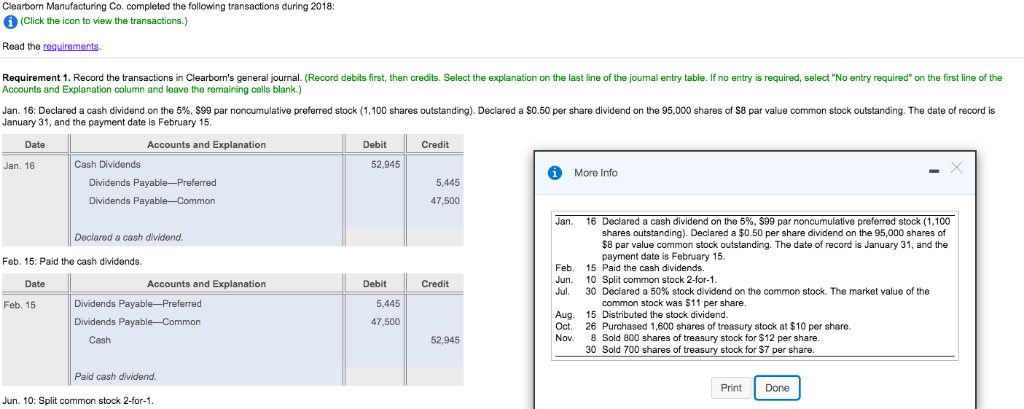

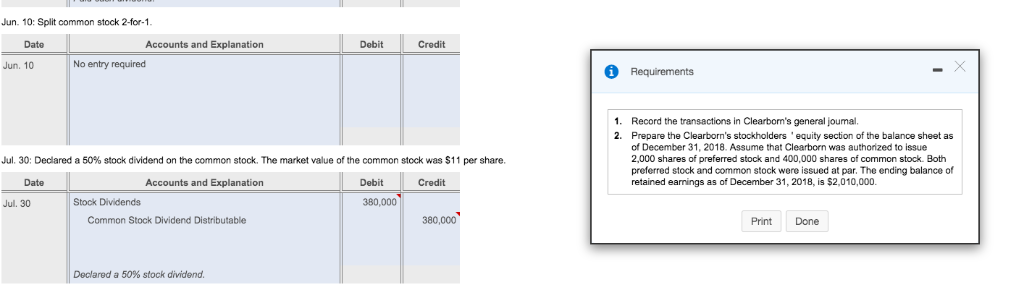

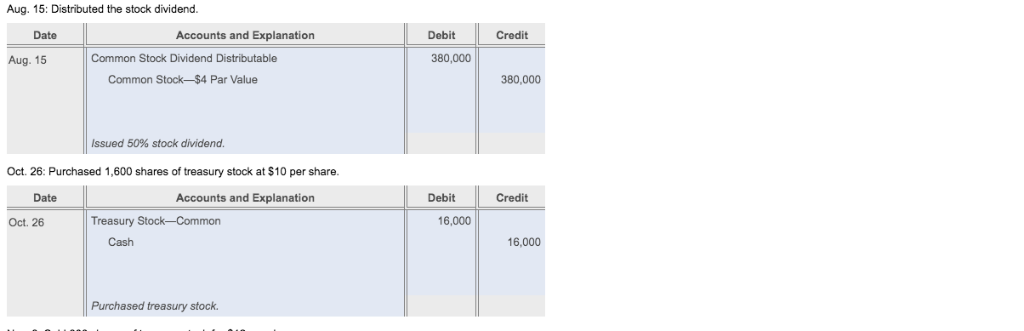

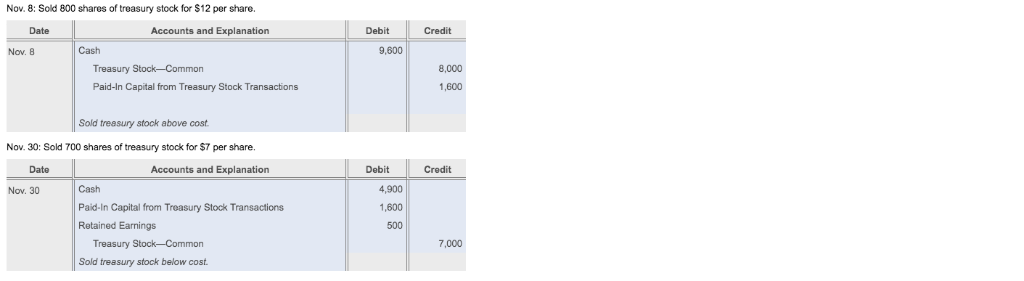

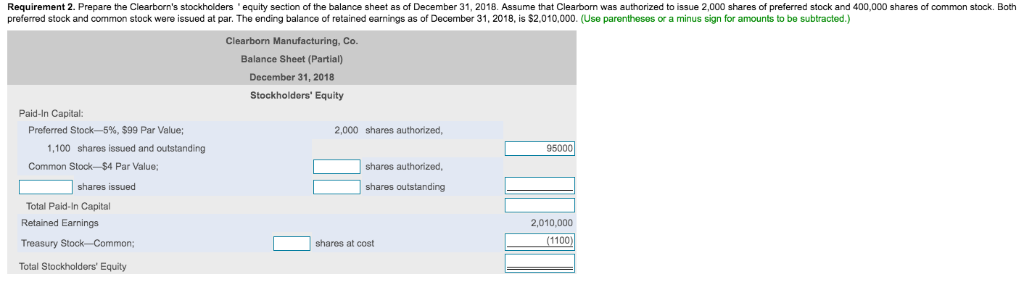

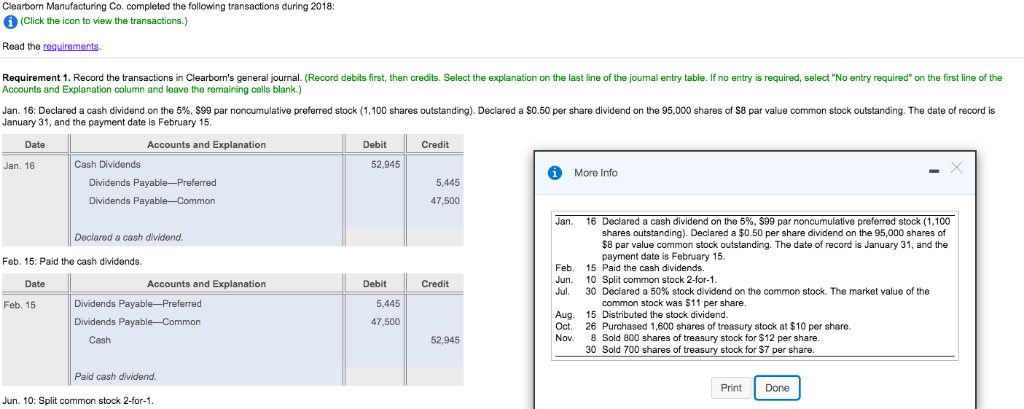

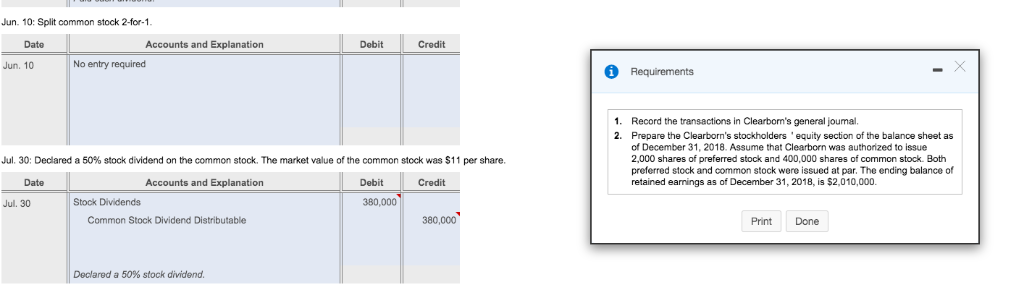

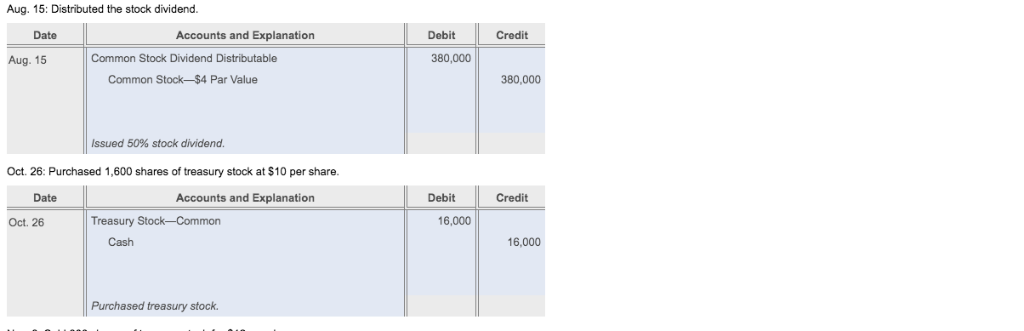

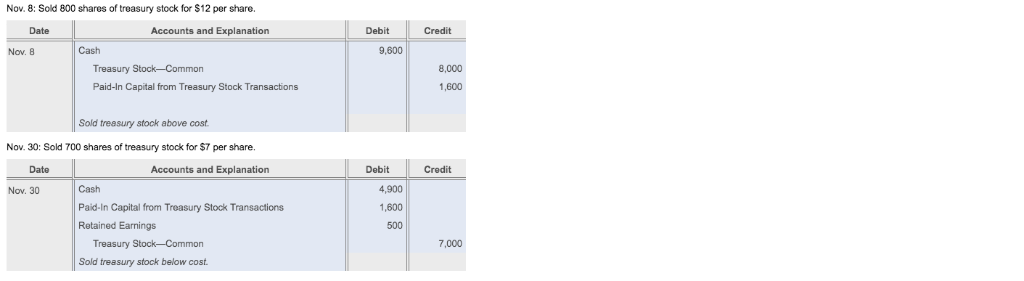

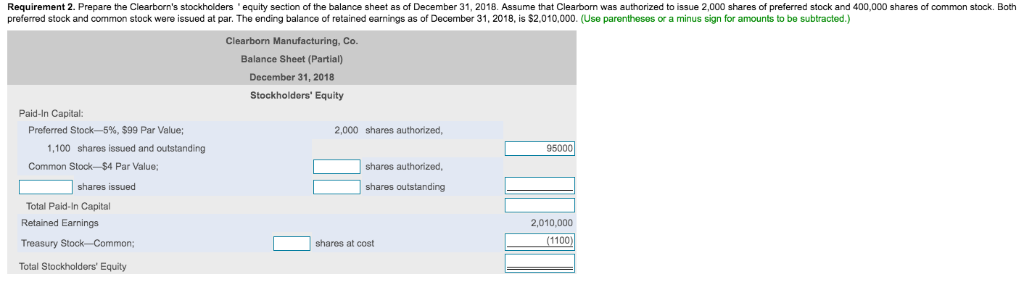

Clearbon Manufacturing Co. completed the following transactions during 2018 (Click the icon to view the transactions.) Read the requirements Requirement 1. Record the transactions in Clearborn's general journal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry Accounts and Explanation column and leave the remaining cells blank.) required, select "No entry required" on the first line of the Jan. 16: Declared a cash dividend on the 5 %, $99 par noncumulative preferred stock January 31, and the payment date is February 15 1,100 shares outstanding). Declared a $0.50 per share dividend on the 95,000 shares of $8 par value common stock outstanding. The date of record is Credit Date Accounts and Explanation Debit 52,945 Cash Dividends Jan. 16 More Info Dividends Payable-Preferred 5,445 Dividends Payable-Common 47,500 16 Declared a cash dividend on the 5 %, $99 par noncumulative preferred stock (1,100 shares outstanding). Declared a $0.50 per share dividend on the 95,000 shares of outstanding. The date of record is January 31, and the Jan. Declared a cash dividend payment date is February 15. 15 Paid the cash dividends. 10 Split common stock 2-for-1 30 Feb. 15: Paid the cash dividends. Feb Jun Jul Credit Date Accounts and Explanation Debit the common stock. The market value of the tee e 11 cer ahare Feb. 15 Dividends Payable-Preferred 5,445 Aug Oct. Nov 15 Distributed the stock dividend. 47,500 Dividends Payable-Common 26 Purchased 1,600 shares of treasury stock at $10 per share. Cash 52,945 30 Sold 700 shares of treasury stock for $7 per share. Paid cash dividend. Print Done Jun. 10: Split common stock 2-for-1 Jun. 10: Split common stock 2-for-1 Date Credit Accounts and Explanation Debit No entry required Jun. 10 Requirements Record the transactions in Clearbon's general joumal. Prepare the Clearborn's stockholders 'equity section of the balance sheet as 1 2 of December 31, 2018. Assume that Clearborn was authonized to issue Jul. 30: Declared a 50 % stock dividend on the common stock. The market value of the common stock was $11 per share. Both preferred stock and common stock were issued at par. The ending balance of retained earnings S2.010.000. Accounts and Explanation of December 31, 2018, i Date Debit Credit 380.000 Jul. 30 Stock Dividends 380,000 Common Stock Dividend Distributable Print Done Declared a 50% stock dividend. Aug. 15: Distributed the stock dividend. Date Accounts and Explanation Debit Credit Common Stock Dividend Distributable 380,000 Aug. 15 Common Stock-$4 Par Value 380.000 Issued 50% stock dividend. Oct. 26: Purchased 1,600 shares of treasury stock at $10 per share. Date Accounts and Explanation Debit Credit Treasury Stock-Common 16,000 Oct. 26 Cash 16,000 Purchased treasury stock. Nov. 8: Sold 800 shares of treasury stock for $12 per share. Accounts and Explanation Date Debit Credit Cash 9,600 Nov. 8 Treasury Stock-Common 8,000 Paid-In Capital from Treasury Stock Transactions 1,600 Sold treasury stock above cost Nov. 30: Sold 700 shares of treasury stock for $7 per share. Accounts and Explanation Date Credit Debit Cash 4.900 Nov. 30 Paid-In Capital from Treasury Stock Transactions 1.600 Retained Earnings 500 Treasury Stock-Common 7,000 Sold treasury stock below cost Requirement 2. Prepare the Clearborn's stockholders equity section of the balance sheet preferred stock and common stock were issued at par. The ending balance of retained earnings of December 31, 2018. Assume that Clearborn was authorized to issue 2,000 shares of preferred stock and 400,000 shares of common stock. Both s of December 31, 2018, is $2,010,000. (Use parentheses ra minus sian for amounts to e subtracted.) Clearborn Manufacturing, Co. Balance Sheet (Partial) December 31, 2018 Stockholders' Equity Paid-In Capital: 2.000 shares authorized, Preferred Stock-5% , $99 Par Value; 1,100 shares issued and outstanding 95000 Common Stock-$4 Par Value: shares authorized, shares issued shares outstanding Total Paid-In Capita Retained Earnings 2.010.000 144D01 (11001 Treasury Stock-Common; shares at cost Total Stockholders' Equity