clean surplus dividend (lo3 cfa 9) Use the imformation from the previous problem 27, 28, 29 and calculate the stock price with the clean surplus dividend. Do you get the same stock price as in the previous problem? Why or Why not

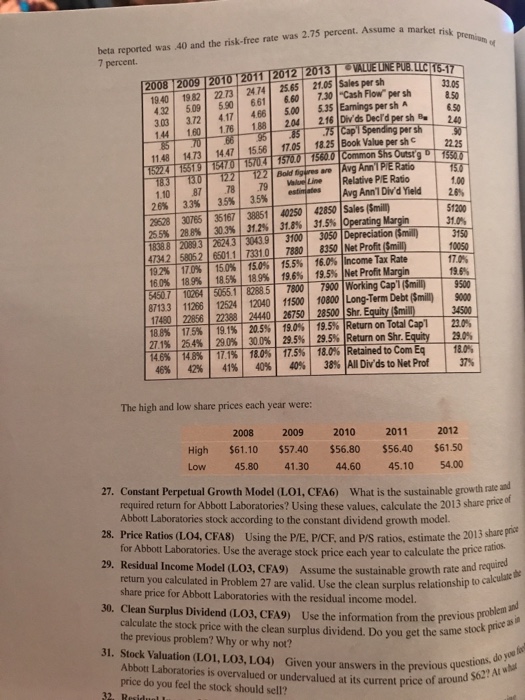

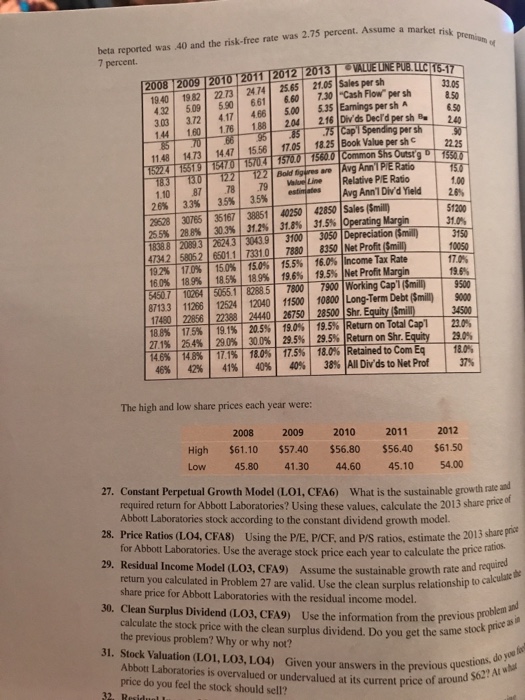

beta reported was 40 and the risk-free rate was 2.75 percent. Assume a market n percent. 1940 | 1982 2273 2474| 25.65 | 21.05|Sales per sh 432| 509| 5.901 661 6.60 | 1301-cash Flow" per sh 303 3.721 417| 466| 5.00 | 5.35 |Earnings per shA 144| 160| 176 1881204|216|Divds Decrd per sh (S0 2225 | 351 CapT Spending persh 11.48 1473 14.47 15.56 17.05 18.25 Book Value per sh c Shs Line Relative PIE Ratio Avg Ann! Divd Yield | 26% | 3.3% 3.5% | 3.5%| esti- 28% 262 30765 35167 38851 40250 | 42850 |Sales($min) 255% | 288% | 30.3% | 31.2%| 31.8% | 31,5%Operating Margin 1838.8t20893 26243 30439-3100-3050 IDepreciation(Smil 47342 58052 6501.1 73310 7880 8350 Net Profit (Smil 192%T 170%|15.0% | 15.0% | 15.5% | 16.0% |Income Tax Rate 160% | 189% | 185% | 189% | 19.6% | 19.5%|Net Profit Margin | 1 54507 10264 5055.182885 800 7900 Working Cap1(Smil500 87133 11266 12524 12040 11500 10800 Long-Term Debt (Smil s000 17480 22856 22388 24440 26750 28500 Shr. Equity (Smill 18.8%-175% 119.1%-20.5%|-19.0 19.5%|Return on Total Capi n0% 271% | 254% | 290% | 300% | 29,5% | 29,5% Return on Shr TEN 145% 17.1% 18.0% 1T5% 18.0%|Retained to Com 46% | 42% | 41%| 40%| 40%| 38%|AllDivds to Net Prof The high and low share prices each year were: High $61.10 $57.40 $56.80 $56.40 $61.50 Low 45.80 41.30 44.60 45.10 54.00 27. Constant Perpetual Growth Model (LO1, CFA6) What is the sustainable growth rate u 28. Price Ratios (L04, CFAS) Using the P/E, P/CF, and P/S ratios, estimate the 2013 share proir 29. Residual Income Model (L.O3, CFA9) Assume the sustainable growth 30. Clean Surplus Dividend (L.03, CFA9) Use the information from the previous at rice a 31. Stock Valuation (L.O1, LO3, LO4) Given your answers in the previous ques22 w required return for Abbott Laboratories? Using these values, calculate the 2013 share pice Abbott Laboratories stock according to the constant dividend growth model. for Abbott Laboratories. Use the average stock price each year to calculate the price rathos. return you calculated in Problem 27 are valid. Use the clean surplus relationship to cal rate and require! share price for Abbott Laboratories with the residual income model. calculate the stock price with the clean surplus dividend. Do you get the same sto the previous problem? Why or why not? Abbott Laboratories is overvalued or undervalued at its current price of arou price do you feel the stock should sell? beta reported was 40 and the risk-free rate was 2.75 percent. Assume a market n percent. 1940 | 1982 2273 2474| 25.65 | 21.05|Sales per sh 432| 509| 5.901 661 6.60 | 1301-cash Flow" per sh 303 3.721 417| 466| 5.00 | 5.35 |Earnings per shA 144| 160| 176 1881204|216|Divds Decrd per sh (S0 2225 | 351 CapT Spending persh 11.48 1473 14.47 15.56 17.05 18.25 Book Value per sh c Shs Line Relative PIE Ratio Avg Ann! Divd Yield | 26% | 3.3% 3.5% | 3.5%| esti- 28% 262 30765 35167 38851 40250 | 42850 |Sales($min) 255% | 288% | 30.3% | 31.2%| 31.8% | 31,5%Operating Margin 1838.8t20893 26243 30439-3100-3050 IDepreciation(Smil 47342 58052 6501.1 73310 7880 8350 Net Profit (Smil 192%T 170%|15.0% | 15.0% | 15.5% | 16.0% |Income Tax Rate 160% | 189% | 185% | 189% | 19.6% | 19.5%|Net Profit Margin | 1 54507 10264 5055.182885 800 7900 Working Cap1(Smil500 87133 11266 12524 12040 11500 10800 Long-Term Debt (Smil s000 17480 22856 22388 24440 26750 28500 Shr. Equity (Smill 18.8%-175% 119.1%-20.5%|-19.0 19.5%|Return on Total Capi n0% 271% | 254% | 290% | 300% | 29,5% | 29,5% Return on Shr TEN 145% 17.1% 18.0% 1T5% 18.0%|Retained to Com 46% | 42% | 41%| 40%| 40%| 38%|AllDivds to Net Prof The high and low share prices each year were: High $61.10 $57.40 $56.80 $56.40 $61.50 Low 45.80 41.30 44.60 45.10 54.00 27. Constant Perpetual Growth Model (LO1, CFA6) What is the sustainable growth rate u 28. Price Ratios (L04, CFAS) Using the P/E, P/CF, and P/S ratios, estimate the 2013 share proir 29. Residual Income Model (L.O3, CFA9) Assume the sustainable growth 30. Clean Surplus Dividend (L.03, CFA9) Use the information from the previous at rice a 31. Stock Valuation (L.O1, LO3, LO4) Given your answers in the previous ques22 w required return for Abbott Laboratories? Using these values, calculate the 2013 share pice Abbott Laboratories stock according to the constant dividend growth model. for Abbott Laboratories. Use the average stock price each year to calculate the price rathos. return you calculated in Problem 27 are valid. Use the clean surplus relationship to cal rate and require! share price for Abbott Laboratories with the residual income model. calculate the stock price with the clean surplus dividend. Do you get the same sto the previous problem? Why or why not? Abbott Laboratories is overvalued or undervalued at its current price of arou price do you feel the stock should sell