Answered step by step

Verified Expert Solution

Question

1 Approved Answer

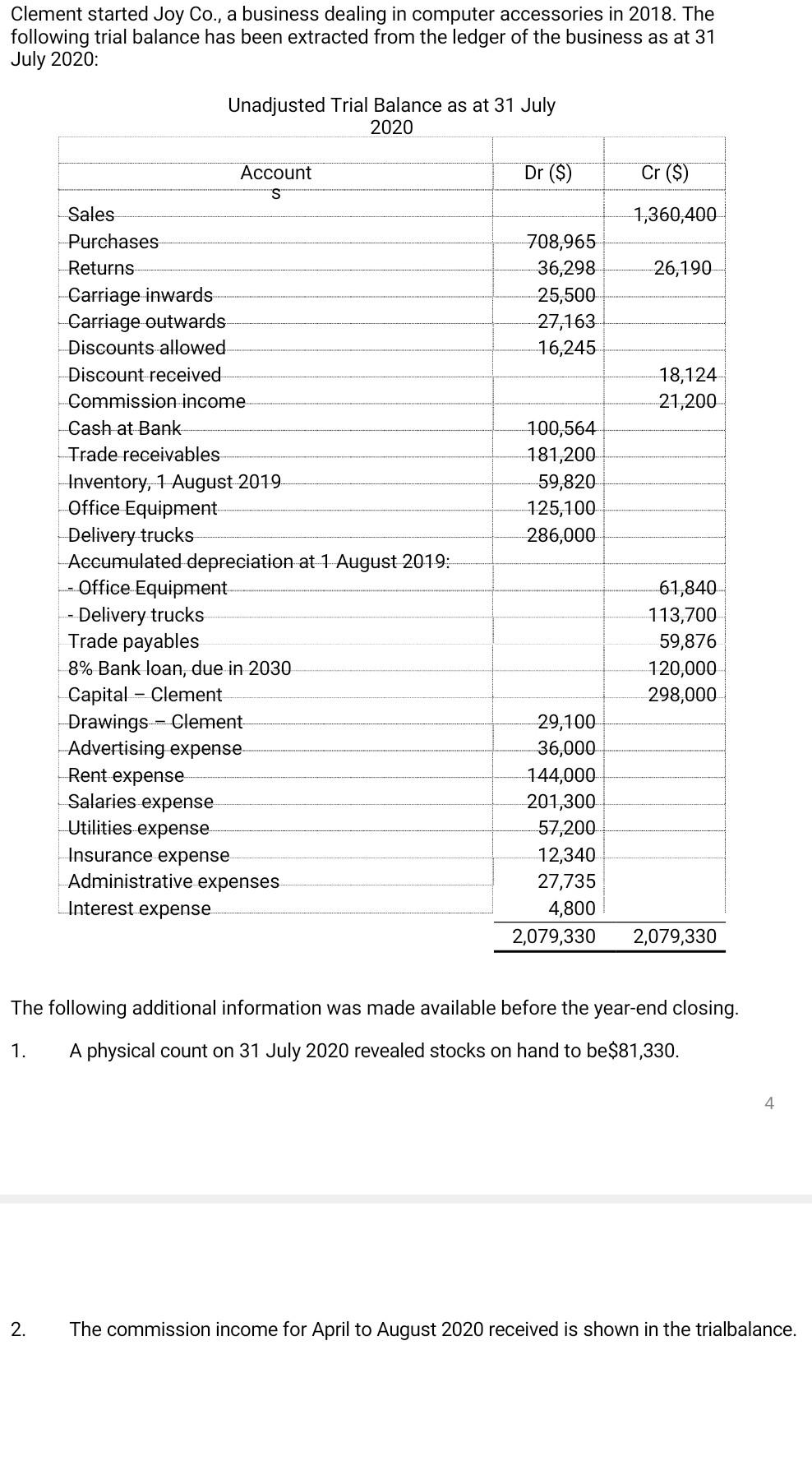

Clement started Joy Co., a business dealing in computer accessories in 2018. The following trial balance has been extracted from the ledger of the business

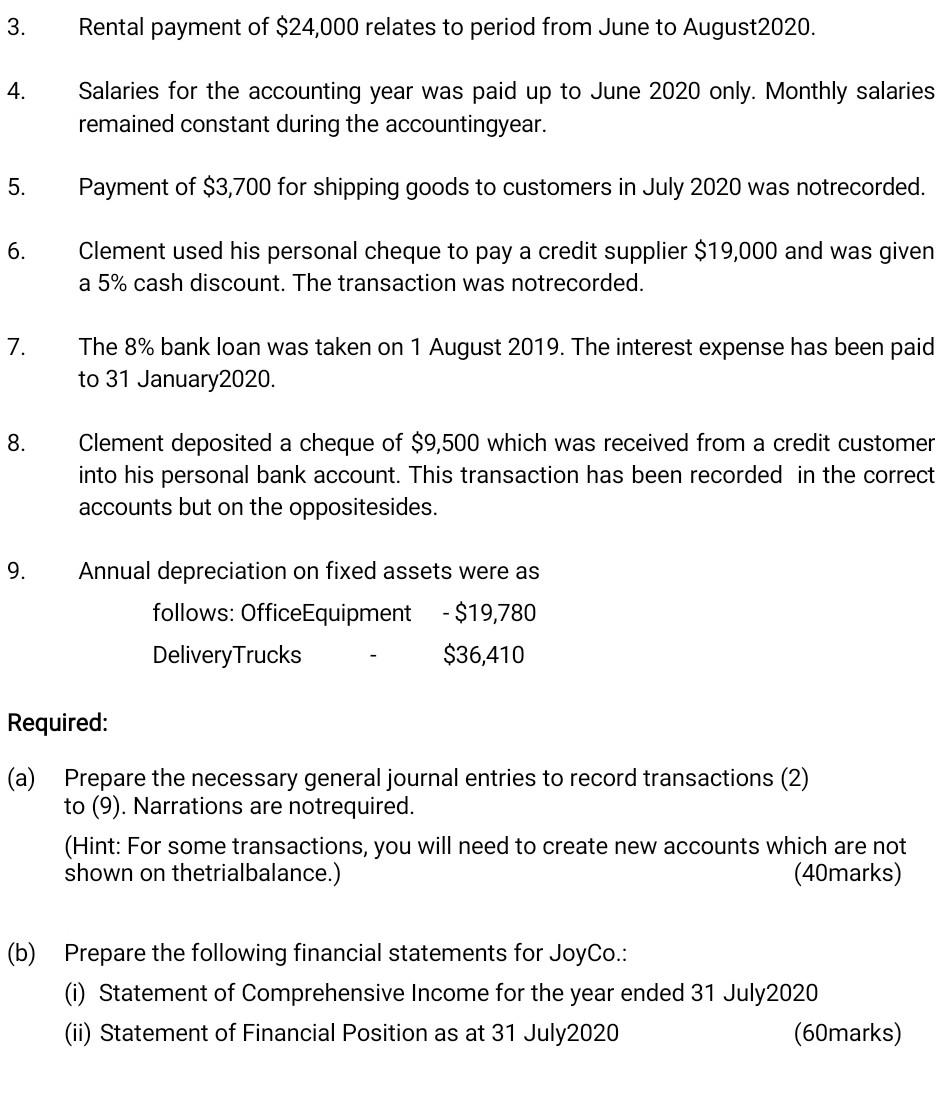

Clement started Joy Co., a business dealing in computer accessories in 2018. The following trial balance has been extracted from the ledger of the business as at 31 July 2020: Unadjusted Trial Balance as at 31 July 2020 Account Dr ($) Cr ($) S 1,360,400 26,190 708,965 36,298 25,500 27,163 16,245 18,124 21,200 100,564 181,200 59,820 125,100 286,000 Sales Purchases Returns Carriage inwards Carriage outwards Discounts allowed Discount received Commission income Cash at Bank Trade receivables Inventory, 1 August 2019. Office Equipment Delivery trucks Accumulated depreciation at 1 August 2019: -- Office Equipment - Delivery trucks Trade payables 8% Bank loan, due in 2030 Capital - Clement Drawings-- Clement Advertising expense. Rent expense Salaries expense Utilities expense Insurance expense Administrative expenses Interest expense -61,840 113,700 59,876 120,000 298,000 29,100 36,000 144,000 201,300 57,200 12,340 27,735 4,800 2,079,330 2,079,330 The following additional information was made available before the year-end closing. 1. A physical count on 31 July 2020 revealed stocks on hand to be $81,330. 4. 2. The commission income for April to August 2020 received is shown in the trialbalance. 3. Rental payment of $24,000 relates to period from June to August2020. 4. Salaries for the accounting year was paid up to June 2020 only. Monthly salaries remained constant during the accountingyear. 5. Payment of $3,700 for shipping goods to customers in July 2020 was notrecorded. 6. Clement used his personal cheque to pay a credit supplier $19,000 and was given a 5% cash discount. The transaction was notrecorded. 7. The 8% bank loan was taken on 1 August 2019. The interest expense has been paid to 31 January2020. 8. Clement deposited a cheque of $9,500 which was received from a credit customer into his personal bank account. This transaction has been recorded in the correct accounts but on the oppositesides. 9. Annual depreciation on fixed assets were as follows: OfficeEquipment -$19,780 Delivery Trucks $36,410 Required: (a) Prepare the necessary general journal entries to record transactions (2) to (9). Narrations are notrequired. (Hint: For some transactions, you will need to create new accounts which are not shown on thetri (40marks) (b) Prepare the following financial statements for JoyCo.: (i) Statement of Comprehensive Income for the year ended 31 July2020 (ii) Statement of Financial Position as at 31 July2020 (60marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started