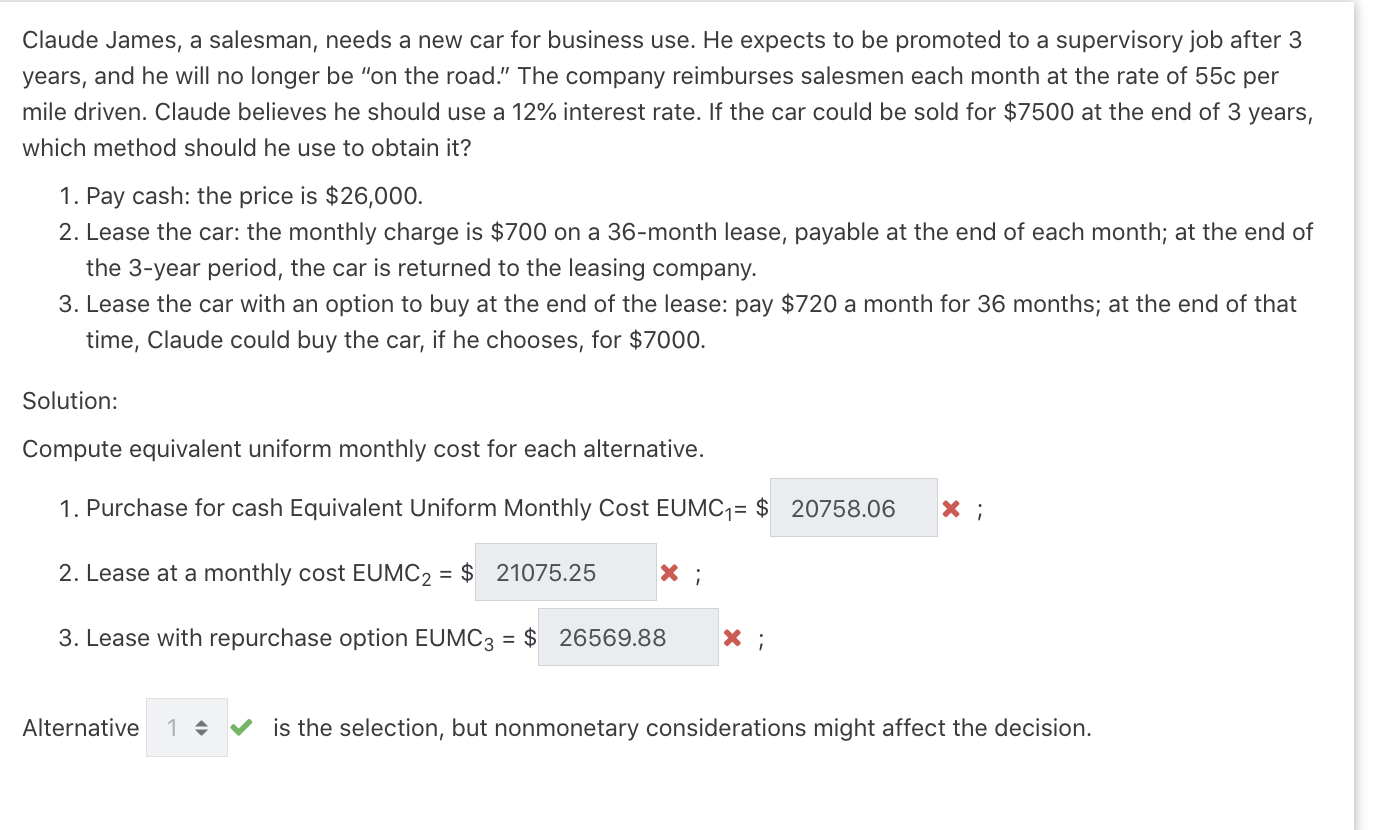

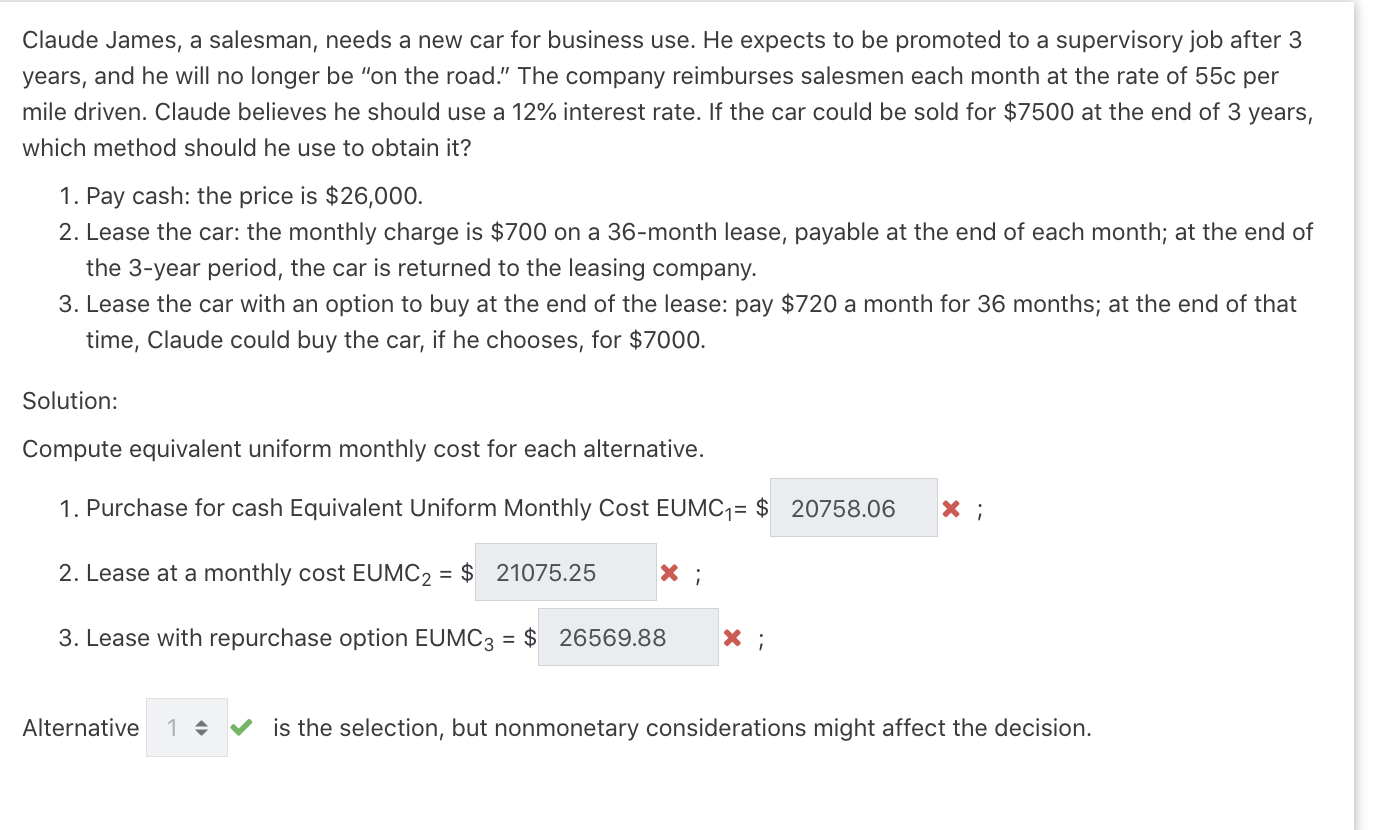

Claude James, a salesman, needs a new car for business use. He expects to be promoted to a supervisory job after 3 years, and he will no longer be "on the road." The company reimburses salesmen each month at the rate of 55c per mile driven. Claude believes he should use a 12% interest rate. If the car could be sold for $7500 at the end of 3 years, which method should he use to obtain it? 1. Pay cash: the price is $26,000. 2. Lease the car: the monthly charge is $700 on a 36-month lease, payable at the end of each month; at the end of the 3-year period, the car is returned to the leasing company. 3. Lease the car with an option to buy at the end of the lease: pay $720 a month for 36 months; at the end of that time, Claude could buy the car, if he chooses, for $7000. Solution: Compute equivalent uniform monthly cost for each alternative. 1. Purchase for cash Equivalent Uniform Monthly Cost EUMC1= $ 20758.06 X; 2. Lease at a monthly cost EUMC2 = $ 21075.25 = X i 3. Lease with repurchase option EUMC3 = $ 26569.88 X; Alternative 1 is the selection, but nonmonetary considerations might affect the decision. Claude James, a salesman, needs a new car for business use. He expects to be promoted to a supervisory job after 3 years, and he will no longer be "on the road." The company reimburses salesmen each month at the rate of 55c per mile driven. Claude believes he should use a 12% interest rate. If the car could be sold for $7500 at the end of 3 years, which method should he use to obtain it? 1. Pay cash: the price is $26,000. 2. Lease the car: the monthly charge is $700 on a 36-month lease, payable at the end of each month; at the end of the 3-year period, the car is returned to the leasing company. 3. Lease the car with an option to buy at the end of the lease: pay $720 a month for 36 months; at the end of that time, Claude could buy the car, if he chooses, for $7000. Solution: Compute equivalent uniform monthly cost for each alternative. 1. Purchase for cash Equivalent Uniform Monthly Cost EUMC1= $ 20758.06 X; 2. Lease at a monthly cost EUMC2 = $ 21075.25 = X i 3. Lease with repurchase option EUMC3 = $ 26569.88 X; Alternative 1 is the selection, but nonmonetary considerations might affect the decision