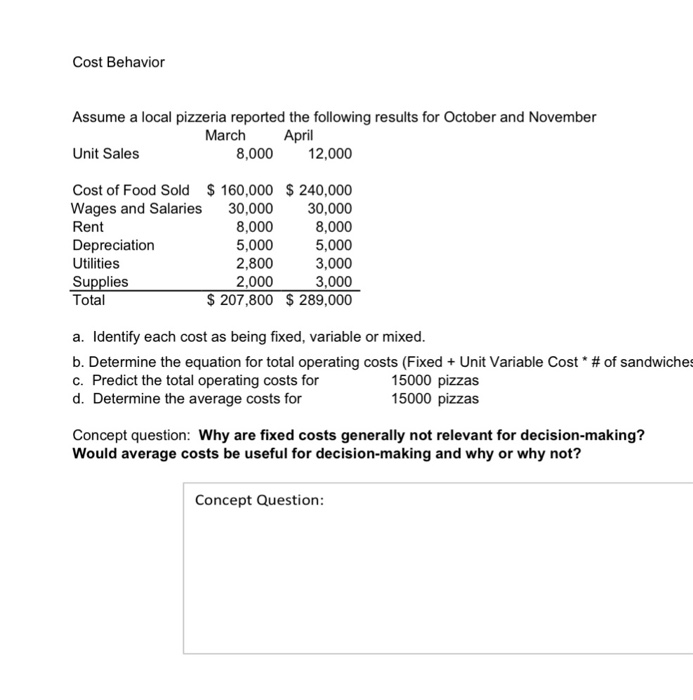

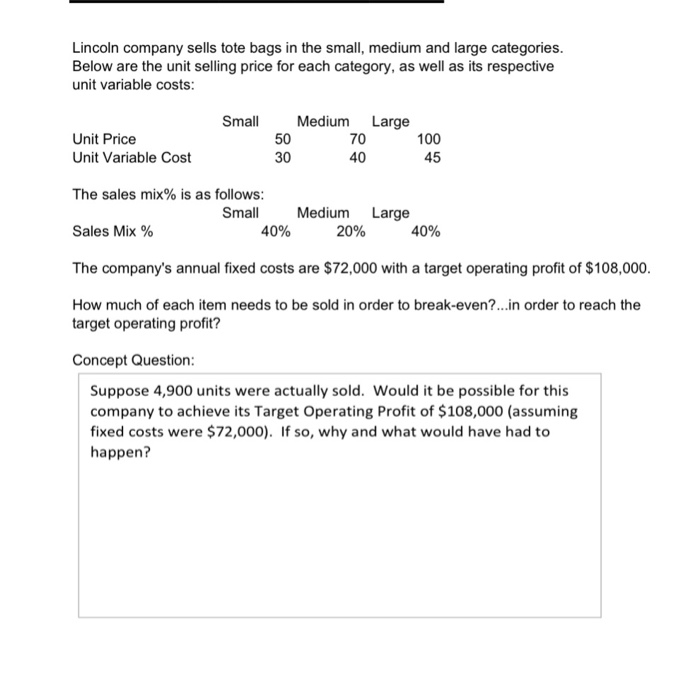

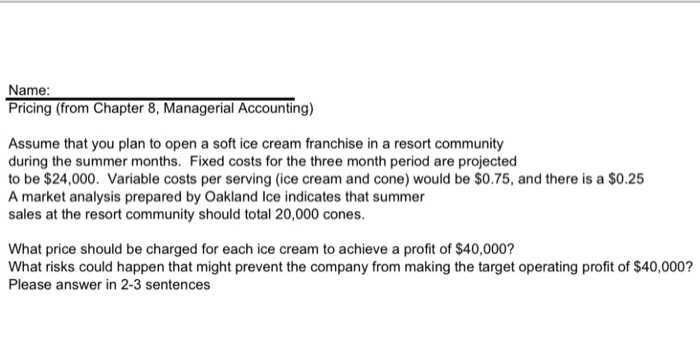

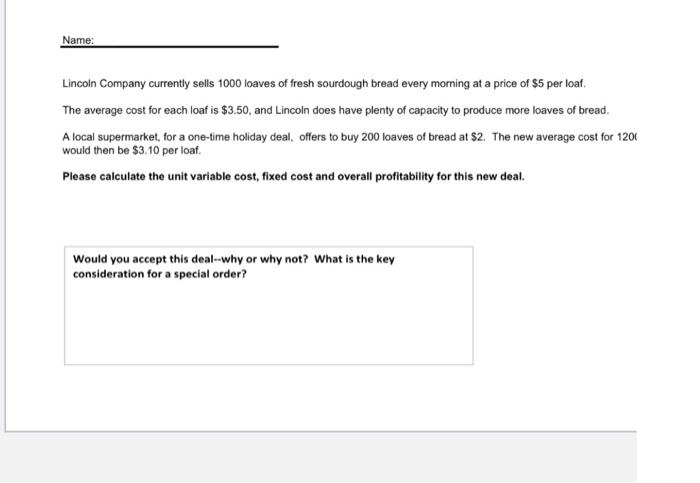

Cost Behavior Assume a local pizzeria reported the following results for October and November March April Unit Sales 8,000 2,000 Cost of Food Sold $ 160,000 $ 240,000 Wages and Salaries 30,000 30,000 Rent Depreciation Utilities Supplies Total 8,000 5,000 3,000 3,000 $ 207,800 $ 289,000 8,000 5,000 2,800 2,000 a. Identify each cost as being fixed, variable or mixed b. Determine the equation for total operating costs (Fixed c. Predict the total operating costs for d. Determine the average costs for Unit Variable Cost * # of sandwiches 15000 pizzas 15000 pizzas Concept question: Why are fixed costs generally not relevant for decision-making? Would average costs be useful for decision-making and why or why not? Concept Question Lincoln company sells tote bags in the small, medium and large categories Below are the unit selling price for each category, as well as its respective unit variable costs Small Medium Large 70 40 100 45 Unit Price 50 30 Unit Variable Cost The sales mix% is as follows: Sales Mix % The company's annual fixed costs are $72,000 with a target operating profit of $108,000 How much of each item needs to be sold in order to break-even?...in order to reach the Small Medium Large 20% 40% 40% target operating profit? Concept Question Suppose 4,900 units were actually sold. Would it be possible for this company to achieve its Target Operating Profit of $108,000 (assuming fixed costs were $72,000). If so, why and what would have had to happen? Name: Pricing (from Chapter 8, Managerial Accounting) Assume that you plan to open a soft ice cream franchise in a resort community during the summer months. Fixed costs for the three month period are projected to be $24,000. Variable costs per serving (ice cream and cone) would be $0.75, and there is a $0.25 A market analysis prepared by Oakland Ice indicates that summer sales at the resort community should total 20,000 cones What price should be charged for each ice cream to achieve a profit of $40,000? What risks could happen that might prevent the company from making the target operating profit of $40,000? Please answer in 2-3 sentences Lincoln Company currently sells 1000 loaves of fresh sourdough bread every morning at a price of $5 per loaf The average cost for each loaf is $3.50, and Lincoln does have plenty of capacity to produce more loaves of bread. A local supermarket, for a one-time holiday deal, offers to buy 200 loaves of bread at $2. The new average cost for 1200 would then be $3.10 per loaf. Please calculate the unit variable cost, fixed cost and overall profitability for this new deal. Would you accept this deal-why or why not? What is the key consideration for a special order