Answered step by step

Verified Expert Solution

Question

1 Approved Answer

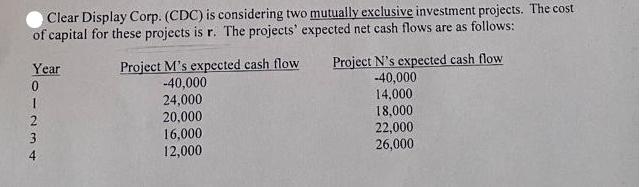

Clear Display Corp. (CDC) is considering two mutually exclusive investment projects. The cost of capital for these projects is r. The projects' expected net

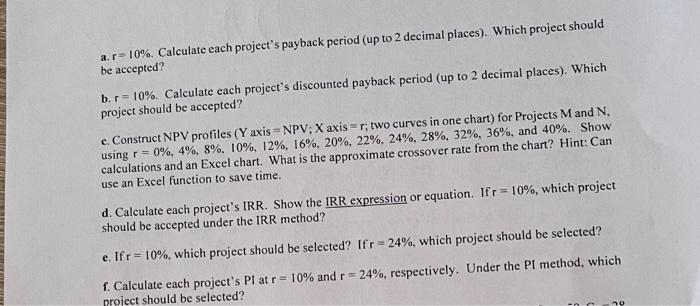

Clear Display Corp. (CDC) is considering two mutually exclusive investment projects. The cost of capital for these projects is r. The projects' expected net cash flows are as follows: Year 123401 Project M's expected cash flow -40,000 24,000 20,000 16,000 12,000 Project N's expected cash flow -40,000 14,000 18,000 22,000 26,000 a.r 10%. Calculate each project's payback period (up to 2 decimal places). Which project should be accepted? b. r= 10%. Calculate each project's discounted payback period (up to 2 decimal places). Which project should be accepted? O c. Construct NPV profiles (Y axis NPV; X axis = r; two curves in one chart) for Projects M and N, using r = 0%, 4%, 8%. 10%, 12%, 16%, 20%, 22%. 24%, 28%, 32%, 36%, and 40%. Show calculations and an Excel chart. What is the approximate crossover rate from the chart? Hint: Can use an Excel function to save time. d. Calculate each project's IRR. Show the IRR expression or equation. If r= 10%, which project should be accepted under the IRR method?. e. If r= 10%, which project should be selected? Ifr 24%, which project should be selected? f. Calculate each project's Pl at r= 10% and r= 24%, respectively. Under the PI method, which project should be selected? - C no

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To solve these calculations lets go through each question step by step a Payback period The payback period is the time it takes for a project to recover its initial investment We sum the net cash flow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started