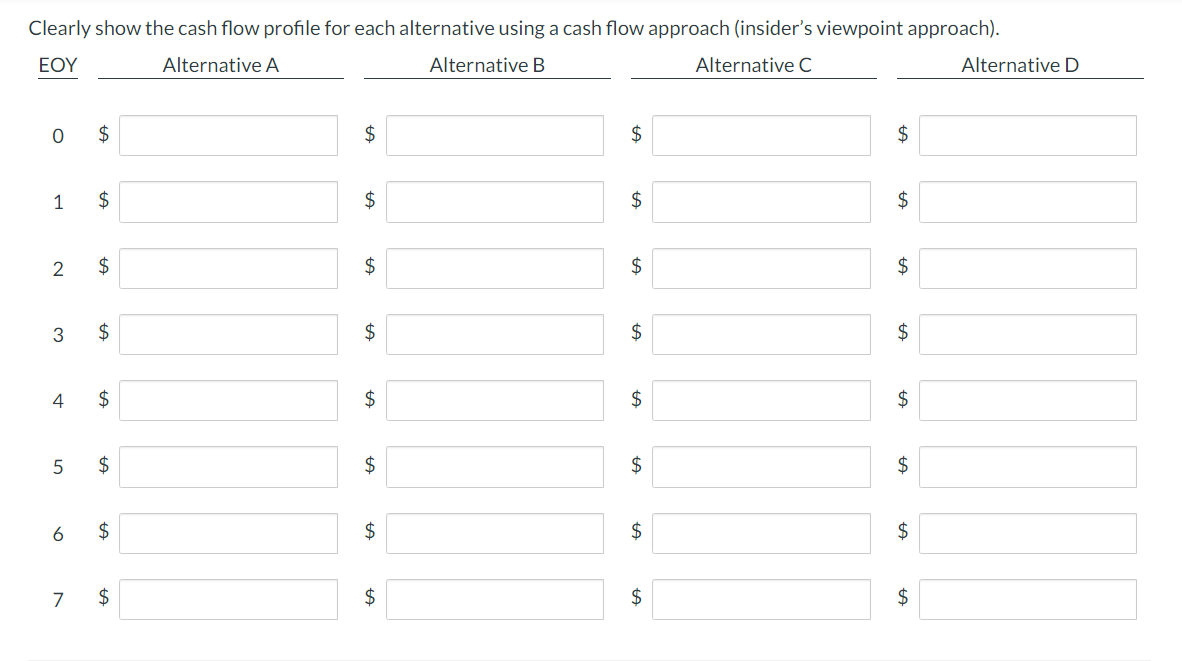

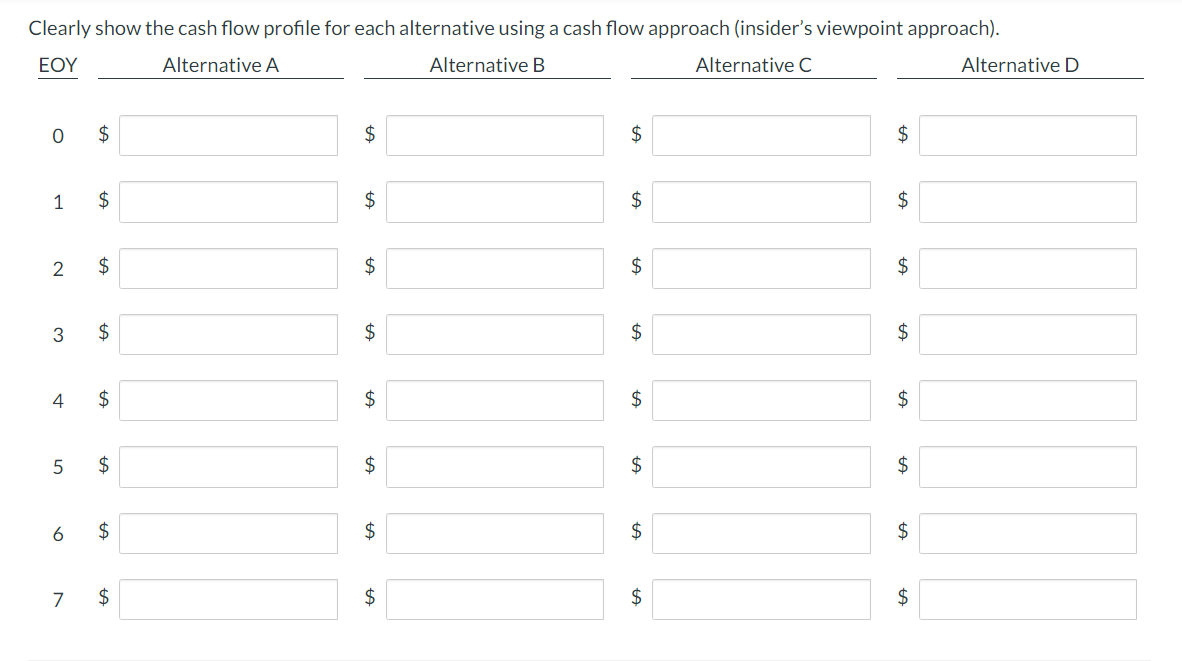

Clear Water Company has a down-hole well auger that was purchased 3 years ago for $30,000. O&M costs are $ 15,500 per year. Alternative A is to keep the existing auger, which has a current market value of $ 12,500. It will have a $0 salvage value after 7 more years. Alternative B is to buy a new auger that will cost $ 55,000 and will have a $ 10,500 salvage value after 7 years. O&M costs are $ 7,000 for the new auger. Clear Water can trade in the existing auger on the new one for $15,000. Alternative C is to trade in the existing auger on a "treated auger" that requires vastly less O&M cost at only $4,250 per year. It costs $ 71,000, and the trade-in allowance for the existing auger is $ 19,000. The "treated auger will have an $18,000 salvage value after 7 years. Alternative D is to sell the existing auger on the open market and to contract with a current competitor to use their equipment and services to perform the drilling that would normally be done with the existing auger. The competitor requires a beginning-of-year retainer payment of $ 9,500. End-of-year O&M cost would be $ 8,500. MARR is 15%, and the planning horizon is 7 years. Clearly show the cash flow profile for each alternative using a cash flow approach (insider's viewpoint approach). EOY Alternative A Alternative B Alternative C Alternative D O $ $ $ $ 1 $ 0+ $ $ $ 2 $ 0+ $ $ $ 3 $ $ $ $ 4 $ $ $ $ 5 $ $ $ $ 6 $ $ $ $ 7 $ $ $ $ Clear Water Company has a down-hole well auger that was purchased 3 years ago for $30,000. O&M costs are $ 15,500 per year. Alternative A is to keep the existing auger, which has a current market value of $ 12,500. It will have a $0 salvage value after 7 more years. Alternative B is to buy a new auger that will cost $ 55,000 and will have a $ 10,500 salvage value after 7 years. O&M costs are $ 7,000 for the new auger. Clear Water can trade in the existing auger on the new one for $15,000. Alternative C is to trade in the existing auger on a "treated auger" that requires vastly less O&M cost at only $4,250 per year. It costs $ 71,000, and the trade-in allowance for the existing auger is $ 19,000. The "treated auger will have an $18,000 salvage value after 7 years. Alternative D is to sell the existing auger on the open market and to contract with a current competitor to use their equipment and services to perform the drilling that would normally be done with the existing auger. The competitor requires a beginning-of-year retainer payment of $ 9,500. End-of-year O&M cost would be $ 8,500. MARR is 15%, and the planning horizon is 7 years. Clearly show the cash flow profile for each alternative using a cash flow approach (insider's viewpoint approach). EOY Alternative A Alternative B Alternative C Alternative D O $ $ $ $ 1 $ 0+ $ $ $ 2 $ 0+ $ $ $ 3 $ $ $ $ 4 $ $ $ $ 5 $ $ $ $ 6 $ $ $ $ 7 $ $ $ $