Question

Clean Aire Anti-Pollution Company is suffering declining sales of its principal product, non-biodegradable plastic cartons. The president, Wade Truman, instructs his controller, Kate Rollins, to

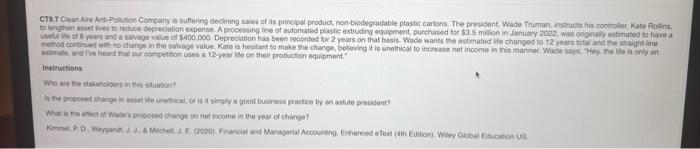

Clean Aire Anti-Pollution Company is suffering declining sales of its principal product, non-biodegradable plastic cartons. The president, Wade Truman, instructs his controller, Kate Rollins, to lengthen asset lives to reduce depreciation expense. A processing line of automated plastic extruding equipment, purchased for $3.5 million in January 2022, was originally estimated to have a useful life of 8 years and a salvage value of $400,000. Depreciation has been recorded for 2 years on that basis. Wade wants the estimated life changed to 12 years total and the straight-line method continued with no change in the salvage value. Kate is hesitant to make the change, believing it is unethical to increase net income in this manner. Wade says, Hey, the life is only an estimate, and Ive heard that our competition uses a 12-year life on their production equipment.

Instructions

Who are the stakeholders in this situation?

Is the proposed change in asset life unethical, or is it simply a good business practice by an astute president?

What is the effect of Wades proposed change on net income in the year of change?

Kimmel, P. D., Weygandt, J. J., & Mitchell, J. E. (2020). Financial and Managerial Accounting, Enhanced eText (4th Edition). Wiley Global Education US.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started