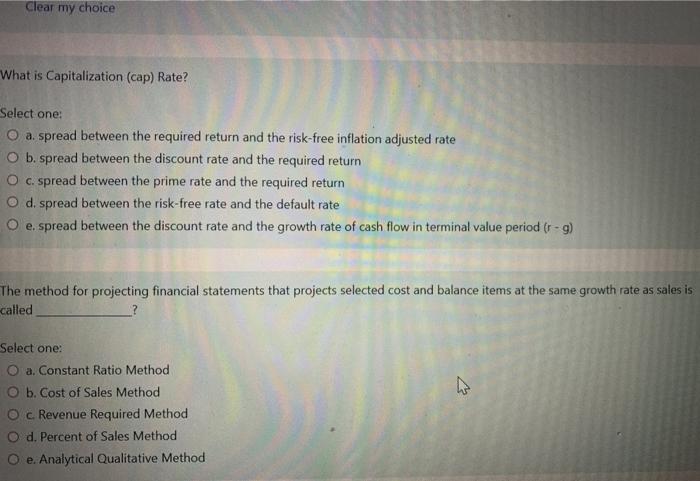

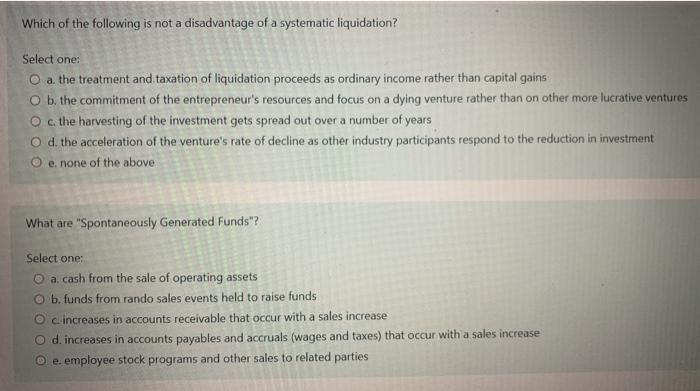

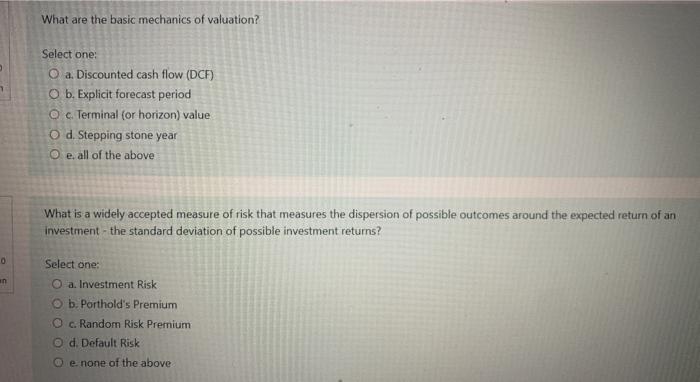

Clear my choice What is Capitalization (cap) Rate? Select one: O a. spread between the required return and the risk-free inflation adjusted rate O b. spread between the discount rate and the required return O c. spread between the prime rate and the required return O d. spread between the risk-free rate and the default rate O e. spread between the discount rate and the growth rate of cash flow in terminal value period (r - g) The method for projecting financial statements that projects selected cost and balance items at the same growth rate as sales is called Select one: a. Constant Ratio Method O b. Cost of Sales Method c Revenue Required Method d. Percent of Sales Method O e Analytical Qualitative Method Which of the following is not a disadvantage of a systematic liquidation? Select one: O a the treatment and taxation of liquidation proceeds as ordinary income rather than capital gains O b. the commitment of the entrepreneur's resources and focus on a dying venture rather than on other more lucrative ventures O c the harvesting of the investment gets spread out over a number of years O d. the acceleration of the venture's rate of decline as other industry participants respond to the reduction in investment O e none of the above What are "Spontaneously Generated Funds"? Select one: O a cash from the sale of operating assets O b. funds from rando sales events held to raise funds O c increases in accounts receivable that occur with a sales increase O d. increases in accounts payables and accruals (wages and taxes) that occur with a sales increase O e employee stock programs and other sales to related parties What are the basic mechanics of valuation? Select one: O a. Discounted cash flow (DCF) O b. Explicit forecast period O c Terminal (or horizon) value O d. Stepping stone year O e, all of the above What is a widely accepted measure of risk that measures the dispersion of possible outcomes around the expected return of an investment - the standard deviation of possible investment returns? 0 Select one: an O a. Investment Risk b. Porthold's Premium O c. Random Risk Premium d. Default Risk e none of the above