classify each of the investments made during 2018

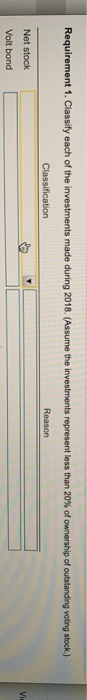

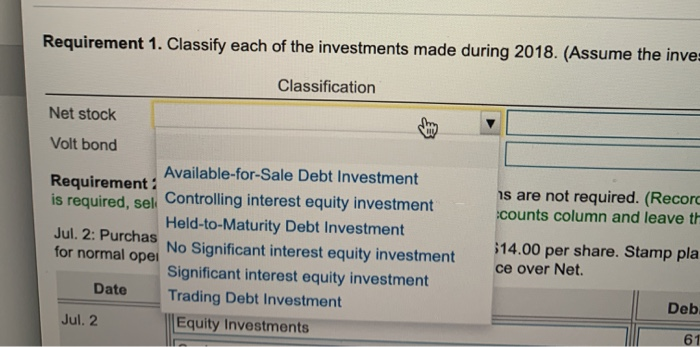

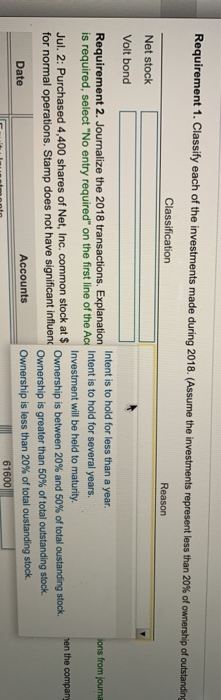

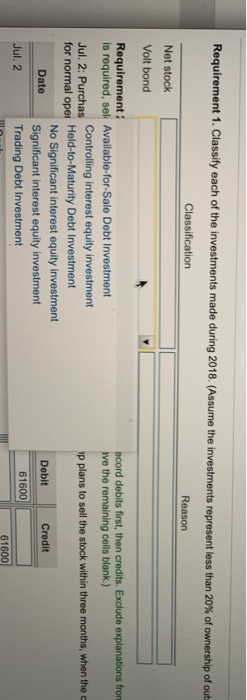

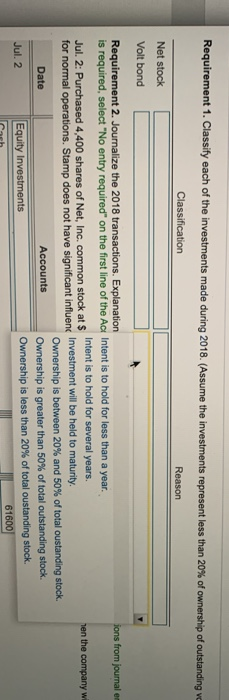

Requirement 1. Classify each of the investments made during 2018. (Assume the investments represent less than 20% of ownership of outstanding voting stock.) Classification Reason Net stock Volt bond Requirement 1. Classify each of the investments made during 2018. (Assume the inve Classification is are not required. (Record :counts column and leave th Net stock Volt bond Available-for-Sale Debt Investment Requirement: is required, sel Controlling interest equity investment Held-to-Maturity Debt Investment Jul. 2: Purchas for normal opei No Significant interest equity investment Significant interest equity investment Date Trading Debt Investment Jul. 2 Equity Investments $14.00 per share. Stamp pla ce over Net. Deb Requirement 1. Classify each of the investments made during 2018. (Assume the investments represent less than 20% of ownership of outstanding ions from journa Classification Reason Net stock L Volt bond Intent is to hold for less than a year. Requirement 2. Journalize the 2018 transactions. Explanation is required, select "No entry required" on the first line of the Act Intent is to hold for several years. Investment will be held to maturity. Jul. 2: Purchased 4,400 shares of Net, Inc. common stock at $ Ownership is between 20% and 50% of total oustanding stock. for normal operations. Stamp does not have significant influenc Ownership is greater than 50% of total outstanding stock. Date Accounts Ownership is less than 20% of total oustanding stock. 61600 hen the company Requirement 1. Classify each of the investments made during 2018. (Assume the investments represent less than 20% of ownership of out Classification Reason Net stock Volt bond ecord debits first, then credits. Exclude explanations from ive the remaining cells blank.) p plans to sell the stock within three months, when the Requirement: is required, seli Available for Sale Debt Investment Controlling interest equity investment Jul. 2: Purchas for normal opel Held-to-Maturity Debt Investment No Significant interest equity investment Date Significant interest equity investment Jul. 2 Trading Debt Investment Credit Debit 61600 61600 Requirement 1. Classify each of the investments made during 2018. (Assume the investments represent less than 20% of ownership of outstanding v Classification Reason Net stock Volt bond ions from journal er hen the company w Requirement 2. Journalize the 2018 transactions. Explanation is required, select "No entry required" on the first line of the Ac Intent is to hold for less than a year. Intent is to hold for several years. Jul. 2: Purchased 4,400 shares of Net, Inc. common stock at $ for normal operations. Stamp does not have significant influenc Investment will be held to maturity. Ownership is between 20% and 50% of total oustanding stock. Date Accounts Ownership is greater than 50% of total outstanding stock. Jul. 2 Equity Investments Ownership is less than 20% of total oustanding stock. 61600 Requirement 1. Classify each of the investments made during 2018. (Assume the investments represent less than 20% of ownership of outstanding voting stock.) Classification Reason Net stock Volt bond Requirement 1. Classify each of the investments made during 2018. (Assume the inve Classification is are not required. (Record :counts column and leave th Net stock Volt bond Available-for-Sale Debt Investment Requirement: is required, sel Controlling interest equity investment Held-to-Maturity Debt Investment Jul. 2: Purchas for normal opei No Significant interest equity investment Significant interest equity investment Date Trading Debt Investment Jul. 2 Equity Investments $14.00 per share. Stamp pla ce over Net. Deb Requirement 1. Classify each of the investments made during 2018. (Assume the investments represent less than 20% of ownership of outstanding ions from journa Classification Reason Net stock L Volt bond Intent is to hold for less than a year. Requirement 2. Journalize the 2018 transactions. Explanation is required, select "No entry required" on the first line of the Act Intent is to hold for several years. Investment will be held to maturity. Jul. 2: Purchased 4,400 shares of Net, Inc. common stock at $ Ownership is between 20% and 50% of total oustanding stock. for normal operations. Stamp does not have significant influenc Ownership is greater than 50% of total outstanding stock. Date Accounts Ownership is less than 20% of total oustanding stock. 61600 hen the company Requirement 1. Classify each of the investments made during 2018. (Assume the investments represent less than 20% of ownership of out Classification Reason Net stock Volt bond ecord debits first, then credits. Exclude explanations from ive the remaining cells blank.) p plans to sell the stock within three months, when the Requirement: is required, seli Available for Sale Debt Investment Controlling interest equity investment Jul. 2: Purchas for normal opel Held-to-Maturity Debt Investment No Significant interest equity investment Date Significant interest equity investment Jul. 2 Trading Debt Investment Credit Debit 61600 61600 Requirement 1. Classify each of the investments made during 2018. (Assume the investments represent less than 20% of ownership of outstanding v Classification Reason Net stock Volt bond ions from journal er hen the company w Requirement 2. Journalize the 2018 transactions. Explanation is required, select "No entry required" on the first line of the Ac Intent is to hold for less than a year. Intent is to hold for several years. Jul. 2: Purchased 4,400 shares of Net, Inc. common stock at $ for normal operations. Stamp does not have significant influenc Investment will be held to maturity. Ownership is between 20% and 50% of total oustanding stock. Date Accounts Ownership is greater than 50% of total outstanding stock. Jul. 2 Equity Investments Ownership is less than 20% of total oustanding stock. 61600