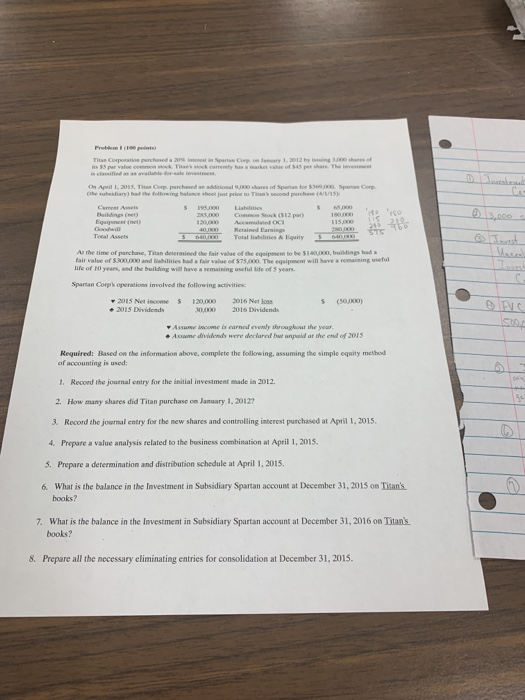

classified as an available dor-sale Che sheidiary) hd the following balance shot just pron to Tian'sond parchase (4/35S Toeal Assels fTotal liailities & Eaity Ar he time of panchase, Titan determined the fair valee of the equipment to be 51400000, buidings had a fair valee of $300000 and liabilities had a fair value of 575,000. The eqsipment will have a life of tO years, and the building will have a semaining uscful life of 5 years Spartan Corps operatioms involved the following activitics s (30000) 2015 Nt income 2015 Dividends 12000 2016 Net loss 0,0002016 Dividends Assunve income is earned evenly shroaghout the year Assame dividends were declared but anpaid at the end of 2013 Required: Based on the information above, complete the following, assuming the simple equity methed of accounting is used: 1. Record the journal entry for the initial investment made in 2012 2. How many shares did Titan purchase on January 1, 2012 3. Record the journal entry for the new shares and controlling inberest purchased at April 1, 2015 Prepare a value analysis related to the business combination at April 1, 2015. 5. Prepare a determination and distribution schedule at April 1, 2015. 6. What is the balance in the Investment in Subsidiary Spartan account at December 31, 2015 on Titan's. books? 7. What is the balance in the Investment in Subsidiary Spartan account at December 31, 2016 on Titan's books? 8. Prepare all the necessary eliminating entries for consolidation at December 31, 2015. classified as an available dor-sale Che sheidiary) hd the following balance shot just pron to Tian'sond parchase (4/35S Toeal Assels fTotal liailities & Eaity Ar he time of panchase, Titan determined the fair valee of the equipment to be 51400000, buidings had a fair valee of $300000 and liabilities had a fair value of 575,000. The eqsipment will have a life of tO years, and the building will have a semaining uscful life of 5 years Spartan Corps operatioms involved the following activitics s (30000) 2015 Nt income 2015 Dividends 12000 2016 Net loss 0,0002016 Dividends Assunve income is earned evenly shroaghout the year Assame dividends were declared but anpaid at the end of 2013 Required: Based on the information above, complete the following, assuming the simple equity methed of accounting is used: 1. Record the journal entry for the initial investment made in 2012 2. How many shares did Titan purchase on January 1, 2012 3. Record the journal entry for the new shares and controlling inberest purchased at April 1, 2015 Prepare a value analysis related to the business combination at April 1, 2015. 5. Prepare a determination and distribution schedule at April 1, 2015. 6. What is the balance in the Investment in Subsidiary Spartan account at December 31, 2015 on Titan's. books? 7. What is the balance in the Investment in Subsidiary Spartan account at December 31, 2016 on Titan's books? 8. Prepare all the necessary eliminating entries for consolidation at December 31, 2015