Question

Solve to get FV of $960 using TVM SOLVER on calculator. To illustrate, take one more look at our 7.5%, 15-year bond. This time, lets

Solve to get FV of $960 using TVM SOLVER on calculator.

To illustrate, take one more look at our 7.5%, 15-year bond. This time, lets assume that you feel the price of the bond, which is now trading at a discount, will rise sharply as interest rates fall over the next few years. In particular, assume the bond is currently priced at $809.50 (to yield 10%) and you anticipate holding the bond for three years.

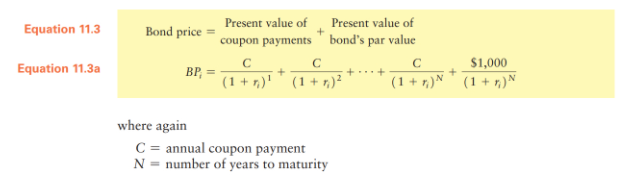

Over that time, you expect market rates to drop to 8%. With that assumption in place, and recognizing that three years from now the bond will have 12 remaining coupon payments, you can use Equation 11.3 (inserted below) to estimate that the bonds price will be approximately $960 in three years. Thus, you are assuming that you will buy the bond today at a market price of $809.50 and sell it three years laterafter interest rates have declined to 8%at a price of $960. Given these assumptions, the expected return (realized yield) on this bond is 14.6%, which is the discount rate in the following equation that will produce a current market price of $809.50.

Equation 11.3:

This is part of my textbook reading. I understand everything so far, but could someone please explain what numbers they inserted into the TVM solver to get the present value of $960?

Please include what was put in for N, I%, FV, PMT, and PV.

Thank you!

Equation 11.3 Bond price Present value of Present value of + coupon payments bond's par value + + ... + (1 + 1) (1 + r)? (1 + r) Equation 11.3a BP $1,000 (1 + r) where again C = annual coupon payment N = number of years to maturityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started