Question

Classifying Cash Flows. Big Sky, Inc., had the following transactions during 2012: Issued common stock for $150,000 cash Paid $25,000 in principal on previously issued

Classifying Cash Flows. Big Sky, Inc., had the following transactions during 2012:

Issued common stock for $150,000 cash

Paid $25,000 in principal on previously issued bonds

Paid $300,000 in salaries and wages to employees

Sold property for $45,000 cash

Paid $3,000 in cash dividends

Received $600,000 from customers for cash sales

Paid $350,000 cash for merchandise

Converted bonds into common stock

Purchased a building for $850,000 cash

Paid $310,000 for operating expenses

Received $200,000 cash for the sale of long-term investments

Issued bonds for $87,000 cash

Repurchased common stock for $35,000 cash

Issued common stock to purchase land valued at $450,000

Paid $10,000 cash for interest on notes payable

Required:

Classify each transaction as one of the following: operating activity, investing activity, financing activity, or noncash transaction. Briefly explain your answer for each item.

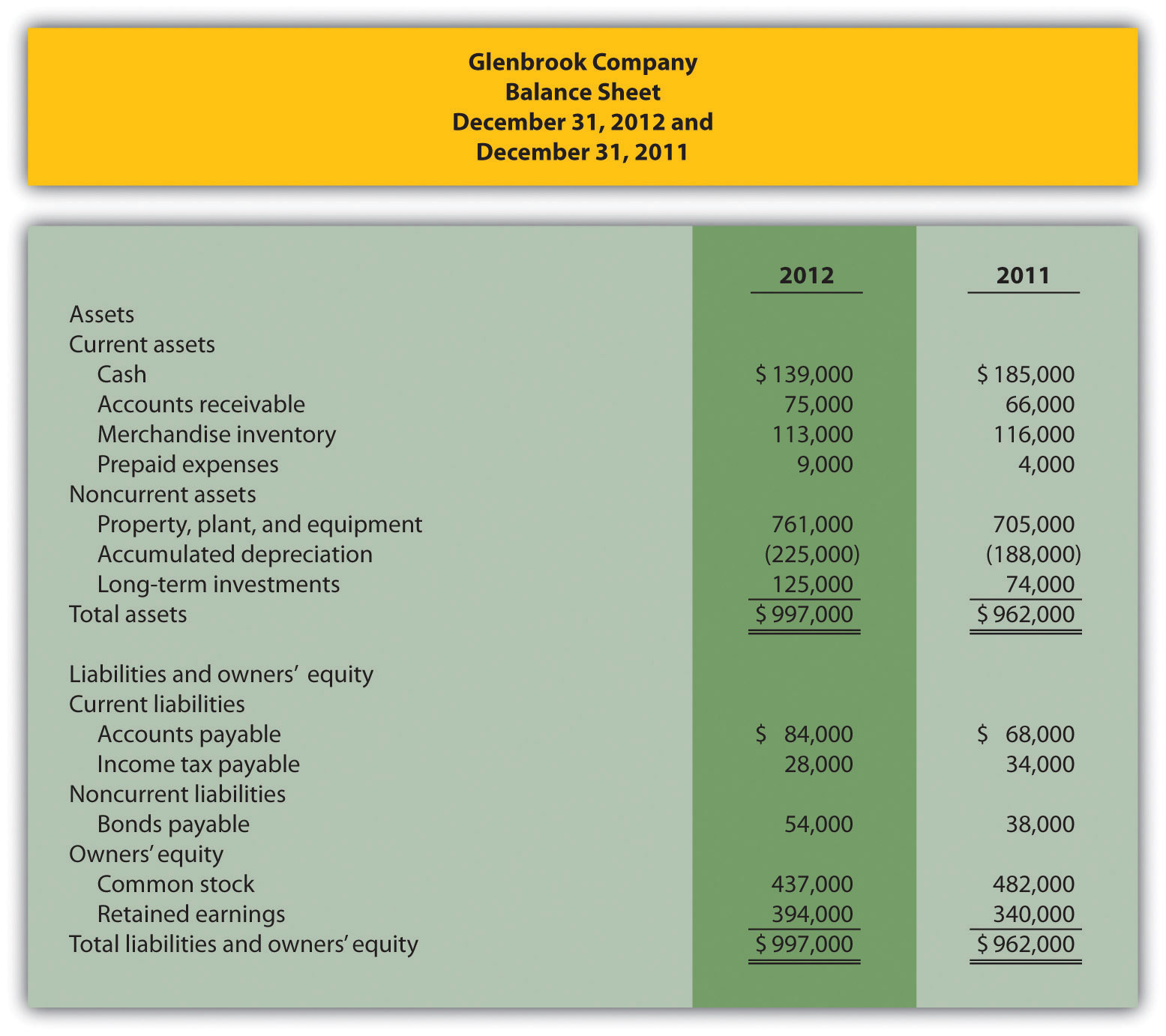

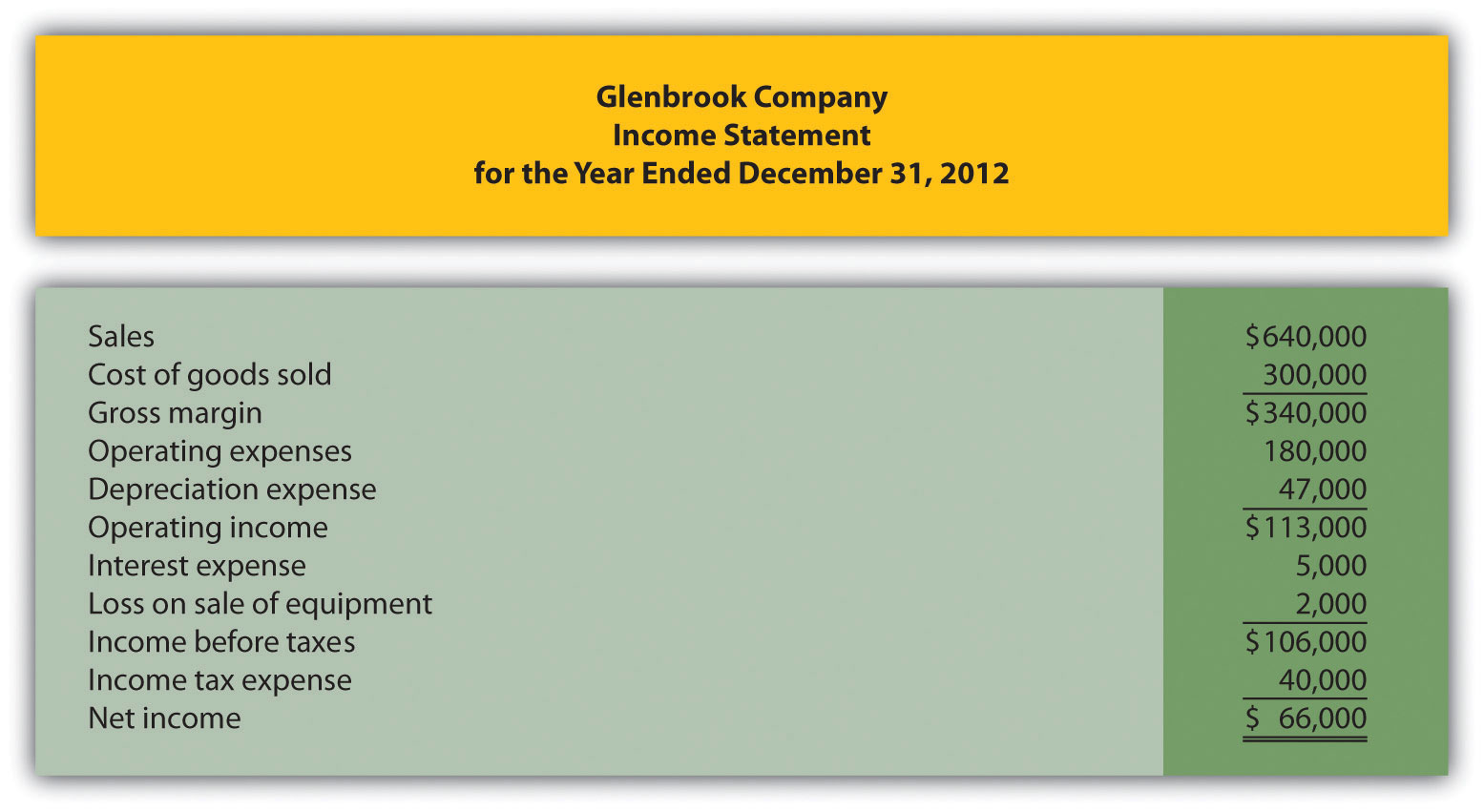

Prepare a Statement of Cash Flows, Indirect Method. Glenbrook Companys most recent balance sheet, income statement, and other important information for 2012 are presented as follows.

Additional data for 2012 are as follows:

Sold equipment with a book value of $30,000 (= $40,000 cost $10,000 accumulated depreciation) for $28,000 cash

Purchased equipment for $96,000 cash

There were no sales of long-term investments (Hint: Solve for the purchase of long-term investments.)

Issued bonds for $16,000 cash

Repurchased common stock (treasury shares) for $45,000 cash

Declared and paid $12,000 in cash dividends

Required:

Use the four steps described in the chapter to prepare a statement of cash flows for the year ended December 31, 2012, using the indirect method. Refer to the format presented in Figure 12.8 "Statement of Cash Flows (Home Store, Inc.)".

Briefly describe the major changes in cash identified in the statement of cash flows.

(Appendix) Prepare a Statement of Cash Flows, Direct Method. Refer to the information for Glenbrook Company presented in the previous problem.

Required:

Use the four steps described in the chapter, including the appendix, to prepare a statement of cash flows for the year ended December 31, 2012, using the directmethod. Refer to the operating activities section format using the direct method presented in Figure 12.12 "Operating Activities Section Using the Direct Method (Home Store, Inc.)" and the adjustment rules for the direct method presented in Figure 12.13 "Adjustment Rules for the Direct Method".

Briefly describe the major changes in cash identified in the statement of cash flows.

Glenbrook Company Balance Sheet December 31, 2012 and December 31, 2011 2012 2011 Assets Current assets Cash Accounts receivable Merchandise inventory Prepaid expenses $ 139,000 75,000 113,000 9,000 $ 185,000 66,000 116,000 4,000 Noncurrent assets Property, plant, and equipment Accumulated depreciation Long-term investments 761,000 (225,000) 125,000 $997,000 705,000 (188,000) 74,000 $962,000 Total assets Liabilities and owners' equity Current liabilities $ 84,000 28,000 $ 68,000 34,000 Accounts payable Income tax payable Bonds payable Common stock Noncurrent liabilities 54,000 38,000 Owners' equity 437,000 394,000 $997,000 482,000 340,000 $962,000 Retained earnings Total liabilities and owners' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started