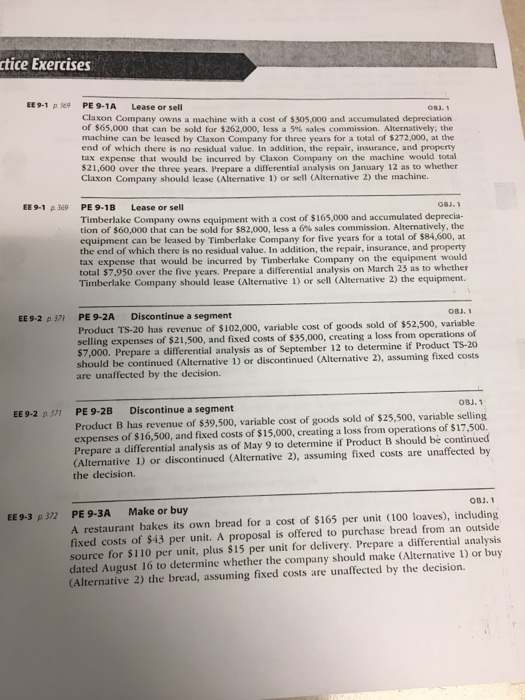

Claxon Company owns a machine with a cost of $305,000 and accumulated depreciation of $65,000 that can be sold for $262,000, less a 5% sales commission. Alternatively, the machine can be leased by Claxon Company for three years for a total of $272,000, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Claxon Company on the machine would total tax $21, 600 over the three years. Prepare a differential analysis on 12 as to whether Claxon Company should lease (Alternative 1) or sell (Alternative 2) the machine. Timberlake Company owns equipment with a cost of s165,000 and accumulated depreciation $60,000 that can be sold for $82,000, less 6% sales commission. Alternatively, the equipment can be leased by Timberlake Company for five years for a total of $84, 600, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Timberlake Company on the equipment would total $7, 950 over the five years. Prepare a differential analysis on March 23 as to whether Timberlake Company should lease (Alternative 1) or sell (Alternative 2) the equipment. Product TS-20 has revenue of $102,000, variable cost of goods sold of $52, 500, variable selling expenses of $21, 500, and fixed costs of $35,000, creating a loss from operations of $7,000. Prepare a differential analysis as of September 12 to determine if Product TS-20 should be continued (Alternative 1) or discontinued (Alternative 2), assuming fixed costs are unaffected by the decision Product B has revenue of $39, 500, variable cost of goods $25, 500, variable selling expenses of $16, 500, and fixed costs of $15,000, creating a loss from operations of $17, 500. Prepare a differential analysis as of May 9 to determine if Product B should be continued (Alternative 1) or discontinued (Alternative 2), assuming fixed costs are unaffected by the decision. A restaurant bakes its own bread for a cost of $165 per unit (100 loaves), including fixed costs of $43 per unit. A proposal is offered to purchase bread from an outside source for $110 per unit, plus $15 per unit for delivery. Prepare a differential analysis dated August 16 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the bread, assuming fixed costs are unaffected by the decision