clear a,b,c,d,e. thanks and urgent

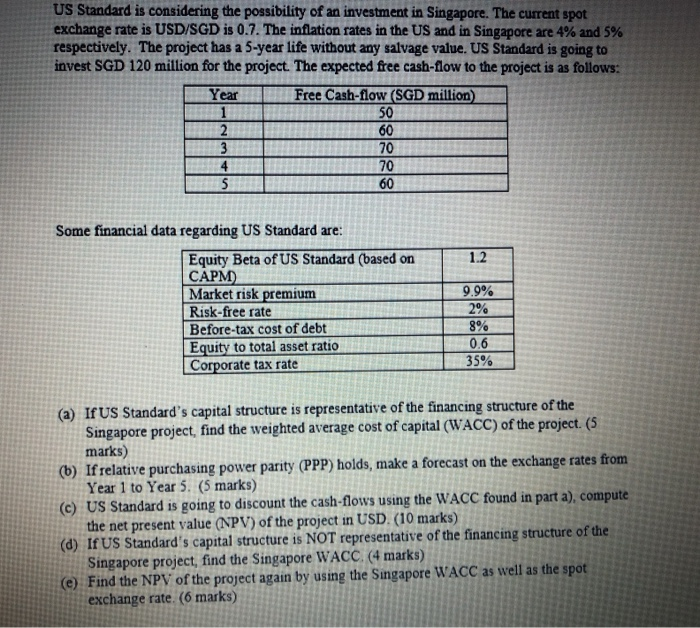

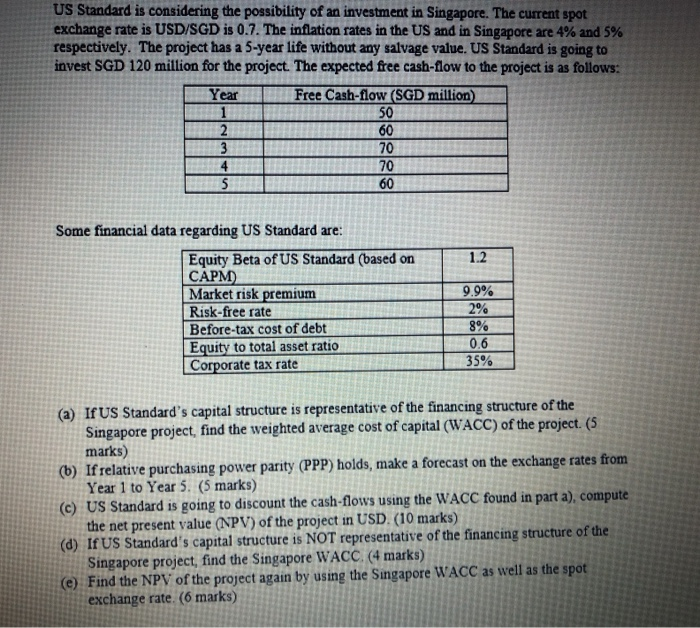

US Standard is considering the possibility of an investment in Singapore. The current spot exchange rate is USD/SGD is 0.7. The inflation rates in the US and in Singapore are 4% and 5% respectively. The project has a 5-year life without any salvage value. US Standard is going to invest SGD 120 million for the project. The expected free cash-flow to the project is as follows: Year Free Cash-flow (SGD million) 1 50 2 60 3 70 4 70 5 60 1.2 Some financial data regarding US Standard are: Equity Beta of US Standard (based on CAPM) Market risk premium Risk-free rate Before-tax cost of debt Equity to total asset ratio Corporate tax rate 9.9% 2% 8% 0.6 35% (a) If US Standard's capital structure is representative of the financing structure of the Singapore project, find the weighted average cost of capital (WACC) of the project. (5 marks) (b) If relative purchasing power parity (PPP) holds, make a forecast on the exchange rates from Year 1 to Year 5. (5 marks) (c) US Standard is going to discount the cash-flows using the WACC found in part a), compute the net present value (NPV) of the project in USD. (10 marks) (d) If US Standard's capital structure is NOT representative of the financing structure of the Singapore project, find the Singapore WACC (4 marks) (e) Find the NPV of the project again by using the Singapore WACC as well as the spot exchange rate. (6 marks) US Standard is considering the possibility of an investment in Singapore. The current spot exchange rate is USD/SGD is 0.7. The inflation rates in the US and in Singapore are 4% and 5% respectively. The project has a 5-year life without any salvage value. US Standard is going to invest SGD 120 million for the project. The expected free cash-flow to the project is as follows: Year Free Cash-flow (SGD million) 1 50 2 60 3 70 4 70 5 60 1.2 Some financial data regarding US Standard are: Equity Beta of US Standard (based on CAPM) Market risk premium Risk-free rate Before-tax cost of debt Equity to total asset ratio Corporate tax rate 9.9% 2% 8% 0.6 35% (a) If US Standard's capital structure is representative of the financing structure of the Singapore project, find the weighted average cost of capital (WACC) of the project. (5 marks) (b) If relative purchasing power parity (PPP) holds, make a forecast on the exchange rates from Year 1 to Year 5. (5 marks) (c) US Standard is going to discount the cash-flows using the WACC found in part a), compute the net present value (NPV) of the project in USD. (10 marks) (d) If US Standard's capital structure is NOT representative of the financing structure of the Singapore project, find the Singapore WACC (4 marks) (e) Find the NPV of the project again by using the Singapore WACC as well as the spot exchange rate. (6 marks)