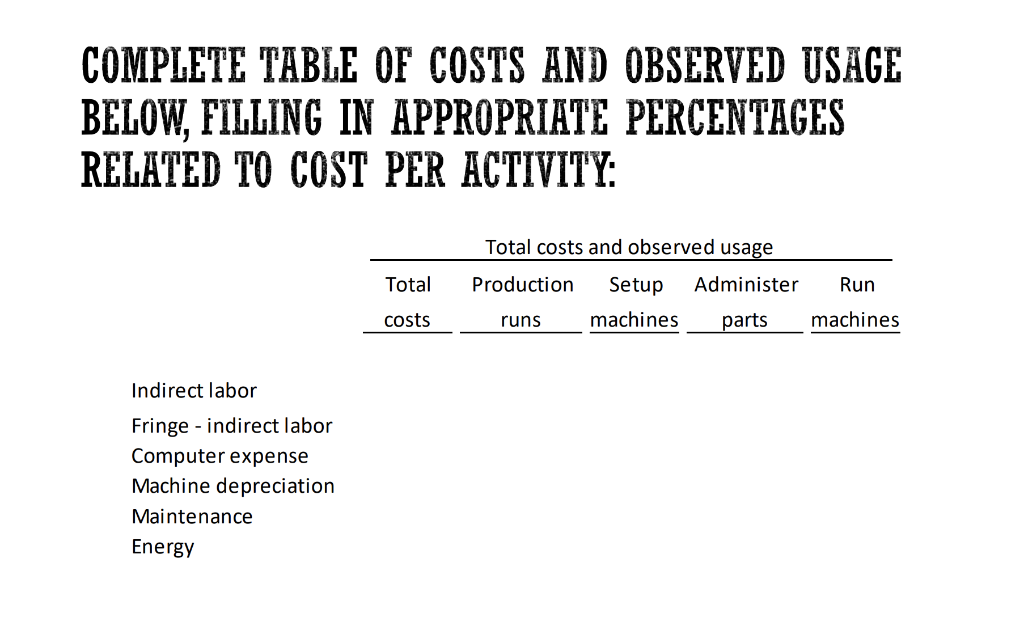

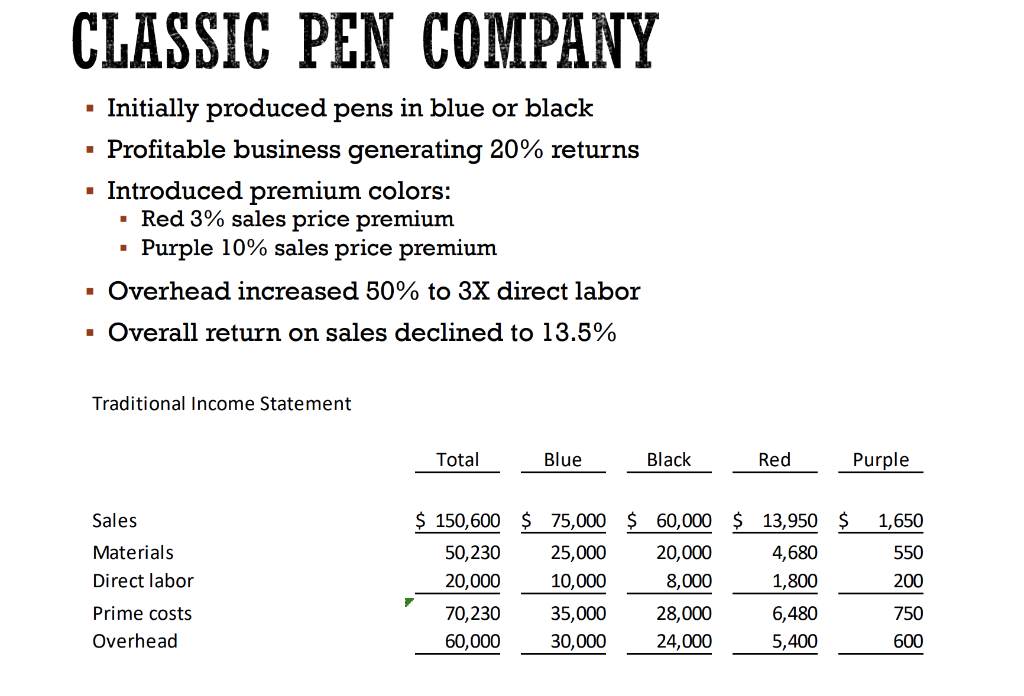

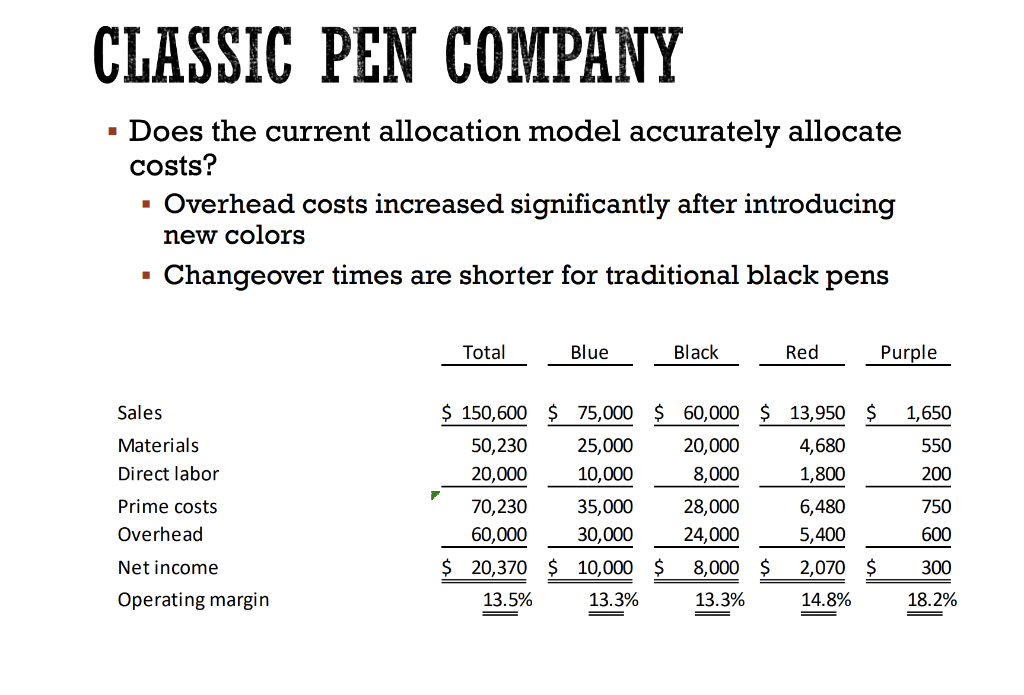

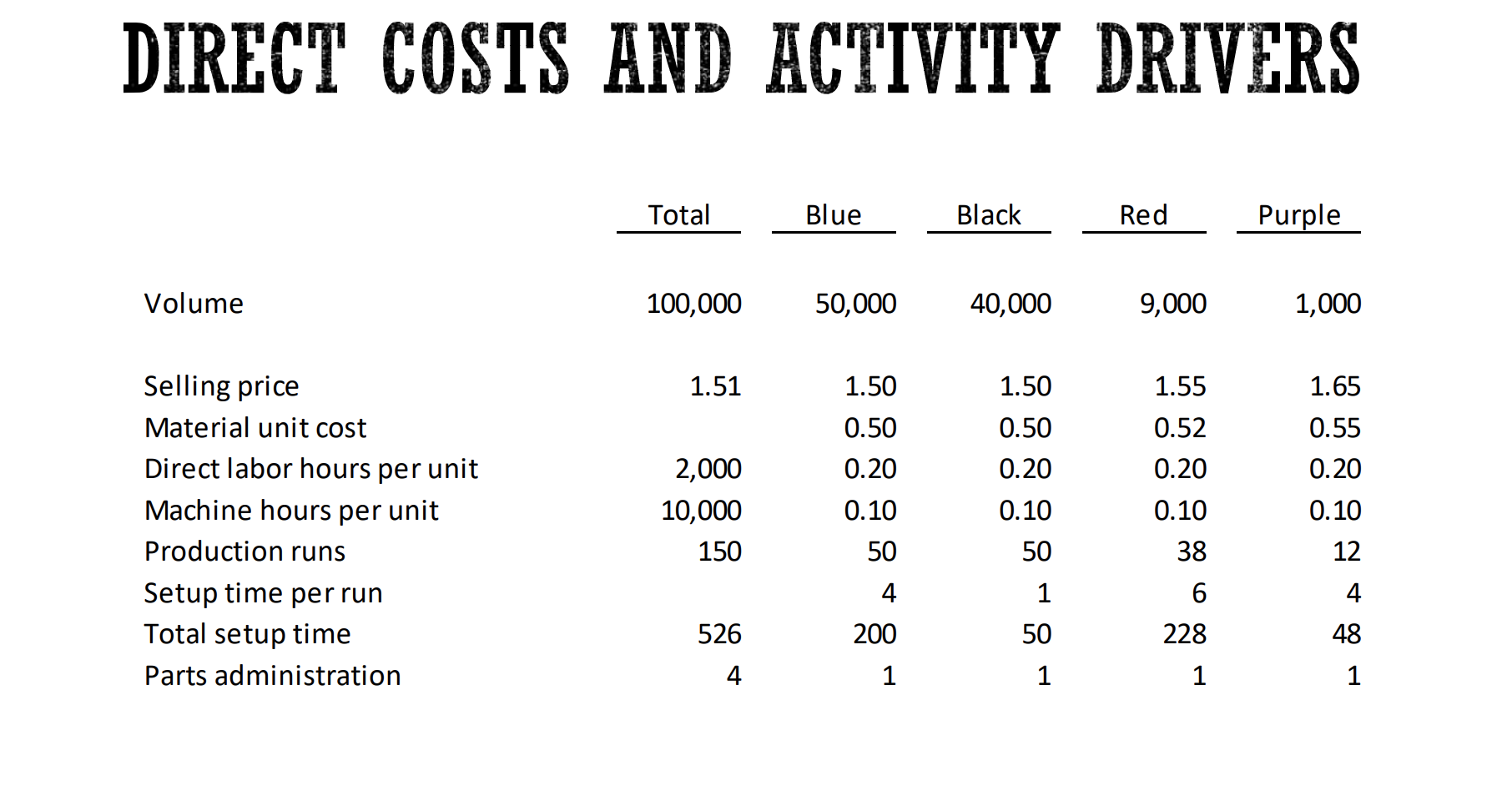

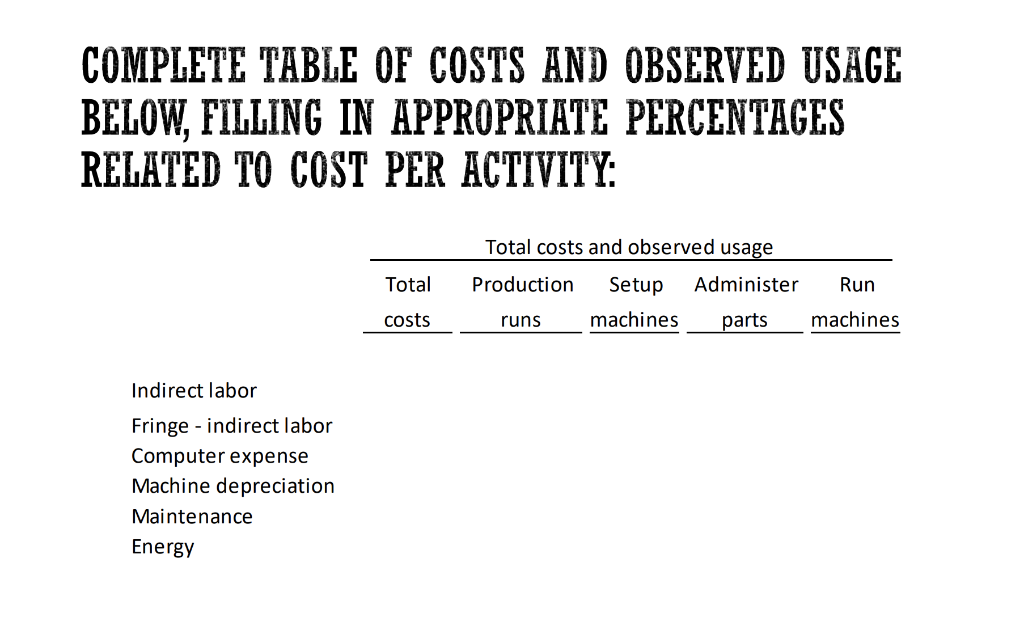

CLASSIC PEN COMPANY Initially produced pens in blue or black Profitable business generating 20% returns Introduced premium colors: Red 3% sales price premium Purple 10% sales price premium Overhead increased 50% to 3X direct labor Overall return on sales declined to 13.5% Traditional Income Statement Total Black Blue Red Purple $150,600 $ 75,000 $60,000 $ 13,950 $ Sales 1,650 50,230 Materials 20,000 4,680 25,000 550 Direct labor 20,000 10,000 8,000 1,800 200 28,000 Prime costs 70,230 35,000 6,480 750 Overhead 60,000 30,000 24,000 5,400 600 CLASSIC PEN COMPANY Does the current allocation model accurately allocate costs? Overhead costs increased significantly after introducing new colors Changeover times are shorter for traditional black pens Black Red Total Purple Blue Sales $150,600 $ 75,000 $60,000 $13,950 $ 1,650 20,000 Materials 50,230 25,000 4,680 550 8,000 Direct labor 1,800 20,000 10,000 200 Prime costs 70,230 35,000 28,000 6,480 750 24,000 Overhead 30,000 $ 20,370 $ 10,000 $ 60,000 5,400 600 2,070 $ 8,000 $ Net income 300 13.5% 14.8% Operating margin 13.3% 13.3% 18.2% = DIRECT COSTS AND ACTIVITY DRIVERS Purple Total Blue Black Red Volume 9,000 100,000 50,000 40,000 1,000 Selling price 1.50 1.65 1.51 1.5 1.55 Material unit cost 0.52 0.50 0.50 0.55 Direct labor hours per unit 2,000 0.20 0.20 0.20 0.20 Machine hours per unit 10,000 0.10 0.10 0.10 0.10 Production runs 150 50 38 50 12 Setup time per run 6 4 1 4 Total setup time 200 526 50 228 48 Parts administration 4 1 1 1 1 COMPLETE TABLE OF COSTS AND OBSERVED USAGE BELOW, FILLING IN APPROPRIATE PERCENTAGES RELATED TO COST PER ACTIVITY Total costs and observed usage Total Production Administer Setup Run machines machines costs parts runs Indirect labor Fringe indirect labor Computer expense Machine depreciation Maintenance Energy CLASSIC PEN COMPANY Initially produced pens in blue or black Profitable business generating 20% returns Introduced premium colors: Red 3% sales price premium Purple 10% sales price premium Overhead increased 50% to 3X direct labor Overall return on sales declined to 13.5% Traditional Income Statement Total Black Blue Red Purple $150,600 $ 75,000 $60,000 $ 13,950 $ Sales 1,650 50,230 Materials 20,000 4,680 25,000 550 Direct labor 20,000 10,000 8,000 1,800 200 28,000 Prime costs 70,230 35,000 6,480 750 Overhead 60,000 30,000 24,000 5,400 600 CLASSIC PEN COMPANY Does the current allocation model accurately allocate costs? Overhead costs increased significantly after introducing new colors Changeover times are shorter for traditional black pens Black Red Total Purple Blue Sales $150,600 $ 75,000 $60,000 $13,950 $ 1,650 20,000 Materials 50,230 25,000 4,680 550 8,000 Direct labor 1,800 20,000 10,000 200 Prime costs 70,230 35,000 28,000 6,480 750 24,000 Overhead 30,000 $ 20,370 $ 10,000 $ 60,000 5,400 600 2,070 $ 8,000 $ Net income 300 13.5% 14.8% Operating margin 13.3% 13.3% 18.2% = DIRECT COSTS AND ACTIVITY DRIVERS Purple Total Blue Black Red Volume 9,000 100,000 50,000 40,000 1,000 Selling price 1.50 1.65 1.51 1.5 1.55 Material unit cost 0.52 0.50 0.50 0.55 Direct labor hours per unit 2,000 0.20 0.20 0.20 0.20 Machine hours per unit 10,000 0.10 0.10 0.10 0.10 Production runs 150 50 38 50 12 Setup time per run 6 4 1 4 Total setup time 200 526 50 228 48 Parts administration 4 1 1 1 1 COMPLETE TABLE OF COSTS AND OBSERVED USAGE BELOW, FILLING IN APPROPRIATE PERCENTAGES RELATED TO COST PER ACTIVITY Total costs and observed usage Total Production Administer Setup Run machines machines costs parts runs Indirect labor Fringe indirect labor Computer expense Machine depreciation Maintenance Energy