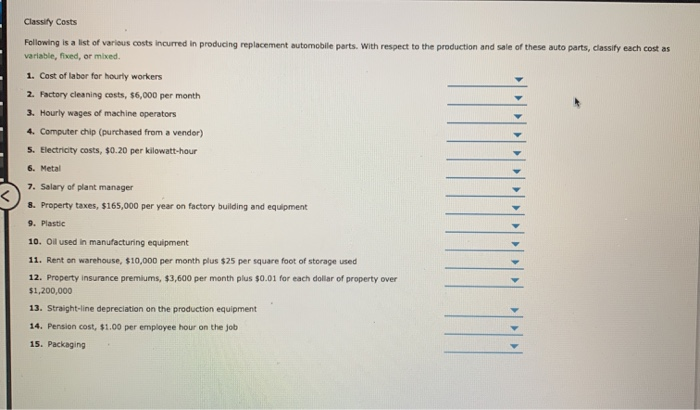

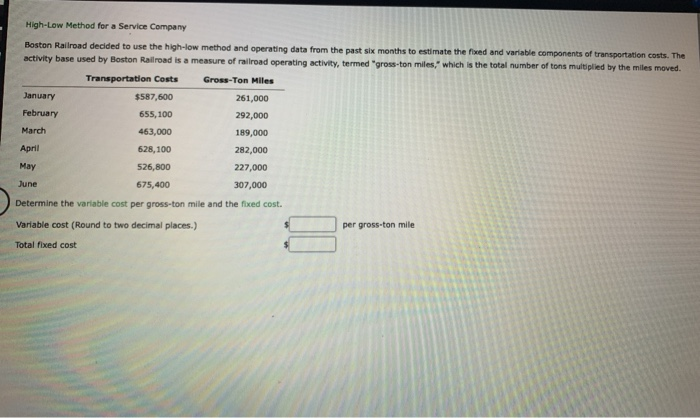

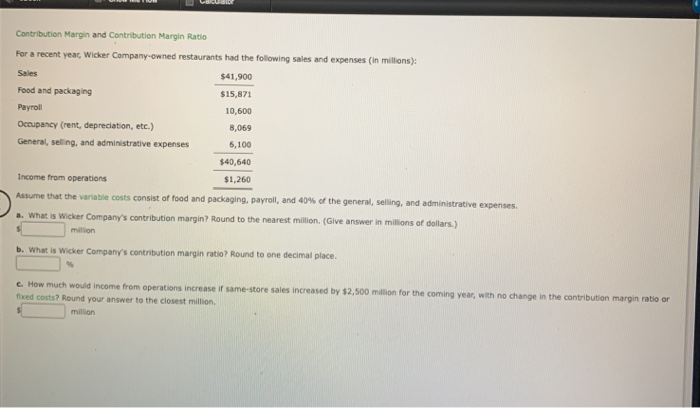

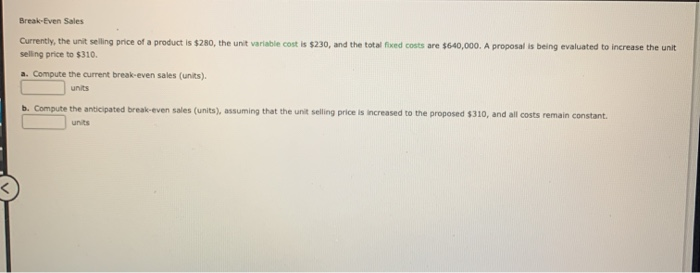

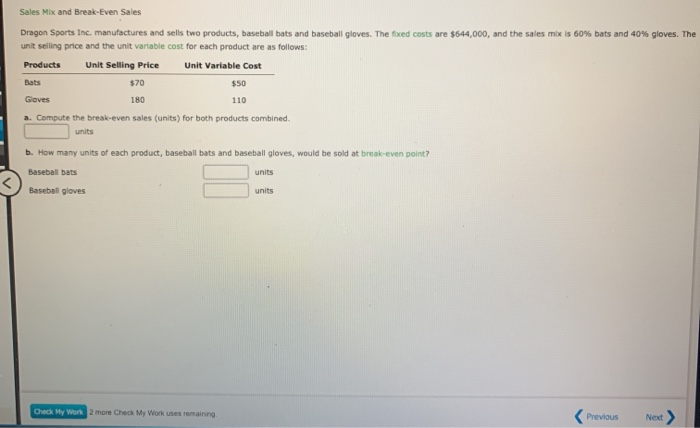

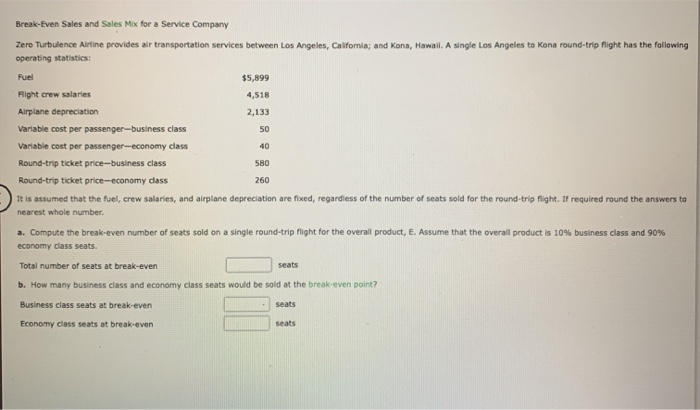

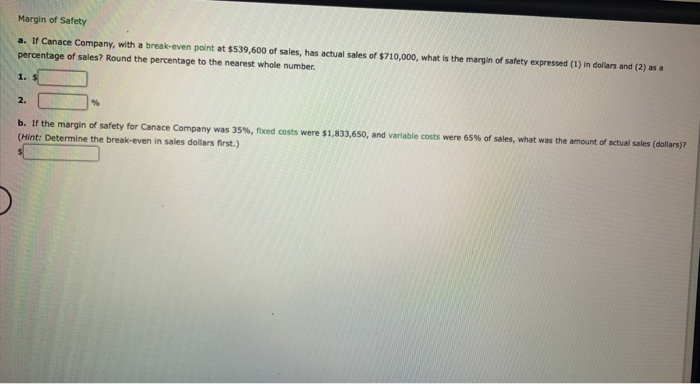

Classify Costs Following is a list of various costs incurred in producing replacement automobile parts. With respect to the production and sale of these auto parts, classify each cost as variable, fixed, or mixed. 1. Cost of labor for hourly workers 2. Factory cleaning costs, $6,000 per month 3. Hourly wages of machine operators 4. Computer chip (purchased from a vendor) 5. Electricity costs, $0.20 per kilowatt-hour 6. Metal 7. Salary of plant manager 8. Property taxes, $165,000 per year on factory building and equipment 9. Plastic 10. Oil used in manufacturing equipment 11. Rent on warehouse, $10,000 per month plus $25 per square foot of storage used 12. Property insurance premiums, $3,600 per month plus $0.01 for each dollar of property over $1,200,000 13. Straight-line depreciation on the production equipment 14. Pension cost, $1.00 per employee hour on the job 15. Packaging Contribution Margin and Contribution Margin Ratio For a recent year, Wicker Company-owned restaurants had the following sales and expenses (in millions): Sales $41,900 Food and packaging $15,871 Payroll 10,600 Occupancy (rent, depreciation, etc.) 3,069 General, selling, and administrative expenses 6,100 $40,640 Income from operations $1.260 Assume that the variable costs consist of food and packaging, payroll, and 40% of the general, selling, and administrative expenses a. What is Wicker Company's contribution margin? Round to the nearest million. (Give answer in millions of dollars.) million b. What is Wicker Company's contribution margin ratio? Round to one decimal place. c. How much would income from operations increase if same-store sales increased by $2,500 million for the coming year, with no change in the contribution margin ratio or fixed costs? Round your answer to the closest million milton S Break-Even Sales Currently, the unit selling price of a product is $280, the unit variable cost is $230, and the total fixed costs are $640,000. A proposal is being evaluated to increase the unit selling price to $310. a. Compute the current break-even sales (units). units b. Compute the anticipated break-even sales (units), assuming that the unit selling price is increased to the proposed $310, and all costs remain constant. units Break-Even Sales and Sales Mix for a Service Company Zero Turbulence Airline provides air transportation services between Los Angeles, California; and Kona, Hawall. A single Los Angeles to Kona round-trip flight has the following operating statistics: Fuel $5,899 Flight crew salaries 4,518 Airplane depreciation 2,133 Variable cost per passenger-business class Variable cost per passenger-economy class 40 Round-trip ticket price-business class 580 Round-trip ticket price-economy class 260 It is assumed that the fuel, crew salaries, and airplane depreciation are fixed, regardless of the number of seats sold for the round-trip flight. If required round the answers to nearest whole number a. Compute the break-even number of seats sold on a single round-trip flight for the overall product, E. Assume that the overall product is 10% business class and 90% economy class seats Total number of seats at break-even seats b. How many business class and economy class seats would be sold at the break-even point? Business class seats at break-even Economy class seats at break-even Margin of Safety a. If Canace Company, with a break-even point at $539,600 of sales, has actual sales of $710,000, what is the margin of safety expressed (1) in dollars and (2) as a percentage of sales? Round the percentage to the nearest whole number 1. $ 2. % b. If the margin of safety for Cance Company was 35%, fixed costs were $1,833,650, and variable costs were 65% of sales, what was the amount of actual sales (dollars)? (Hint: Determine the break-even in sales dollars first.)