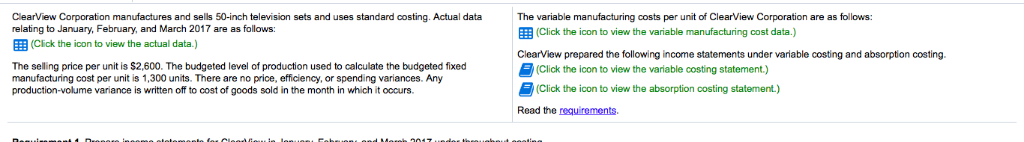

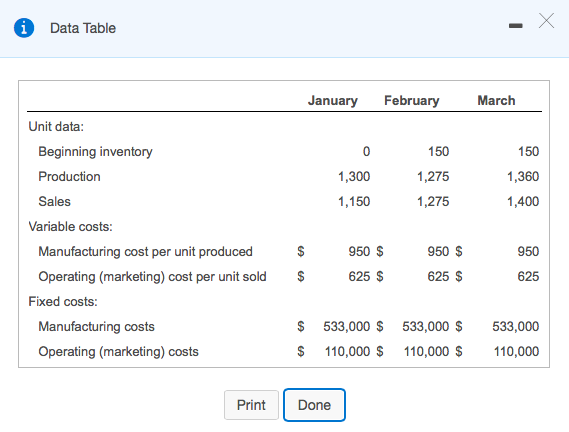

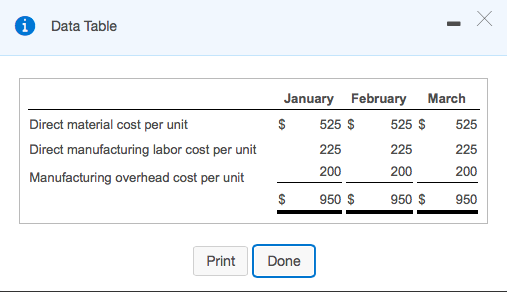

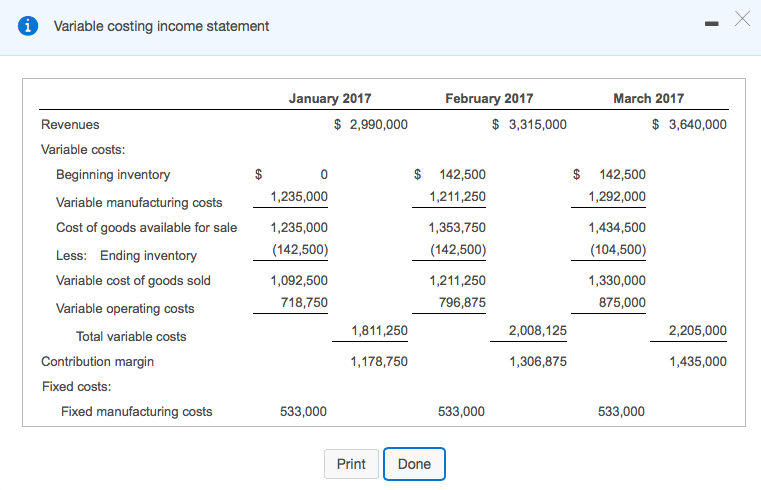

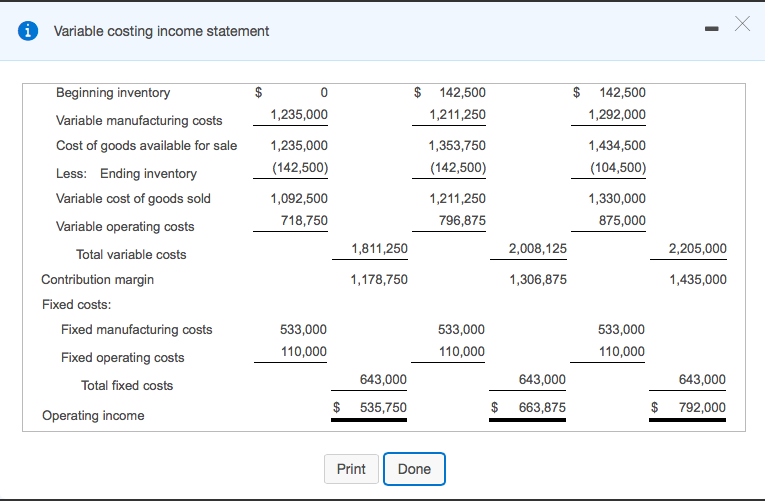

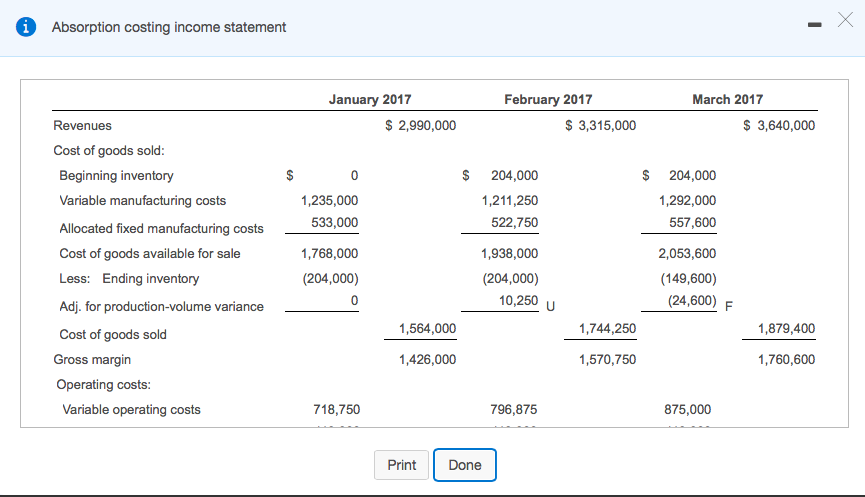

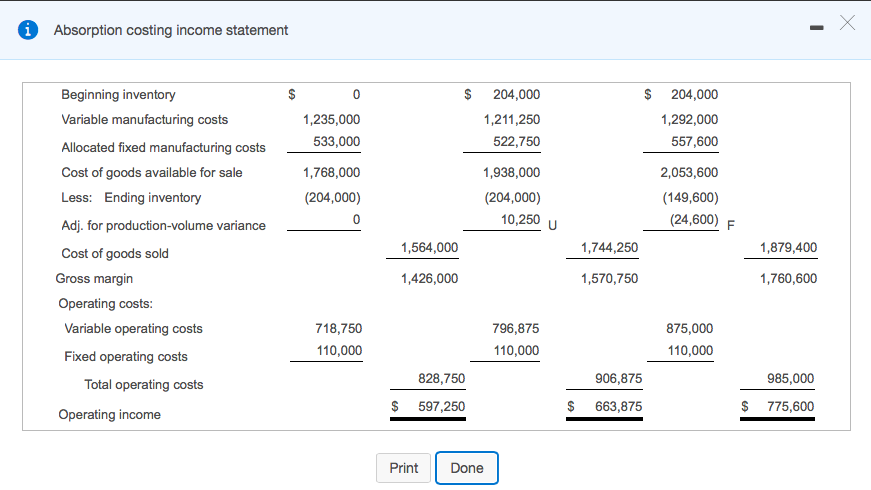

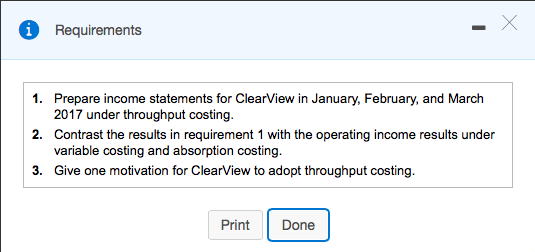

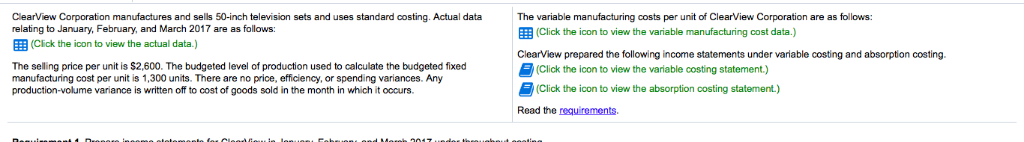

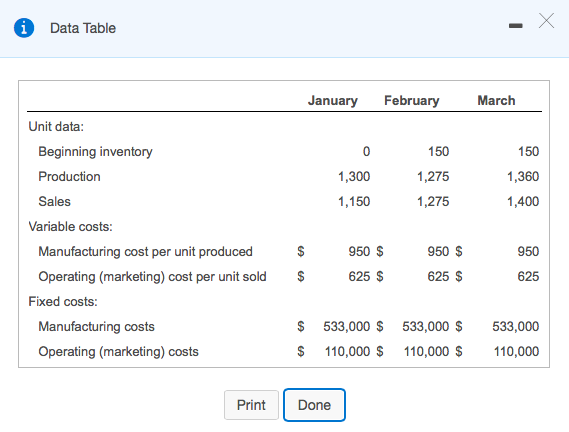

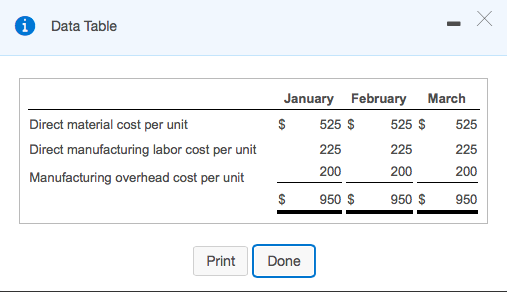

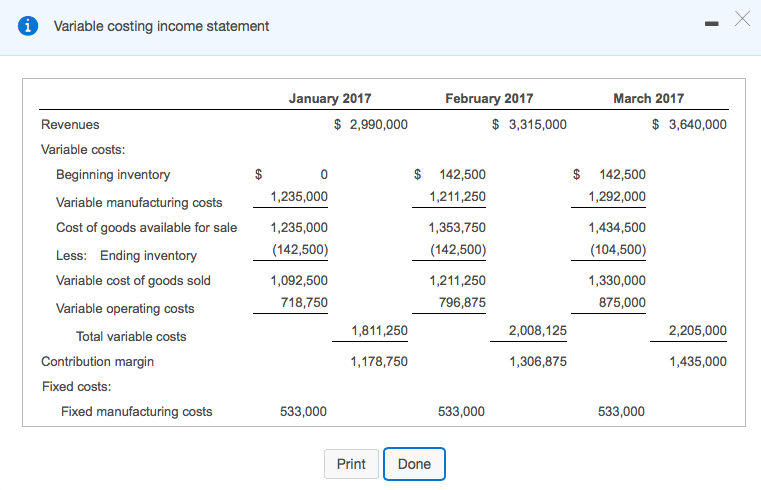

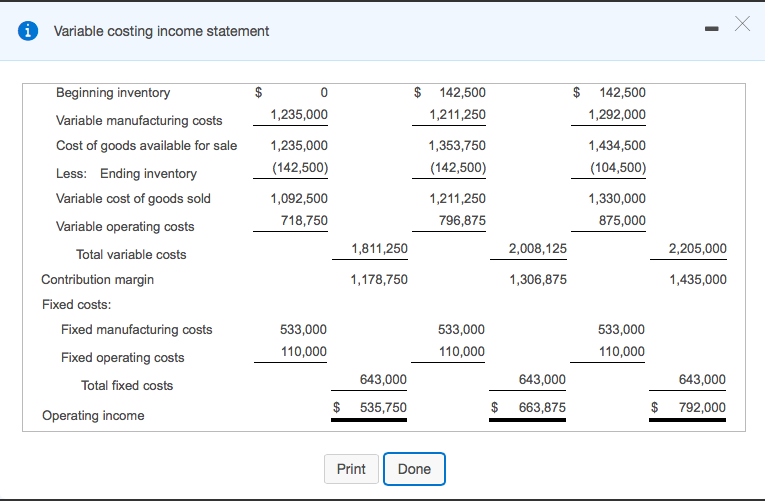

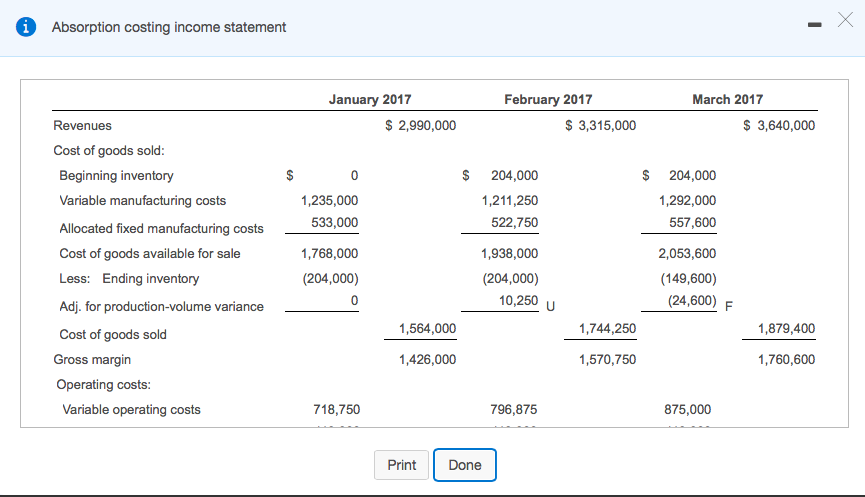

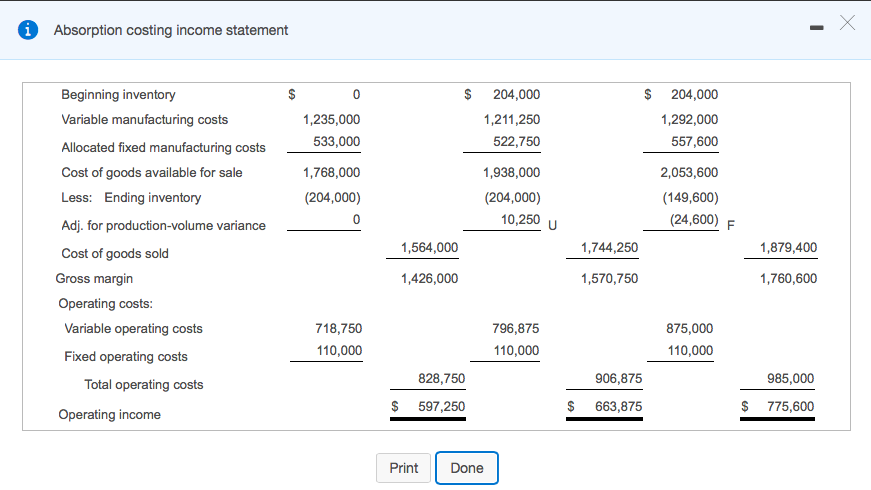

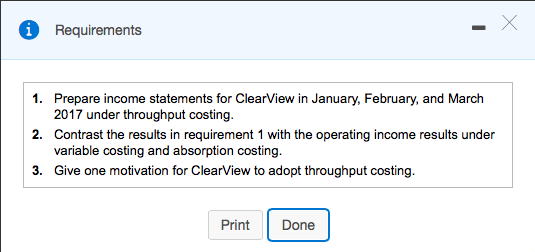

Clear View Corporation manufactures and sells 50-inch television sets and uses standard costing. Actual data relating to January, February, and March 2017 are as follows: (Click the icon to view the actual data.) The variable manufacturing costs per unit of Clear View Corporation are as follows: E: (Click the icon to view the variable manufacturing cost data.) The selling price per unit is $2,600. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 1,300 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs. ClearView prepared the following income statements under variable costing and absorption costing (Click the icon to view the variable costing statement.) (Click the icon to view the absorption costing statement.) Read the requirements. D a ta de la Cabello 047dbou i Data Table January February March Unit data: Beginning inventory 150 Production 0 1,300 1,150 1,275 150 1,360 1,400 Sales 1,275 950 $ 950 $ $ 950 $ 625 $ 625 $ 625 Variable costs: Manufacturing cost per unit produced Operating (marketing) cost per unit sold Fixed costs: Manufacturing costs Operating (marketing) costs $ $ 533,000 $ 110,000 $ 533,000 $ 110,000 $ 533,000 110,000 Print Done A Data Table $ Direct material cost per unit Direct manufacturing labor cost per unit January February March 525 $ 525 $ 525 225 225 225 200 $ 950 $ 950 $ 950 200 Manufacturing overhead cost per unit Print Done ] 0 Variable costing income statement January 2017 February 2017 March 2017 Revenues $ 2,990,000 $ 3,315,000 $ 3,640,000 $ $ $ Variable costs: Beginning inventory Variable manufacturing costs Cost of goods available for sale 142,500 1,211,250 142,500 1,292,000 0 1,235,000 1,235,000 (142,500) 1,353,750 (142,500) 1,434,500 (104,500) Less: Ending inventory Variable cost of goods sold Variable operating costs 1,092,500 718,750 1,211,250 796,875 1,330,000 875,000 Total variable costs 1,811,250 2,008,125 2,205,000 1,178,750 1,306,875 1,435,000 Contribution margin Fixed costs: Fixed manufacturing costs 533,000 533,000 533,000 Print Print Done Done 0 Variable costing income statement $ $ $ Beginning inventory Variable manufacturing costs Cost of goods available for sale 0 1,235,000 1,235 142,500 1,211,250 142,500 1,292,000 1,235,000 (142,500) 1,353,750 (142,500) 1,434,500 (104,500) Less: Ending inventory Variable cost of goods sold 1,092,500 718,750 1,211,250 796,875 1,330,000 875,000 Variable operating costs Total variable costs 1,811,250 2,205,000 2,008,125 1,178,750 1,306,875 1,435,000 Contribution margin Fixed costs: Fixed manufacturing costs 533,000 110,000 533,000 110,000 533,000 110,000 Fixed operating costs Total fixed costs 643,000 643,000 643,000 535,750 $ $ 663,875 $ 792,000 Operating income Print Done 0 Absorption costing income statement January 2017 February 2017 March 2017 Revenues $ 2,990,000 $ 3,315,000 $ 3,640,000 Cost of goods sold: Beginning inventory Variable manufacturing costs $ $ $ 0 1,235,000 533,000 204,000 1,211,250 522,750 204,000 1,292,000 557,600 Allocated fixed manufacturing costs Cost of goods available for sale Less: Ending inventory 1,938,000 1,768,000 (204,000) 2,053,600 (149,600) (204,000) 10,250 u (24,600) F Adj. for production-volume variance 1,564,000 1,744,250 1,879,400 1,426,000 1,570,750 1,760,600 Cost of goods sold Gross margin Operating costs: Variable operating costs 718,750 796,875 875,000 Print | Done ] i Absorption costing income statement AH $ $ $ Beginning inventory Variable manufacturing costs 0 1,235,000 533,000 204,000 1,211,250 522,750 204,000 1,292,000 557,600 Allocated fixed manufacturing costs Cost of goods available for sale Less: Ending inventory 1,768,000 (204,000) 1,938,000 (204,000) 10,250 2,053,600 (149,600) (24,600) F 1,564,000 1,744,250 1,879,400 1,426,000 1,570,750 1,760,600 Adj. for production-volume variance Cost of goods sold Gross margin Operating costs: Variable operating costs Fixed operating costs 718,750 110,000 796,875 110,000 875,000 110,000 Total operating costs 828,750 906,875 985,000 775,600 $ 597,250 $ 663,875 $ Operating income Print Done 0 Requirements 1. Prepare income statements for Clear View in January, February, and March 2017 under throughput costing. 2. Contrast the results in requirement 1 with the operating income results under variable costing and absorption costing. 3. Give one motivation for ClearView to adopt throughput costing. Print Print Done