Answered step by step

Verified Expert Solution

Question

1 Approved Answer

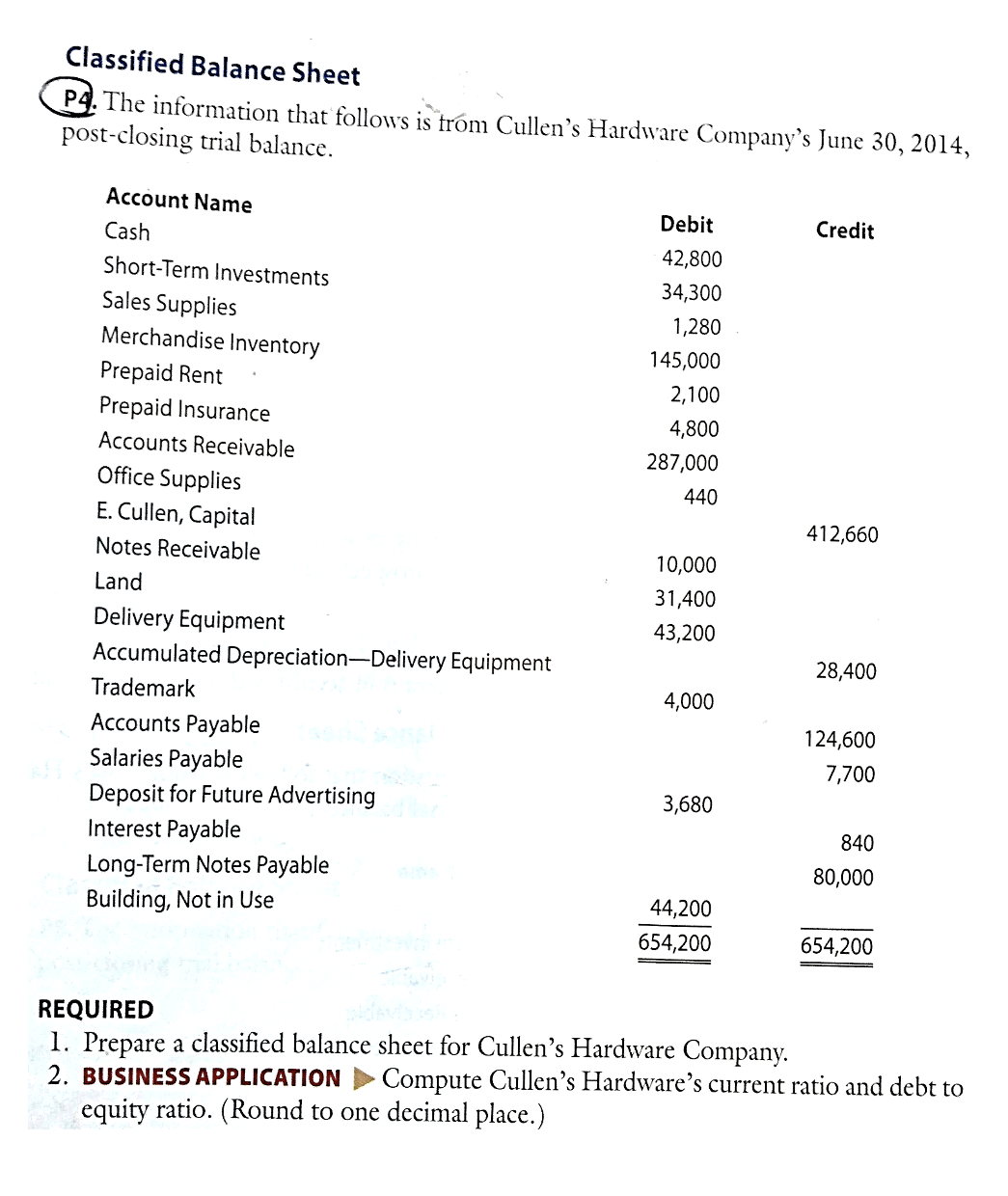

Classified Balance Sheet P4. The information that follows is from Cullen's Hardware Company's June 30, 2014, post-closing trial balance. Account Name Debit Credit Cash

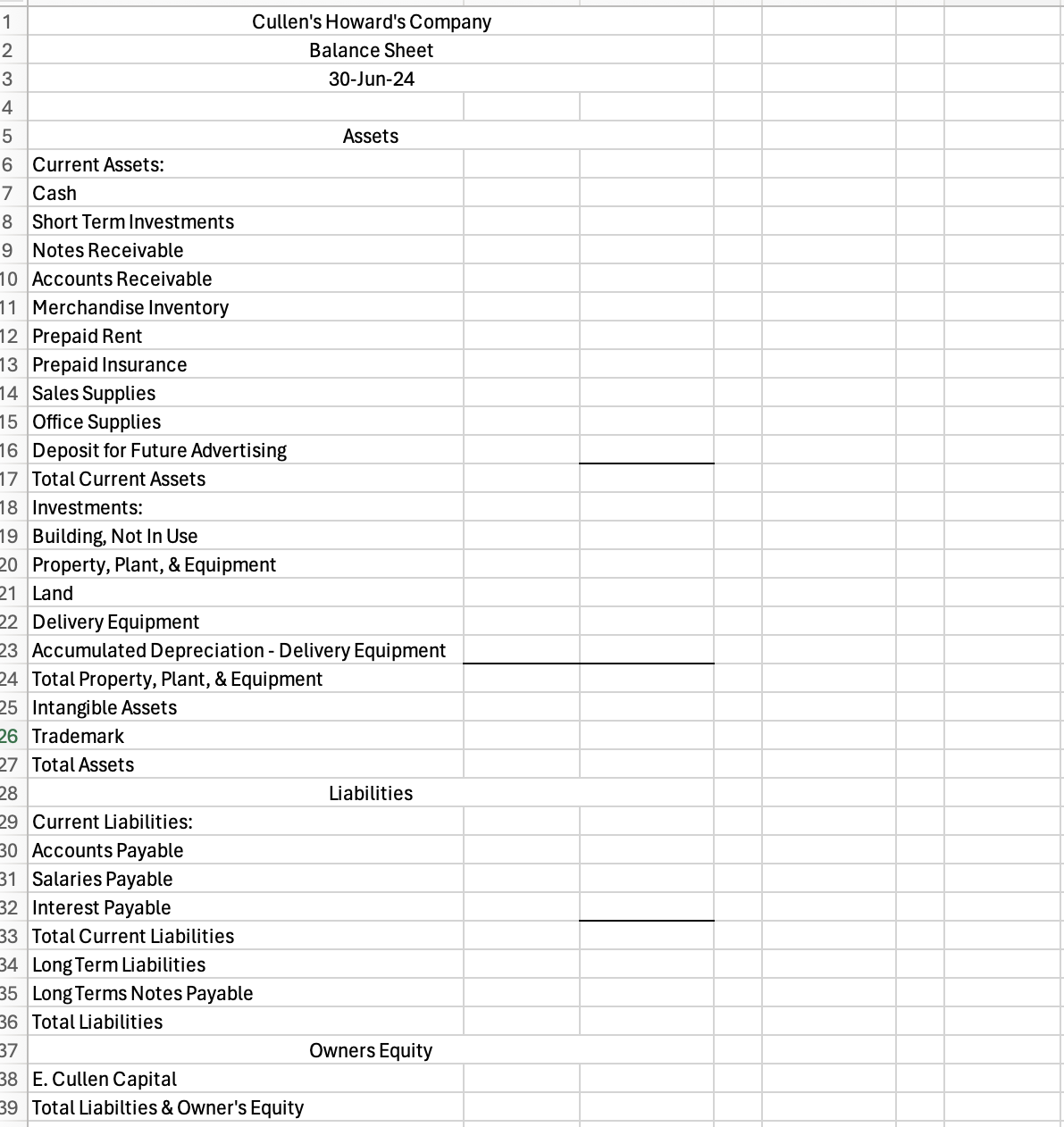

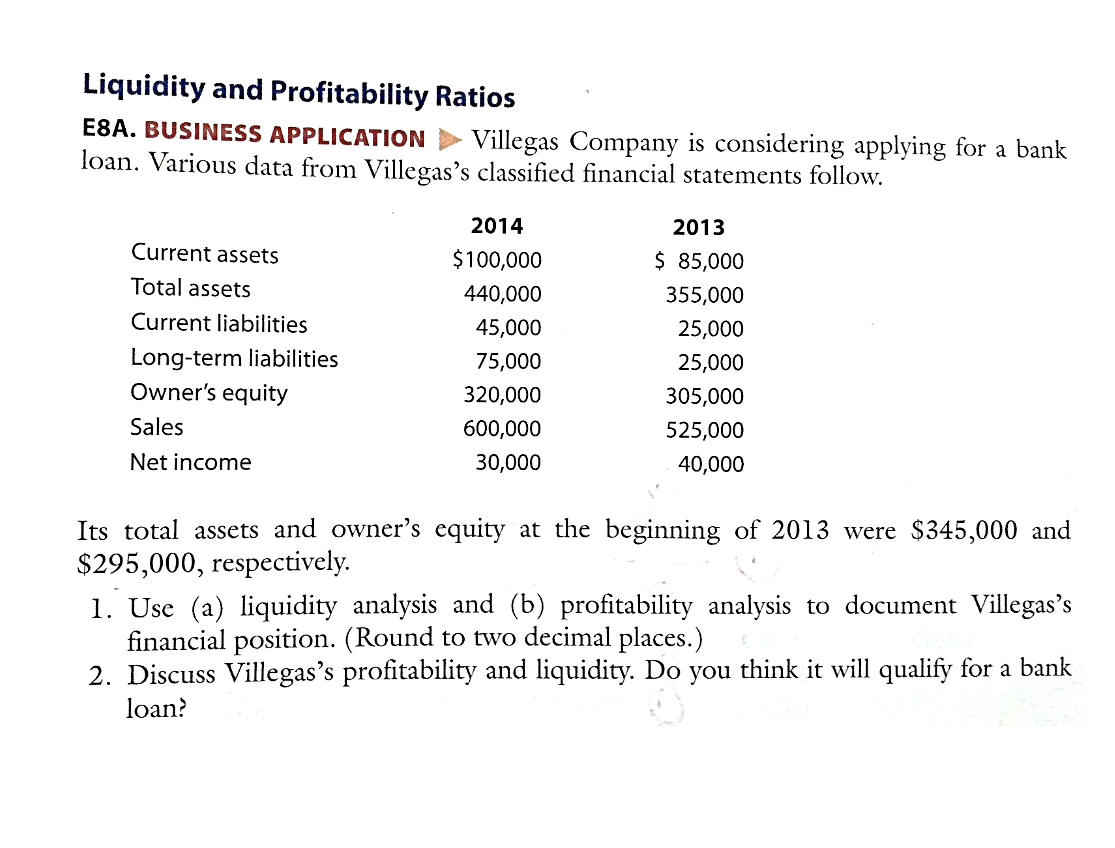

Classified Balance Sheet P4. The information that follows is from Cullen's Hardware Company's June 30, 2014, post-closing trial balance. Account Name Debit Credit Cash 42,800 Short-Term Investments 34,300 Sales Supplies 1,280 Merchandise Inventory 145,000 Prepaid Rent 2,100 Prepaid Insurance 4,800 Accounts Receivable 287,000 Office Supplies E. Cullen, Capital 440 412,660 Notes Receivable 10,000 Land 31,400 Delivery Equipment 43,200 Accumulated Depreciation-Delivery Equipment 28,400 Trademark 4,000 Accounts Payable 124,600 Salaries Payable 7,700 Deposit for Future Advertising 3,680 Interest Payable 840 Long-Term Notes Payable 80,000 Building, Not in Use 44,200 654,200 654,200 REQUIRED 1. Prepare a classified balance sheet for Cullen's Hardware Company. 2. BUSINESS APPLICATION Compute Cullen's Hardware's current ratio and debt to equity ratio. (Round to one decimal place.) 1 2 3 4 5 6 Current Assets: Cullen's Howard's Company Balance Sheet 30-Jun-24 Assets 7 Cash 8 Short Term Investments 9 Notes Receivable 10 Accounts Receivable 11 Merchandise Inventory 12 Prepaid Rent 13 Prepaid Insurance 14 Sales Supplies 15 Office Supplies 16 Deposit for Future Advertising 17 Total Current Assets 18 Investments: 19 Building, Not In Use 20 Property, Plant, & Equipment 21 Land 22 Delivery Equipment 23 Accumulated Depreciation - Delivery Equipment 24 Total Property, Plant, & Equipment 25 Intangible Assets 26 Trademark 27 Total Assets 28 29 Current Liabilities: 30 Accounts Payable 31 Salaries Payable 32 Interest Payable 33 Total Current Liabilities 34 Long Term Liabilities 35 Long Terms Notes Payable Liabilities 36 Total Liabilities 37 38 E. Cullen Capital 39 Total Liabilties & Owner's Equity Owners Equity Liquidity and Profitability Ratios E8A. BUSINESS APPLICATION Villegas Company is considering applying for a bank loan. Various data from Villegas's classified financial statements follow. 2014 2013 Current assets $100,000 $ 85,000 Total assets 440,000 355,000 Current liabilities 45,000 25,000 Long-term liabilities 75,000 25,000 Owner's equity 320,000 305,000 Sales 600,000 525,000 Net income 30,000 40,000 Its total assets and owner's equity at the beginning of 2013 were $345,000 and $295,000, respectively. 1. Use (a) liquidity analysis and (b) profitability analysis to document Villegas's financial position. (Round to two decimal places.) 2. Discuss Villegas's profitability and liquidity. Do you think it will qualify for a bank loan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started