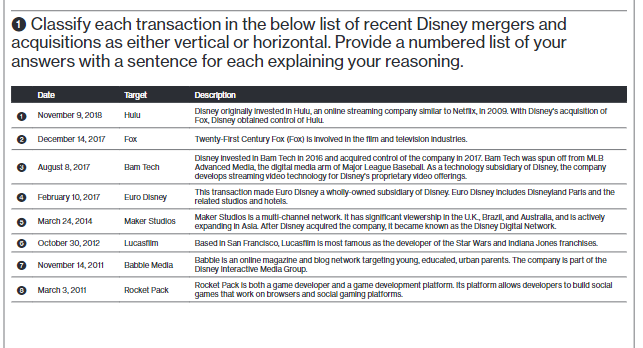

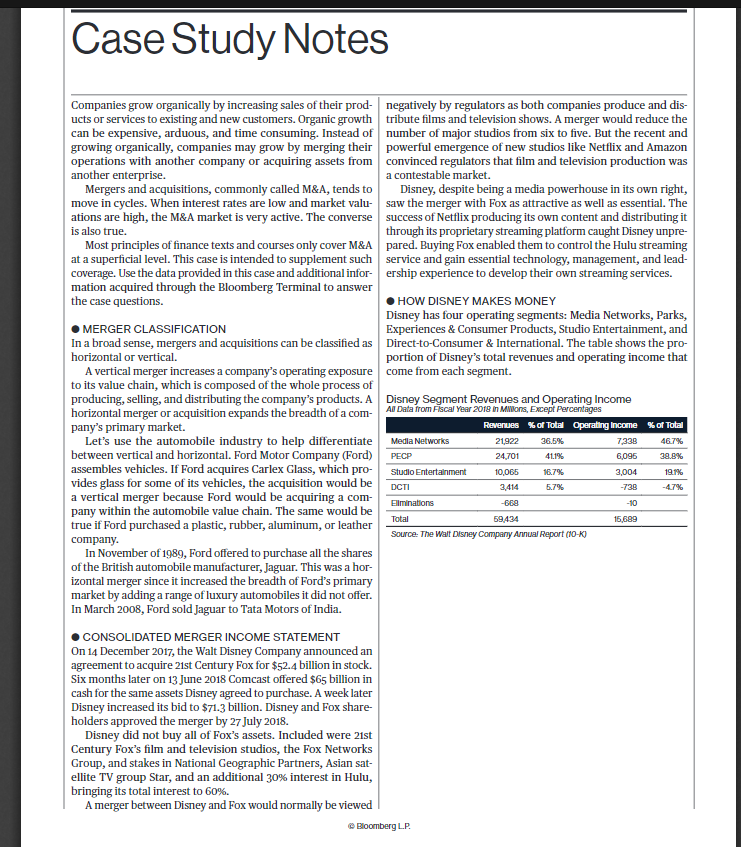

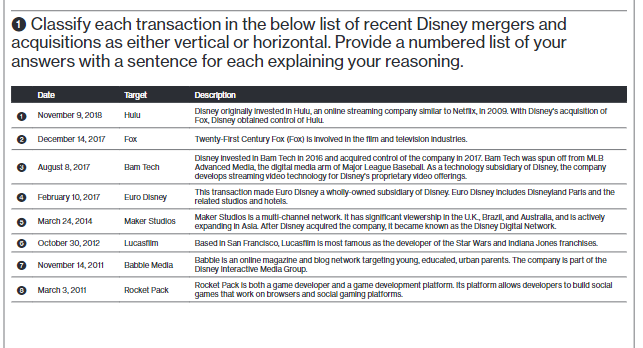

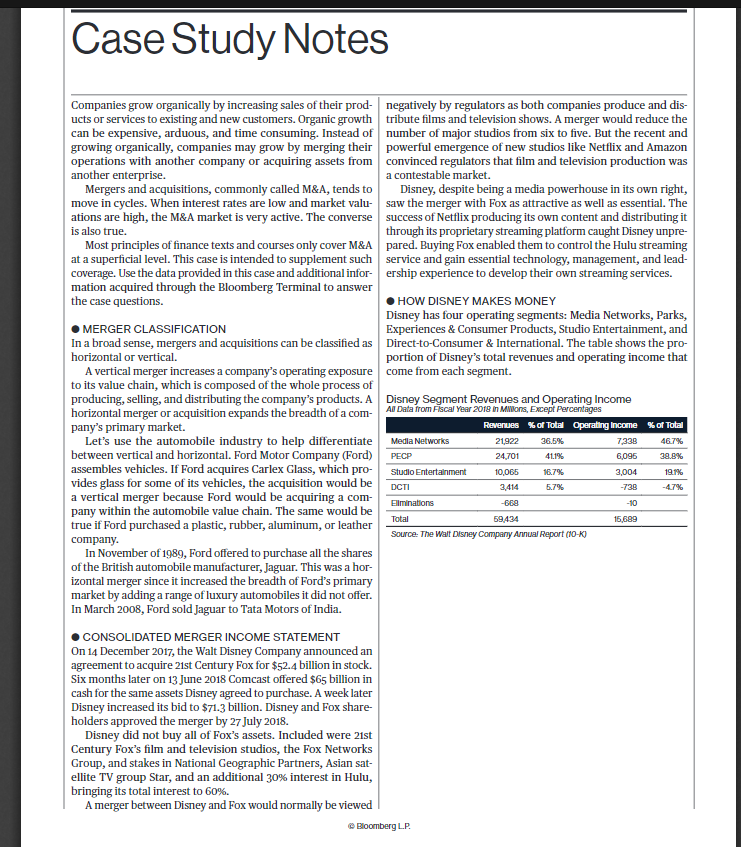

Classify each transaction in the below list of recent Disney mergers and acquisitions as either vertical or horizontal. Provide a numbered list of your answers with a sentence for each explaining your reasoning. Date Target November 9, 2018 Hulu 2 December 14, 2017 Fox August 8, 2017 Bam Tech February 10, 2017 Euro Disney Description Disney originally Invested in Hulu, an online streaming company similar to Netflix, in 2009. with Disney's acquisition of Fox, Disney obtained control of Hulu Twenty-First Century Fox (Fox) is involved in the film and television Industries. Disney Invested in Bam Tech In 2016 and acquired control of the company in 2017. Bam Tech was spun off from MLB Advanced Media, the digital media arm of Major League Baseball. As a technology subsidiary of Disney, the company develops streaming video technology for Disney's proprietary video offerings. This transaction made Euro Disney a wholly-owned subsidiary of Disney. Euro Disney Includes Disneyland Parts and the related studios and hotels Maker Studios is a multi-channel network. It has significant viewership in the UK, Brazil, and Australia and is actively expanding In Asia After Disney acquired the company. It became known as the Disney Digital Network Based in San Francisco, Lucasfilm is most famous as the developer of the Star Wars and Indiana Jones franchises. Babble Is an online magazine and blog network targeting young, educated, urban parents. The company is part of the Disney Interactive Media Group. Rocket Pack is both a game developer and a game development platform. Its platform allows developers to build social games that work on browsers and social gaming platforms. > March 24, 2014 Maker Studios Lucasfilm October 30, 2012 November 14, 2011 Babble Media March 3, 2011 Rocket Pack Case Study Notes 21.922 46.7% Media Networks PECP 36.5% 41.1% Companies grow organically by increasing sales of their prod negatively by regulators as both companies produce and dis- ucts or services to existing and new customers. Organic growth tribute films and television shows. A merger would reduce the can be expensive, arduous, and time consuming. Instead of number of major studios from six to five. But the recent and growing organically, companies may grow by merging their powerful emergence of new studios like Netflix and Amazon operations with another company or acquiring assets from convinced regulators that film and television production was another enterprise. a contestable market. Mergers and acquisitions, commonly called M&A, tends to Disney, despite being a media powerhouse in its own right, move in cycles. When interest rates are low and market valu- saw the merger with Fox as attractive as well as essential. The ations are high, the M&A market is very active. The converse success of Netflix producing its own content and distributing it is also true. through its proprietary streaming platform caught Disney unpre- Most principles of finance texts and courses only cover M&A pared. Buying Fox enabled them to control the Hulu streaming at a superficial level. This case is intended to supplement such service and gain essential technology, management, and lead- coverage. Use the data provided in this case and additional infor- ership experience to develop their own streaming services. mation acquired through the Bloomberg Terminal to answer the case questions. HOW DISNEY MAKES MONEY Disney has four operating segments: Media Networks, Parks, MERGER CLASSIFICATION Experiences & Consumer Products, Studio Entertainment, and In a broad sense, mergers and acquisitions can be classified as Direct-to-Consumer & International. The table shows the pro- horizontal or vertical. portion of Disney's total revenues and operating income that A vertical merger increases a company's operating exposure come from each segment. to its value chain, which is composed of the whole process of producing, selling, and distributing the company's products. A Disney Segment Revenues and Operating Income horizontal merger or acquisition expands the breadth of a com- All data from Fiscal Year 2018 in Mwlons, Except Percentages pany's primary market. Revenues of Total Operating Income % of Total Let's use the automobile industry to help differentiate between vertical and horizontal. Ford Motor Company (Ford) 24,701 assembles vehicles. If Ford acquires Carlex Glass, which pro- Studio Entertainment vides glass for some of its vehicles, the acquisition would be a vertical merger because Ford would be acquiring a com- pany within the automobile value chain. The same would be true if Ford purchased a plastic, rubber, aluminum, or leather company. Source: The Walt Disney Company Annual Report (10-K) In November of 1989, Ford offered to purchase all the shares of the British automobile manufacturer, Jaguar. This was a hor- izontal merger since it increased the breadth of Ford's primary market by adding a range of luxury automobiles it did not offer. In March 2008, Ford sold Jaguar to Tata Motors of India. CONSOLIDATED MERGER INCOME STATEMENT On 14 December 2017, the Walt Disney Company announced an agreement to acquire 21st Century Fox for $52.4 billion in stock. Six months later on 13 June 2018 Comcast offered $65 billion in cash for the same assets Disney agreed to purchase. A week later Disney increased its bid to $71.3 billion. Disney and Fox share holders approved the merger by 27 July 2018. Disney did not buy all of Fox's assets. Included were 21st Century Fox's film and television studios, the Fox Networks Group, and stakes in National Geographic Partners, Asian sat- ellite TV group Star, and an additional 30% interest in Hulu, bringing its total interest to 60%. A merger between Disney and Fox would normally be viewed Bloomberg LP. 7.338 6,096 3,004 -738 38.8% 19.1% 16.7% 10,065 3,414 -669 DCTI Eliminations Total 5.7% -10 59.434 15,689