Answered step by step

Verified Expert Solution

Question

1 Approved Answer

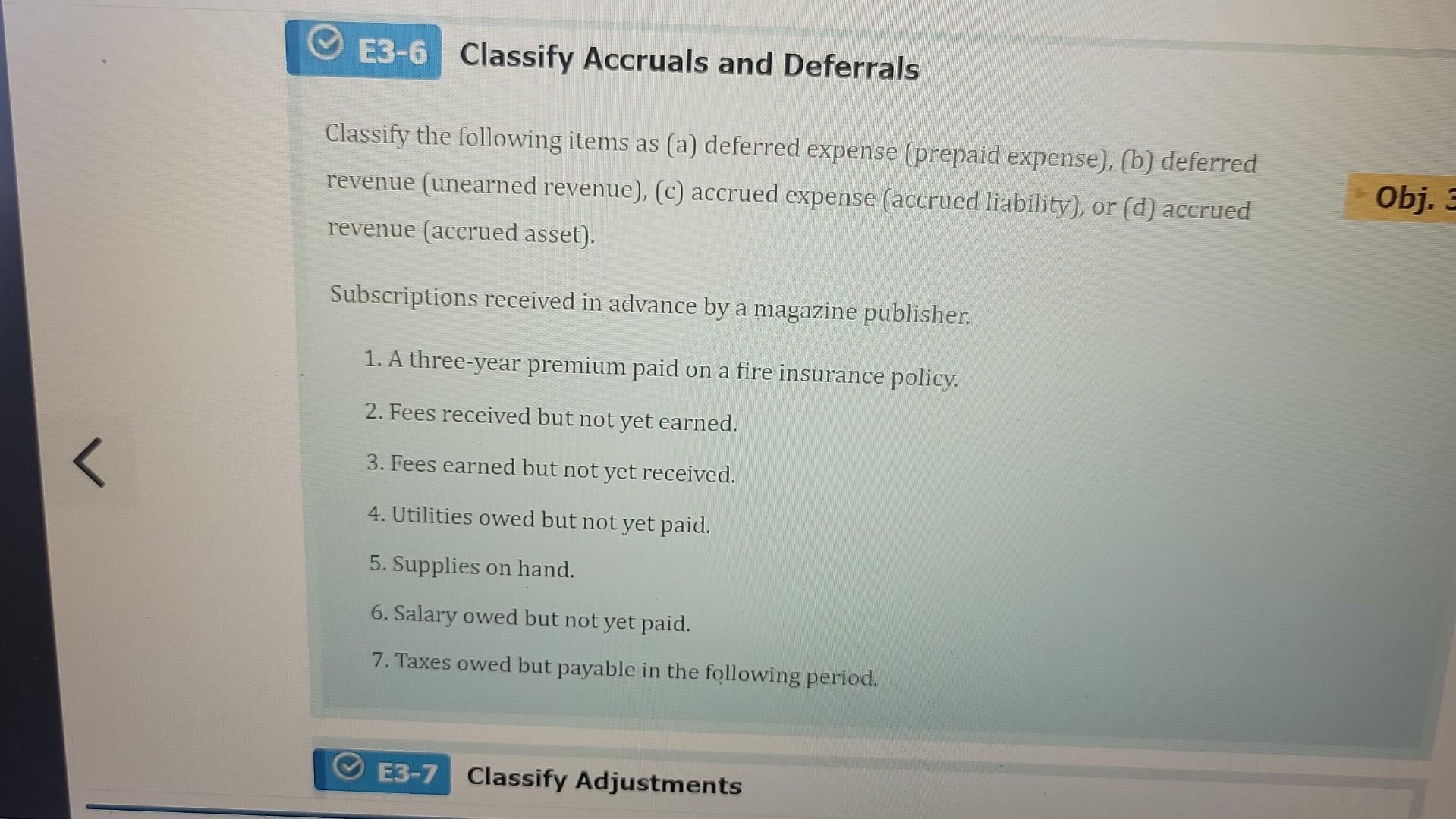

Classify Accruals and Deferrals Classify the following items as (a) deferred expense (prepaid expense), (b) deferred revenue (unearned revenue), (c) accrued expense (accrued liability), or

Classify Accruals and Deferrals Classify the following items as (a) deferred expense (prepaid expense), (b) deferred revenue (unearned revenue), (c) accrued expense (accrued liability), or (d) accrued revenue (accrued asset). Subscriptions received in advance by a magazine publisher: 1. A three-year premium paid on a fire insurance policy. 2. Fees received but not yet earned. 3. Fees earned but not yet received. 4. Utilities owed but not yet paid. 5. Supplies on hand. 6. Salary owed but not yet paid. 7. Taxes owed but payable in the following period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started