Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Claus and Company Inc, is gearing up for the holiday season. The following transactions and events have occurred: Dec. 1 - Borrowed $12,000 from the

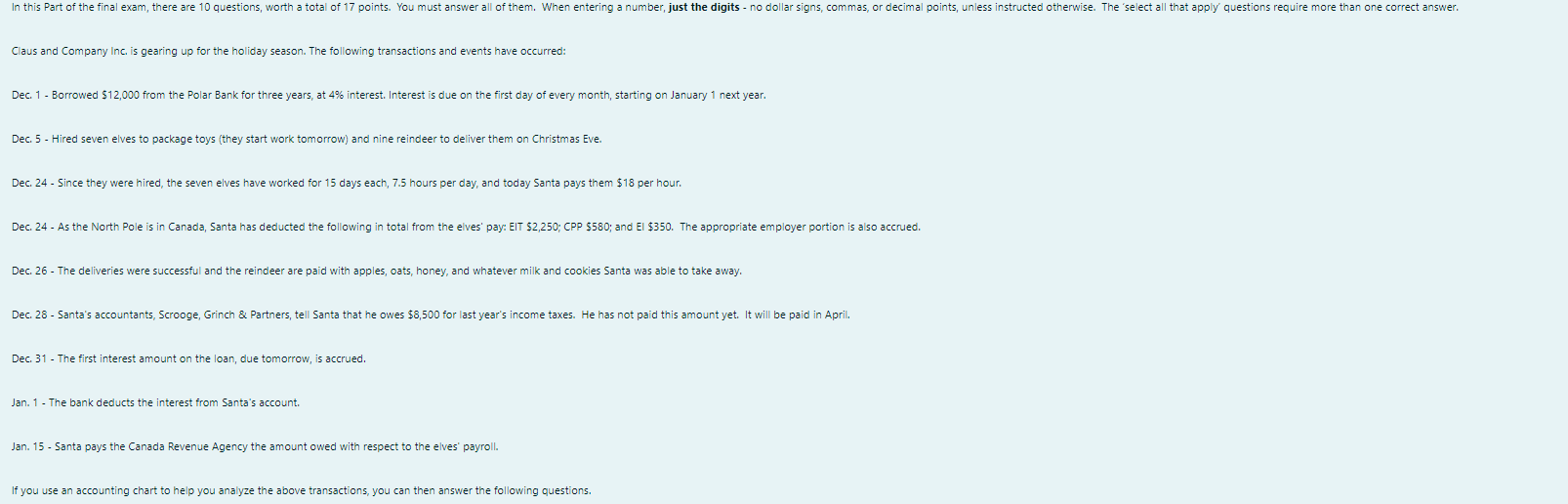

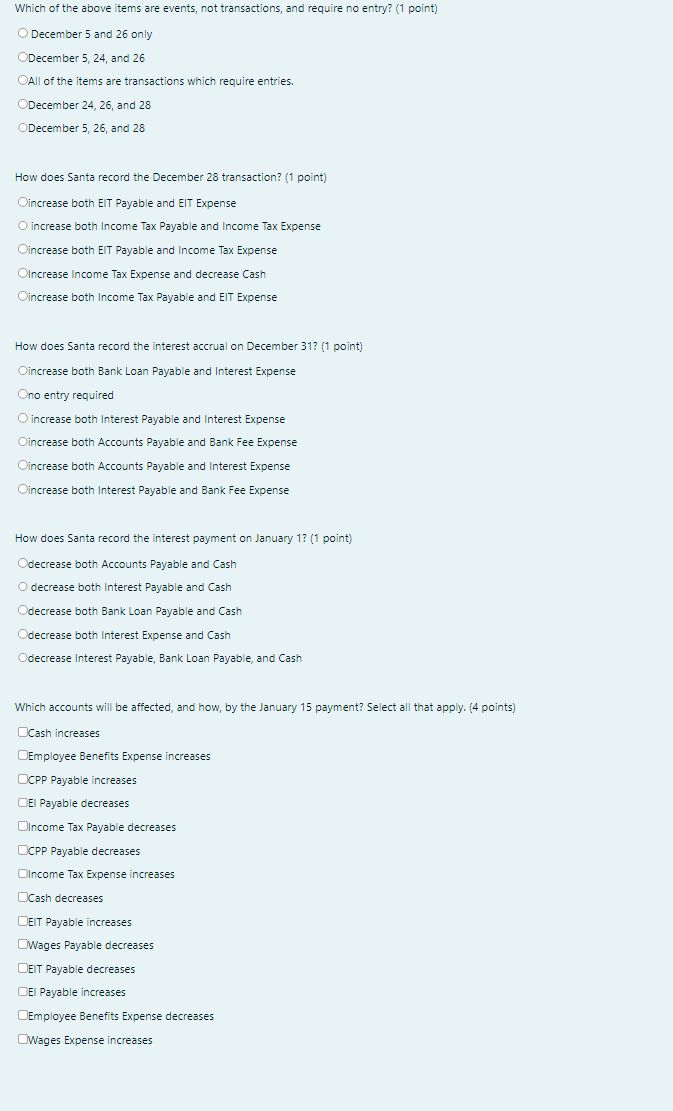

Claus and Company Inc, is gearing up for the holiday season. The following transactions and events have occurred: Dec. 1 - Borrowed \$12,000 from the Polar Bank for three years, at 4\% interest. Interest is due on the first day of every month, starting on January 1 next year. Dec. 5 - Hired seven elves to package toys (they start work tomorrow) and nine reindeer to deliver them on Christmas Eve. Dec. 24 - Since they were hired, the seven elves have worked for 15 days each, 7.5 hours per day, and today Santa pays them \$18 per hour. Dec. 24 - As the North Pole is in Canada, Santa has deducted the following in total from the elves' pay: EIT \$2,250; CPP \$580; and El \$350. The appropriate employer portion is also accrued. Dec. 26 - The deliveries were successful and the reindeer are paid with apples, oats, honey, and whatever milk and cookies Santa was able to take away. Dec. 28 - Santa's accountants, Scrooge, Grinch \& Partners, tell Santa that he owes $8,500 for last year's income taxes. He has not paid this amount yet. It will be paid in April. Dec. 31 - The first interest amount on the loan, due tomorrow, is accrued. Jan. 1 - The bank deducts the interest from Santa's account. Jan. 15 - Santa pays the Canada Revenue Agency the amount owed with respect to the elves' payroll. If you use an accounting chart to help you analyze the above transactions, you can then answer the following questions. Which of the above items are events, not transactions, and require no entry? ( 1 point) December 5 and 26 only December 5, 24, and 26 All of the items are transactions which require entries. December 24,26 , and 28 December 5,26 , and 28 How does Santa record the December 28 transaction? (1 point) increase both EIT Payable and EIT Expense increase both Income Tax Payable and Income Tax Expense increase both EIT Payable and Income Tax Expense Increase Income Tax Expense and decrease Cash increase both Income Tax Payable and EIT Expense How does Santa record the interest accrual on December 31? (1 point) increase both Bank Loan Payable and Interest Expense no entry required increase both Interest Payable and Interest Expense ncrease both Accounts Payable and Bank Fee Expense increase both Accounts Payable and Interest Expense increase both Interest Payable and Bank Fee Expense How does Santa record the interest payment on January 1? (1 point) decrease both Accounts Payable and Cash decrease both Interest Payable and Cash decrease both Bank Loan Payable and Cash decrease both Interest Expense and Cash decrease Interest Payable, Bank Loan Payable, and Cash Which accounts will be affected, and how, by the January 15 payment? Select all that apply. (4 points) Cash increases Employee Benefits Expense increases IPP Payable increases :I Payable decreases Income Tax Payable decreases CPP Payable decreases Income Tax Expense increases Cash decreases EIT Payable increases Wages Payable decreases IIT Payable decreases Il Payable increases Employee Benefits Expense decreases Wages Expense increases

Claus and Company Inc, is gearing up for the holiday season. The following transactions and events have occurred: Dec. 1 - Borrowed \$12,000 from the Polar Bank for three years, at 4\% interest. Interest is due on the first day of every month, starting on January 1 next year. Dec. 5 - Hired seven elves to package toys (they start work tomorrow) and nine reindeer to deliver them on Christmas Eve. Dec. 24 - Since they were hired, the seven elves have worked for 15 days each, 7.5 hours per day, and today Santa pays them \$18 per hour. Dec. 24 - As the North Pole is in Canada, Santa has deducted the following in total from the elves' pay: EIT \$2,250; CPP \$580; and El \$350. The appropriate employer portion is also accrued. Dec. 26 - The deliveries were successful and the reindeer are paid with apples, oats, honey, and whatever milk and cookies Santa was able to take away. Dec. 28 - Santa's accountants, Scrooge, Grinch \& Partners, tell Santa that he owes $8,500 for last year's income taxes. He has not paid this amount yet. It will be paid in April. Dec. 31 - The first interest amount on the loan, due tomorrow, is accrued. Jan. 1 - The bank deducts the interest from Santa's account. Jan. 15 - Santa pays the Canada Revenue Agency the amount owed with respect to the elves' payroll. If you use an accounting chart to help you analyze the above transactions, you can then answer the following questions. Which of the above items are events, not transactions, and require no entry? ( 1 point) December 5 and 26 only December 5, 24, and 26 All of the items are transactions which require entries. December 24,26 , and 28 December 5,26 , and 28 How does Santa record the December 28 transaction? (1 point) increase both EIT Payable and EIT Expense increase both Income Tax Payable and Income Tax Expense increase both EIT Payable and Income Tax Expense Increase Income Tax Expense and decrease Cash increase both Income Tax Payable and EIT Expense How does Santa record the interest accrual on December 31? (1 point) increase both Bank Loan Payable and Interest Expense no entry required increase both Interest Payable and Interest Expense ncrease both Accounts Payable and Bank Fee Expense increase both Accounts Payable and Interest Expense increase both Interest Payable and Bank Fee Expense How does Santa record the interest payment on January 1? (1 point) decrease both Accounts Payable and Cash decrease both Interest Payable and Cash decrease both Bank Loan Payable and Cash decrease both Interest Expense and Cash decrease Interest Payable, Bank Loan Payable, and Cash Which accounts will be affected, and how, by the January 15 payment? Select all that apply. (4 points) Cash increases Employee Benefits Expense increases IPP Payable increases :I Payable decreases Income Tax Payable decreases CPP Payable decreases Income Tax Expense increases Cash decreases EIT Payable increases Wages Payable decreases IIT Payable decreases Il Payable increases Employee Benefits Expense decreases Wages Expense increases Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started