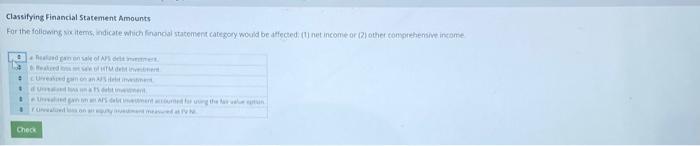

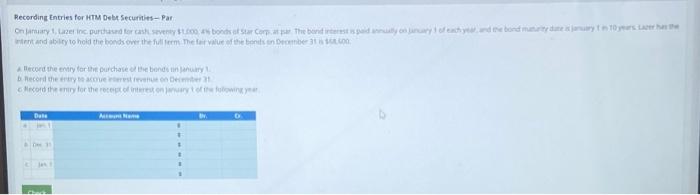

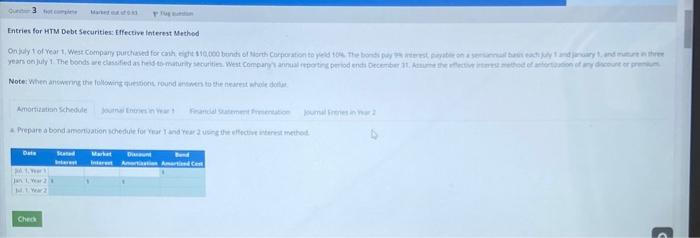

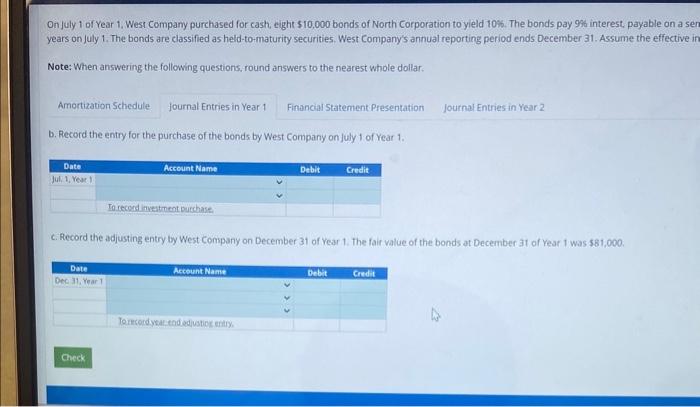

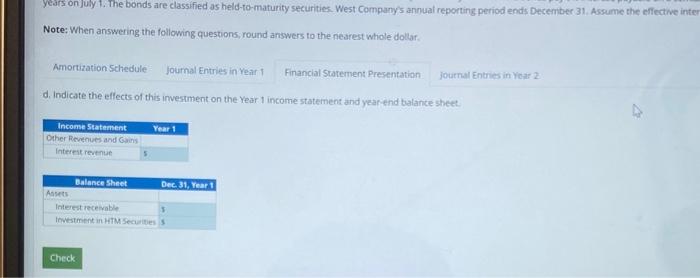

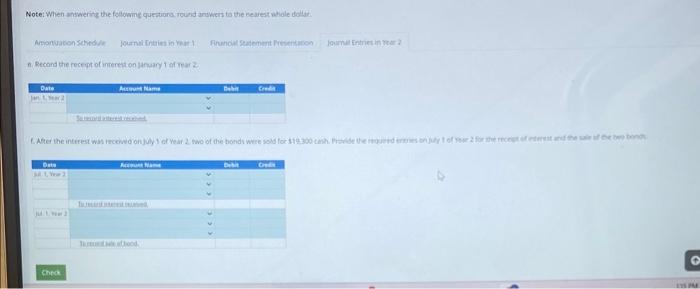

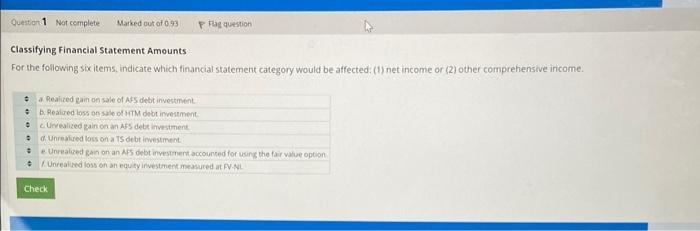

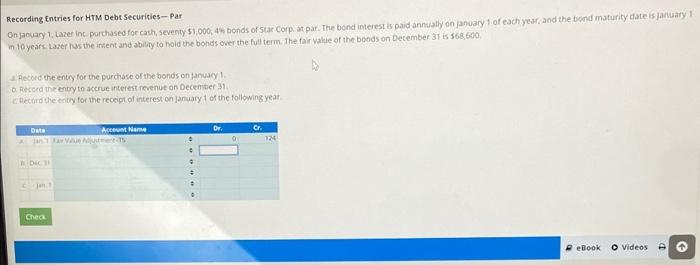

Classifying Finandal statement Amounts Far the folibmes sin itemis indicare which finanoal stasemsent care sory would be affected. (1) net income or (2) other consitehenime instame. Recording Entries for HTM Debe Securitits - Par: Entries for HTM Debt securities: Effective interest Method chesin: On july 1 of Year 1 . West Company purchased for cash, eight $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a se years on July 1. The bonds are classified as held-to-maturity securities. West Company's annual reporting period ends December 31 . Assume the effective i Note: When answering the following questions, round answers to the nearest whole dollar. b. Record the entry for the purchase of the bonds by West Company on july 1 of Year 1. C. Record the adjusting entry by West Company on December 31 of Year 1. The fair value of the bonds at December at of Year 1 was $81,000. years onjuly 1. The bonds are classified as held-to-maturity securities. West Company's annual reporting period ends Decenber 31 . Assume the effective inte. Note: When answering the following questions, round answers to the nearest whole dollar. d. Indicate the effects of this inverment on the Year 1 income statement and yearend balance sheet. n. Reccand the rece pt of inereret on farmary 4 of rear 2 . Classifying Financial Statement Amounts For the following sixitems, indicate which financial statement category would be affected: (1) net income or (2) other comprehensive inicome. a. Realized gain on sale of Nes debtinvestment b. Realced los onsale ot 4 M debt investment C Unvealized gain on an Ats debs invstimene d. Unrealied loss on a Ts debt investment. E Unrealized gan on an AFS debt investment accounced for ueing the far vilue option Onjanvary 1, Lazer inc. porthase for cath, seveny 51,000,45 bonds of star Corp at par. The bond interest is paid annualy on january 1 of each year, and the bond maturity date is january : Recording Entries for HTM Debt Securities - Par in 10 years Laser has the intent and ability to bold the bonds over the full term. The fair value of the bonds on December 31 is 568,600 Aecord the entiy for the purchase of the bonos on january 1. a. pecord the entry to accrue intereq revenue on Decenber 31 e dectind the enity fot the receipt of interest on ]anuary 1 of the following year. Classifying Finandal statement Amounts Far the folibmes sin itemis indicare which finanoal stasemsent care sory would be affected. (1) net income or (2) other consitehenime instame. Recording Entries for HTM Debe Securitits - Par: Entries for HTM Debt securities: Effective interest Method chesin: On july 1 of Year 1 . West Company purchased for cash, eight $10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a se years on July 1. The bonds are classified as held-to-maturity securities. West Company's annual reporting period ends December 31 . Assume the effective i Note: When answering the following questions, round answers to the nearest whole dollar. b. Record the entry for the purchase of the bonds by West Company on july 1 of Year 1. C. Record the adjusting entry by West Company on December 31 of Year 1. The fair value of the bonds at December at of Year 1 was $81,000. years onjuly 1. The bonds are classified as held-to-maturity securities. West Company's annual reporting period ends Decenber 31 . Assume the effective inte. Note: When answering the following questions, round answers to the nearest whole dollar. d. Indicate the effects of this inverment on the Year 1 income statement and yearend balance sheet. n. Reccand the rece pt of inereret on farmary 4 of rear 2 . Classifying Financial Statement Amounts For the following sixitems, indicate which financial statement category would be affected: (1) net income or (2) other comprehensive inicome. a. Realized gain on sale of Nes debtinvestment b. Realced los onsale ot 4 M debt investment C Unvealized gain on an Ats debs invstimene d. Unrealied loss on a Ts debt investment. E Unrealized gan on an AFS debt investment accounced for ueing the far vilue option Onjanvary 1, Lazer inc. porthase for cath, seveny 51,000,45 bonds of star Corp at par. The bond interest is paid annualy on january 1 of each year, and the bond maturity date is january : Recording Entries for HTM Debt Securities - Par in 10 years Laser has the intent and ability to bold the bonds over the full term. The fair value of the bonds on December 31 is 568,600 Aecord the entiy for the purchase of the bonos on january 1. a. pecord the entry to accrue intereq revenue on Decenber 31 e dectind the enity fot the receipt of interest on ]anuary 1 of the following year