Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Clayton contributes land to the American Red Cross for use as a future site for a new building. His AGI is $50, 000. Clayton paid

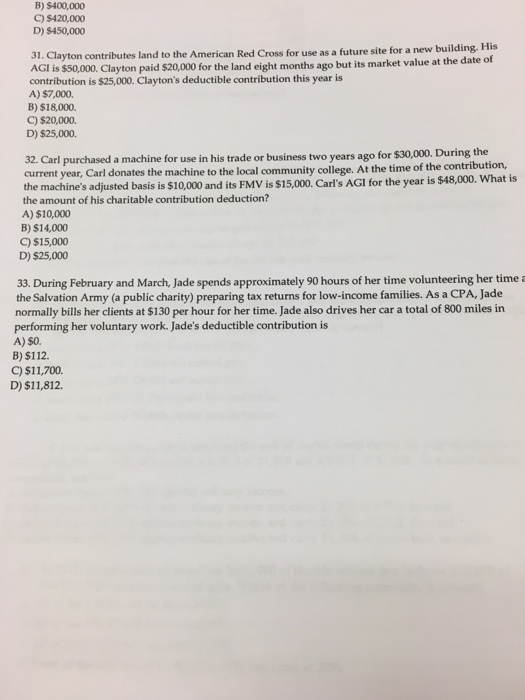

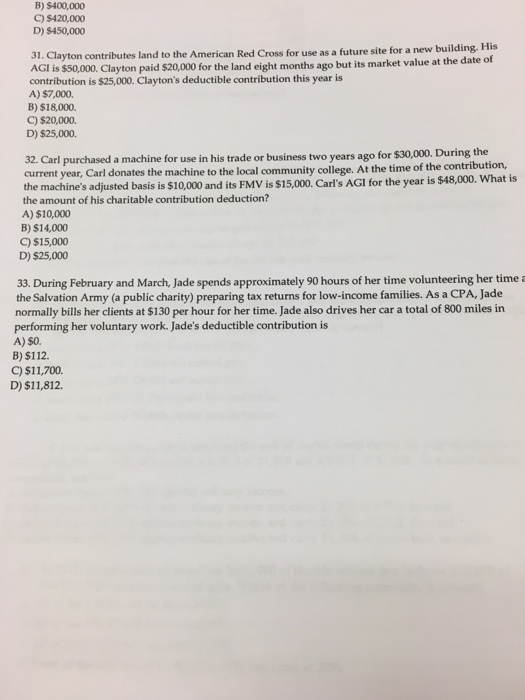

Clayton contributes land to the American Red Cross for use as a future site for a new building. His AGI is $50, 000. Clayton paid $20, 000 for the land eight months ago but its market value at the date of contribution is $25, 000. Clayton's deductible contribution this year is $7, 000. $18, 000. $20, 000. $25, 000. Carl purchased a machine for use in his trade or business two years ago for $30, 000. During the current year, Carl donates the machine to the local community college. At the time of the contribution, the machine s adjusted basis is $10, 000 and its FMV is $15, 000. Call s AGI for the year is $48, 000. What is the amount of his charitable contribution deduction? $10, 000 $14, 000 $15, 000 $25, 000 During February and March, Jade spends approximately 90 hours of her time volunteering her time the Salvation Army (a public charity) preparing tax returns for low-income families. As a CPA, Jade normally bills her clients at $130 per hour for her time. Jade also drives her car a total of 800 miles in performing her voluntary work. Jade's deductible contribution is $0. $112. $11, 700. $11, 812

Clayton contributes land to the American Red Cross for use as a future site for a new building. His AGI is $50, 000. Clayton paid $20, 000 for the land eight months ago but its market value at the date of contribution is $25, 000. Clayton's deductible contribution this year is $7, 000. $18, 000. $20, 000. $25, 000. Carl purchased a machine for use in his trade or business two years ago for $30, 000. During the current year, Carl donates the machine to the local community college. At the time of the contribution, the machine s adjusted basis is $10, 000 and its FMV is $15, 000. Call s AGI for the year is $48, 000. What is the amount of his charitable contribution deduction? $10, 000 $14, 000 $15, 000 $25, 000 During February and March, Jade spends approximately 90 hours of her time volunteering her time the Salvation Army (a public charity) preparing tax returns for low-income families. As a CPA, Jade normally bills her clients at $130 per hour for her time. Jade also drives her car a total of 800 miles in performing her voluntary work. Jade's deductible contribution is $0. $112. $11, 700. $11, 812

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started