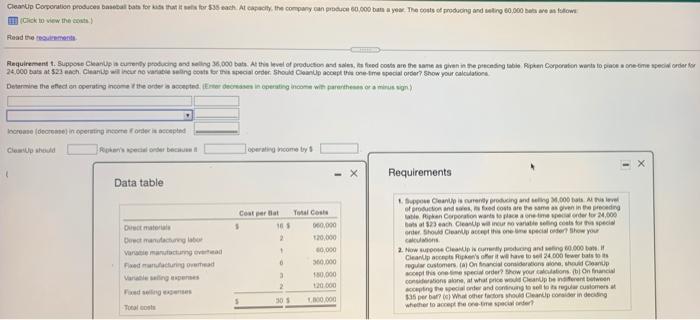

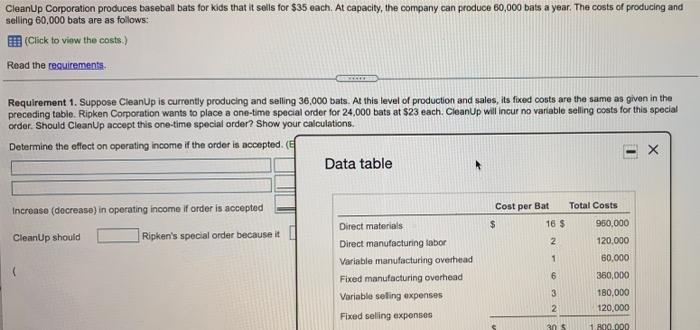

Cleant Corporation produces baseball bata for the late for $95 each. At capacity. The company can produce to,000 buna yow. The cost of producing and intro 60.000 bata re som Read the 24.000 bus at $23 nach Clean who are in coats or recorder. Should CleanUp ce e me special Order Show your calculation Requirement 1. Suppose Clean Up in camering and in 38,000 bats. At the level of production and to feed conta are the same as given in the preceding pee Corporation wants to piece one-time special order for Determine the effect on operating income the ordered, Eerders in operating income with or assign) Promo (decrease) in operating room onder is accepted CleanUp she Rederbeu operating come byt Requirements Data table Coat rnt 1 2 + Det Direct mandag Varenunga Pengad Varbergspers Total Cost 900,000 20.000 0.000 560.000 150,000 Suppo Canis lyring and saling M.000 e orion and fed costs are the same as in the dig Rian Corporation wants to anime de for.000 Bootcath Cleanuprovato costo der Shoe Clantone per Show you cond 2. Now Claire dans 0.00 Clean Resort wave to 24.000 fewer balsts guwustomers. On consider the Clip op the one time order? Show your ton bi On franc Conan, at what ice Cleanup beforent between con especial order and coming to low customers $35 per bor What other worden onder in den whether to come perder 0 3 505 100.000 Total costs CleanUp Corporation produces baseball bats for kids that it sells for $35 each. At capacity, the company can produce 60,000 bats a year. The cost of producing and selling 60,000 bats are as follows: Click to view the costs.) Read the requirements Requirement 1. Suppose Cleanup is currently producing and selling 36,000 bats. At this level of production and sales, its fixed costs are the same as given in the preceding table. Ripken Corporation wants to place a one-time special order for 24,000 bats at $23 each. CleanUp will incur no variable selling costs for this special order. Should CleanUp accept this one-time special order? Show your calculations Determine the effect on operating income if the order is accepted. EX Data table Increase (decrease) in operating income if order is accepted Cost per Bat Total Costs $ 16 $ 950,000 2. 120.000 CleanUp should Ripken's special order because it ! 1 Direct materials Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Variable seling expenses Fixed selling expenses 6 60,000 360,000 180,000 120,000 NGO 2 30 S 1.800.000