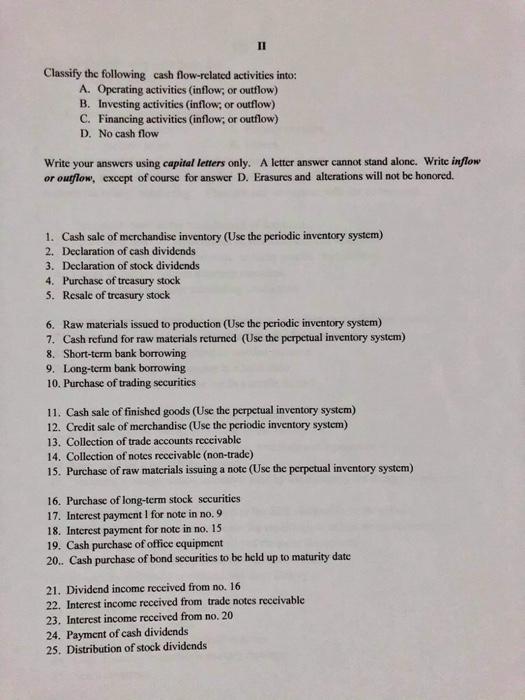

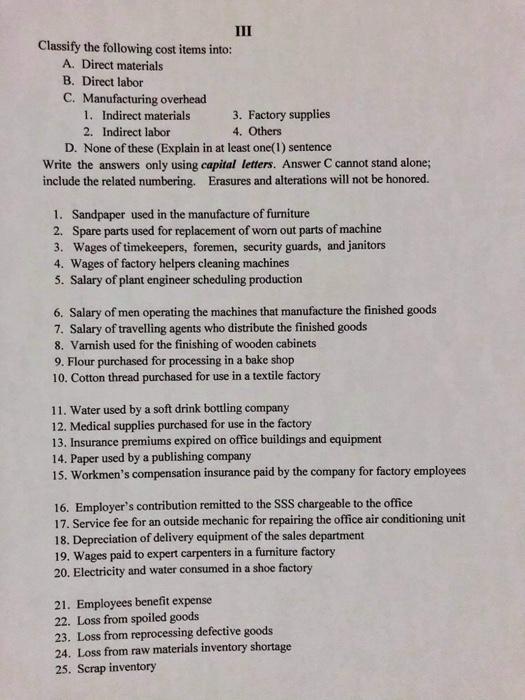

Classify the following cash flow-related activities into: A. Operating activities (inflow, or outflow) B. Investing activities (inflow, or outflow) C. Financing activities (inflow, or outflow) D. No cash flow Write your answers using capital letters only. A letter answer cannot stand alone. Write inflow or outflow, except of course for answer D. Erasures and alterations will not be honored 1. Cash sale of merchandise inventory (Use the periodic inventory system) 2. Declaration of cash dividends 3. Declaration of stock dividends 4. Purchase of treasury stock 5. Resale of treasury stock 6. Raw materials issued to production (Use the periodic inventory system) 7. Cash refund for raw materials returned (Use the perpetual inventory system) 8. Short-term bank borrowing 9. Long-term bank borrowing 10. Purchase of trading securities 11. Cash sale of finished goods (Use the perpetual inventory system) 12. Credit sale of merchandise (Use the periodic inventory system) 13. Collection of trade accounts receivable 14. Collection of notes receivable (non-trade) 15. Purchase of raw materials issuing a notc (Use the perpetual inventory system) 16. Purchase of long-term stock securities 17. Interest payment I for note in no. 9 18. Interest payment for note in no. 15 19. Cash purchase of office equipment 20.. Cash purchase of bond securities to be held up to maturity date 21. Dividend income received from no. 16 22. Interest income received from trade notes receivable 23. Interest income received from no. 20 24. Payment of cash dividends 25. Distribution of stock dividends III Classify the following cost items into: A. Direct materials B. Direct labor C. Manufacturing overhead 1. Indirect materials 3. Factory supplies 2. Indirect labor 4. Others D. None of these (Explain in at least one(1) sentence Write the answers only using capital letters. Answer C cannot stand alone; include the related numbering. Erasures and alterations will not be honored. 1. Sandpaper used in the manufacture of furniture 2. Spare parts used for replacement of worn out parts of machine 3. Wages of timekeepers, foremen, security guards, and janitors 4. Wages of factory helpers cleaning machines 5. Salary of plant engineer scheduling production 6. Salary of men operating the machines that manufacture the finished goods 7. Salary of travelling agents who distribute the finished goods 8. Varnish used for the finishing of wooden cabinets 9. Flour purchased for processing in a bake shop 10. Cotton thread purchased for use in a textile factory 11. Water used by a soft drink bottling company 12. Medical supplies purchased for use in the factory 13. Insurance premiums expired on office buildings and equipment 14. Paper used by a publishing company 15. Workmen's compensation insurance paid by the company for factory employees 16. Employer's contribution remitted to the SSS chargeable to the office 17. Service fee for an outside mechanic for repairing the office air conditioning unit 18. Depreciation of delivery equipment of the sales department 19. Wages paid to expert carpenters in a furniture factory 20. Electricity and water consumed in a shoe factory 21. Employees benefit expense 22. Loss from spoiled goods 23. Loss from reprocessing defective goods 24. Loss from raw materials inventory shortage 25. Scrap inventory